Vietnam-South Korea Trade Relations 2025: Top Traded Goods & VKFTA Insights

Explore Vietnam–South Korea trade relations in 2025, top traded goods, import-export data, & key VKFTA insights shaping bilateral economic growth.

Trade between Vietnam and South Korea has grown steadily for more than three decades, but 2025 marks a point where the partnership is becoming deeper, more technology-driven, and more strategically important for both sides. The trade structure has shifted from textiles and household goods toward electronics, machinery, and advanced manufacturing. According to the latest Vietnam import data and South Korea export data, the total value of Vietnam imports from South Korea reached $55.85 billion in 2024. According to the Vietnam export data, the total value of Vietnam exports to South Korea reached $25.52 billion in 2024-25. The total Vietnam-South Korea trade accounted for $81.37 billion in 2024-25.

Korean companies have expanded investment in Vietnam, and Vietnam has become one of South Korea’s most important regional partners, especially in supply-chain diversification. Vietnam is the 3rd largest trading partner of South Korea, as per the global trade data & Vietnam customs data. This article provides a detailed, data-driven look at how the trade relationship stands in 2025, which product groups lead two-way trade, and how the Vietnam–Korea Free Trade Agreement (VKFTA) continues to shape trade flows.

Overview of Vietnam-South Korea Bilateral Trade in 2025

Trade between Vietnam and South Korea has expanded quickly in the past decade, supported by both VKFTA and the Regional Comprehensive Economic Partnership (RCEP). By 2024, bilateral trade had reached around USD 86–87 billion, which represented a nearly ten percent increase from the previous year. South Korea consistently ranks as one of Vietnam’s top trading partners, while Vietnam has become South Korea’s third-largest partner, behind China and the United States.

During the first half of 2025, the Vietnam-South Korea trade reached roughly USD 42 billion, showing a clear year-on-year increase. Vietnam exported close to USD 14 billion in goods to South Korea during that period and imported about USD 28 billion, continuing the pattern of a significant but strategically expected trade deficit. The imbalance is largely due to Vietnam’s reliance on Korean high-tech components, capital goods, and industrial inputs that feed its export-manufacturing sectors.

Despite that imbalance, the trend shows expanding integration. Korean firms continue to invest in electronics, high-tech assembly, semiconductors, automotive components, and consumer goods production. Vietnam, in turn, has gained a bigger role as a manufacturing base for Korean corporations seeking to strengthen their supply-chain resilience.

Top Vietnam Imports from South Korea: What Does Vietnam Import from South Korea?

Vietnam's imports from South Korea cover a diverse range of products, showcasing the strong economic ties between the two nations. Some of the top imports from South Korea into Vietnam include electronic goods such as smartphones, televisions, and components for manufacturing. Additionally, South Korea is a major supplier of machinery, equipment, and vehicles to Vietnam, supporting the country's industrial growth. The top 10 goods that Vietnam imports from South Korea, as per the Vietnam shipment data & Vietnam-Korea trade data for 2024-25, include:

1. Electrical machinery & equipment (HS code 85): $34.92 billion

One of the most significant imports from South Korea to Vietnam is electrical machinery and equipment. With a total value of $34.92 billion, these products play a crucial role in Vietnam's industrial sector. From consumer electronics to industrial machinery, Vietnam heavily relies on South Korea for these essential goods.

2. Plastics & articles thereof (HS code 39): $3.85 billion

Plastics and articles made of plastic are another major import category for Vietnam from South Korea, as per the data on Vietnam plastic imports from South Korea by HS code. With a total value of $3.85 billion, Vietnam imports a wide range of plastic products for various applications. These include packaging materials, household items, and industrial components.

3. Mineral fuels & oils (HS code 27): $2.71 billion

Vietnam also imports a significant amount of mineral fuels and oils from South Korea, with a total value of $2.71 billion. These products are essential for Vietnam's energy needs and are used in various industries, including transportation and manufacturing.

4. Nuclear reactors & machinery (HS code 84): $2.63 billion

Nuclear reactors and machinery are another crucial import category for Vietnam from South Korea. With a total value of $2.63 billion, these products are used in various sectors, including power generation and manufacturing. Vietnam relies on South Korea for cutting-edge technology in this field.

5. Iron & steel (HS code 72): $1.30 billion

Iron and steel products are also among the top imports from South Korea to Vietnam, with a total value of $1.30 billion. These products are used in construction, manufacturing, and infrastructure projects in Vietnam. South Korea is a major supplier of high-quality iron and steel products to meet Vietnam's growing demand.

6. Optical, medical, surgical instruments (HS code 90): $949.95 million

Vietnam imports a significant amount of optical, medical, and surgical instruments from South Korea, with a total value of $949.95 million. These products are crucial for Vietnam's healthcare sector and are used in hospitals, clinics, and research facilities across the country.

7. Vehicles (HS code 87): $716.05 million

Vehicles are another important import category for Vietnam from South Korea, with a total value of $716.05 million. From passenger cars to commercial vehicles, Vietnam relies on South Korea for a wide range of automotive products. South Korean automakers are known for their quality and innovation, making them popular choices in the Vietnamese market.

8. Articles of iron or steel (HS code 73): $697.68 million

In addition to iron and steel products, Vietnam also imports articles made of iron or steel from South Korea, with a total value of $697.68 million. These products include a variety of metal components and fittings used in construction, manufacturing, and other industries in Vietnam.

9. Knitted or crocheted fabrics (HS code 60): $675.25 million

Knitted or crocheted fabrics are another significant import category for Vietnam from South Korea, with a total value of $675.25 million. These materials are used in the textile and garment industry in Vietnam, supporting the country's vibrant fashion and apparel sector.

10. Aluminum & articles thereof (HS code 76): $640.41 million

Finally, Vietnam imports a substantial amount of aluminum and articles made of aluminum from South Korea, with a total value of $640.41 million. These products are used in various industries, including construction, transportation, and packaging, contributing to Vietnam's economic development.

Top Vietnam Exports to South Korea: What Does Vietnam Export to South Korea?

Vietnam holds a significant position as an exporter to South Korea, with various goods making their way across borders. The top exports from Vietnam to South Korea encompass a wide range of products, including electronics, textiles, footwear, and agricultural goods. Electronics, such as smartphones and computer components, stand out as vital exports that contribute substantially to the trade relationship between the two countries. The major goods that Vietnam exports to South Korea, as per the Vietnam customs export data by country for 2024-25, include:

1. Electrical Machinery & Equipment (HS code 85): $9.53 billion

Electrical machinery and equipment rank at the top of the list of Vietnam's exports to South Korea. With a staggering value of $9.53 billion, these products play a crucial role in Vietnam's trade relations with South Korea, as per the data on Vietnam electronics exports to South Korea by HS code. From electronic components to household appliances, Vietnam has established itself as a reliable supplier of electrical machinery and equipment to its Korean partners.

2. Nuclear Reactors & Machinery (HS code 84): $4.50 billion

Nuclear reactors and machinery occupy the second spot in Vietnam's exports to South Korea, with a total value of $4.50 billion. As South Korea continues to invest in nuclear energy and technology, Vietnam has capitalized on this demand by exporting a wide range of nuclear reactors and machinery to its Korean counterpart.

3. Articles of Apparel, Knitted (HS code 61): $1.96 billion

Vietnam's textile industry has experienced significant growth in recent years, with articles of apparel, knitted being one of the key export products to South Korea. With a total value of $1.96 billion, Vietnam's knitted apparel products have found a strong market in South Korea, thanks to their quality and competitive pricing.

4. Footwear (HS code 64): $1.06 billion

Vietnam is known for its footwear industry, and this is reflected in its exports to South Korea. With a total value of $1.06 billion, Vietnamese footwear products, ranging from sneakers to high-quality leather shoes, have gained popularity among Korean consumers, further strengthening the trade ties between the two countries.

5. Wood & Articles Thereof (HS code 44): $705.16 million

Vietnam's rich forestry resources have enabled it to export a significant amount of wood and articles thereof to South Korea. With a total value of $705.16 million, these products include wooden furniture, flooring, and other wood-based items that cater to the diverse needs of the Korean market.

6. Optical, Medical, Surgical Instruments (HS code 90): $630.89 million

The export of optical, medical, and surgical instruments is another key component of Vietnam's trade with South Korea. With a total value of $630.89 million, Vietnam's high-quality optical products, medical devices, and surgical instruments have found a receptive market in South Korea's advanced healthcare industry.

7. Fish & Seafood (HS code 03): $617.57 million

Vietnam's coastal geography and thriving aquaculture industry have made fish and seafood products a significant export to South Korea. With a total value of $617.57 million, Vietnamese fish, shrimp, and other seafood items are in high demand in South Korea, reflecting the growing appetite for Vietnamese seafood products in the Korean market.

8. Iron & Steel (HS code 72): $566.76 million

Iron and steel products from Vietnam have also made their way to South Korea, with a total export value of $566.76 million. These products include a wide range of iron and steel items, from raw materials to finished goods, that cater to the construction and manufacturing sectors in South Korea.

9. Furniture, Bedding, & Mattresses (HS code 94): $432.49 million

Vietnam's furniture industry is renowned for its craftsmanship and quality, making furniture, bedding, and mattresses a top export to South Korea. With a total value of $432.49 million, Vietnamese furniture products have carved out a niche in the Korean market, offering a blend of style, comfort, and durability to Korean consumers.

10. Plastics & Articles Thereof (HS code 39): $385.77 million

Plastics and articles thereof are another key export product from Vietnam to South Korea, with a total value of $385.77 million. From plastic packaging to household items, Vietnam's diverse range of plastic products has found a steady market in South Korea, where the demand for quality plastic goods continues to rise.

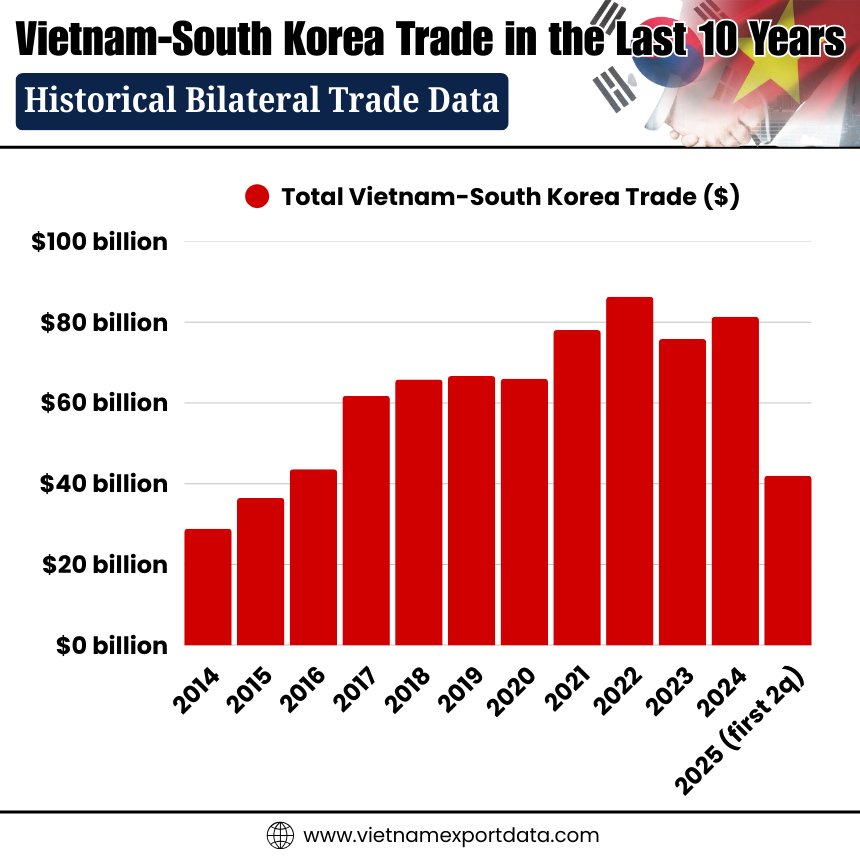

Vietnam-South Korea Trade in the Last 10 Years: Historical Bilateral Trade Data

|

Year of Trade |

Total Vietnam-South Korea Trade ($) |

|

2014 |

$28.88 billion |

|

2015 |

$36.48 billion |

|

2016 |

$43.59 billion |

|

2017 |

$61.74 billion |

|

2018 |

$65.82 billion |

|

2019 |

$66.66 billion |

|

2020 |

$65.98 billion |

|

2021 |

$78.04 billion |

|

2022 |

$86.31 billion |

|

2023 |

$75.82 billion |

|

2024 |

$81.37 billion |

|

2025 (first 2 quarters) |

$42 billion |

VKFTA: How It Shapes the 2025 Trade Landscape

The Vietnam–Korea Free Trade Agreement (VKFTA) remains one of the most influential drivers behind the current trade structure.

High Utilization of Tariff Preferences

Vietnamese exporters have taken advantage of VKFTA tariff cuts at exceptionally high rates. In several categories, the utilization rate of VKFTA certificates of origin exceeds 90%. Examples include:

-

Seafood: around 96%

-

Footwear: near 100%

-

Textiles: near 100%

-

Wood products and furniture: roughly three-quarters

-

Coffee, pepper, and agricultural goods: often above 90%

This means Vietnamese exporters save on duties, making their products more competitive in the Korean market. For sectors like agriculture and textiles, VKFTA benefits help offset rising production costs.

Stimulating Korean Investment

VKFTA provisions and favorable investment rules encourage Korean firms to continue investing in Vietnam. Korean companies, large and small, have built manufacturing operations in electronics, automotive components, chemicals, consumer products, and retail. This investment creates the very goods that drive two-way trade.

The logic is simple: Korean firms produce in Vietnam to serve global markets, while importing intermediate goods from Korea and exporting finished goods back. VKFTA strengthens this loop by reducing trade barriers.

Integration with Regional Trade Frameworks

VKFTA works alongside RCEP, which connects Vietnam and South Korea within a broader Asian trade network. RCEP simplifies rules of origin, making it easier for Korean firms to treat Vietnam as part of their regional supply chain. For Vietnam, this promotes greater diversification in export markets and supports long-term industrial upgrading.

Structural Shifts Behind 2025 Bilateral Trade Data

Trade statistics in 2025 reflect deeper economic shifts that will define the next decade of Vietnam–Korea relations.

Vietnam’s Move Toward High-Tech Manufacturing

Vietnam has advanced from assembling low-value goods to producing computers, semiconductors, mobile device parts, and automotive components. The huge rise in electronics exports to Korea demonstrates this shift. Foreign firms, especially from Korea, are driving the transformation as they expand production capacity in Vietnam.

Korea’s Demand for High-End Intermediate Goods

Korea’s high-tech industries require a steady flow of parts and semi-finished components. Vietnam is increasingly able to supply part of this demand, especially in electronics and transport equipment. This interdependence strengthens the partnership.

Decline in Traditional Sectors

Textiles, footwear, and simple machinery remain important, but they are losing share as higher-value sectors take over. The mild decline in textile export value to Korea reflects this structural change.

Investment-Led Supply-Chain Integration

Korean investment in industrial zones across Vietnam explains why Vietnam imports so many inputs from Korea and then exports finished goods. This integration supports growth but also reinforces Vietnam’s reliance on Korean technology.

Challenges and Risks in the Trade Relationship

Although the trade relationship is strong, it also comes with challenges that both sides must address.

Vietnam’s Persistent Trade Deficit

Vietnam’s trade deficit with South Korea remains significant. In 2024 it stood at roughly USD 30 billion, and early 2025 data shows the gap continuing. The deficit is not necessarily harmful, many imported goods are essential inputs for exports, but it does show structural dependence on foreign technology.

Over-Reliance on Electronics in Exports

Electronics account for more than half of Vietnam’s exports to Korea. This concentration makes Vietnam vulnerable to:

-

Global chip market downturns

-

Changes in Korean demand

-

Supply-chain disruptions

-

Technological shifts that could reduce assembly needs

Vietnam must diversify into more industries to reduce risk.

Limited Local Value Content

Many Vietnamese export products, especially in electronics, contain mostly imported components. While assembly and labor create value, local supporting industries have not fully developed. This limits upstream value capture and weakens domestic firms.

Competition from Other Manufacturing Hubs

Vietnam faces pressure from emerging competitors in Southeast Asia. Countries like Indonesia and the Philippines are attracting more electronics and automotive investment. Vietnam must continue improving its infrastructure, labor skills, and regulatory transparency.

Future Outlook: Trade Toward 2030

Vietnam and South Korea have announced a shared goal to boost bilateral trade to USD 150 billion by 2030. Achieving this will require continued cooperation in several areas.

1. High-Tech and Semiconductor Expansion

Korean semiconductor companies are exploring or expanding operations in Vietnam. If Vietnam can attract major chip-packaging and testing projects, the next wave of high-value exports may emerge in this sector.

2. Green Energy and Renewable Technology

Both countries are investing in green energy. Korea’s strength in battery manufacturing and Vietnam’s renewable-energy potential create opportunities in:

-

solar panel components

-

battery assembly

-

EV supply chains

3. Deepening Automotive Sector Integration

Vietnam’s automotive supporting industries are growing fast. Korea is a natural partner because of its expertise in electric vehicles, steel, and parts manufacturing.

4. Services, Digital Trade, and Retail

Beyond goods and services, trade is rising. Korean brands in finance, retail, cosmetics, and entertainment have strong market positions in Vietnam. Digital services and e-commerce may become the next frontier.

What 2025 Means for Businesses and Policymakers

For Vietnamese Exporters

-

Electronics, automotive parts, and machinery remain top opportunities.

-

VKFTA preferences give a strong competitive edge.

-

Exporters should invest in quality standards, traceability, and advanced production to meet Korean requirements.

For Korean Investors

-

Vietnam offers a large workforce, growing domestic demand, and improved trade.

-

Industrial parks in northern Vietnam are especially attractive for high-tech manufacturing.

-

The stable policy environment and free-trade agreements reduce long-term risk.

For Policymakers in Vietnam

-

Support for upstream industries is essential.

-

Vietnam needs stronger domestic suppliers to reduce import dependence.

-

Infrastructure, energy stability, and skilled labor development are key priorities.

Conclusion and Final Thoughts

By 2026, Vietnam–South Korea trade will become deeper, more technology-intensive, and more strategically aligned than ever. Electronics, computers, mobile components, machinery, and automotive parts dominate two-way flows. VKFTA continues to enable high utilization of tariff preferences, stimulate Korean investment, and reduce costs for Vietnamese exporters. At the same time, structural challenges remain. Vietnam’s heavy dependence on imported components, high concentration in electronics, and large trade deficit need careful policy planning. Yet opportunities are substantial in semiconductors, green energy, automotive supply chains, and advanced manufacturing.

If both countries continue to align trade policies, investment strategies, and industrial development plans, the goal of reaching USD 150 billion in trade by 2030 is realistic. More importantly, the partnership will evolve from one built on assembly and inputs toward a more balanced, innovation-driven economic relationship.

For more insights into the latest Vietnam trade data, or to search live Vietnam import-export data by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports and market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0