Vietnam Furniture Export Data 2024-25: Top Vietnam Furniture Exporters & Vietnam Furniture Exports by Country

Vietnam furniture export 2024-25: Discover top Vietnam furniture exporters, key markets, and export statistics. Explore Vietnam’s growing role in global furniture trade.

In recent years, Vietnam has emerged as a major player in the global furniture market. The country's furniture industry has experienced rapid growth, driven by high demand for Vietnamese-made furniture products. According to the Vietnam export data and the Vietnam furniture export data, the total value of Vietnam furniture exports reached a record high of $17.5 billion in 2024, a 10% increase from the previous year. Vietnam is the 2nd largest furniture exporter in the world, as per the global trade data. In this article, we will examine the latest Vietnam furniture export data for the years 2024-25, identify the top Vietnam furniture exporters, and analyze Vietnam's furniture exports by country.

Overview of Vietnam Furniture Export Data 2024-25

The Vietnam furniture export data for the years 2024-25 indicates a significant increase in Vietnam's furniture exports. Despite global economic challenges, the Vietnamese furniture industry has remained resilient and continues to expand its market reach. This growth can be attributed to Vietnam's competitive labor costs, skilled workforce, and improving manufacturing capabilities.

Over the last ten years, the nation's furniture business has grown from $5 billion to around $20 billion, driven primarily by exports. With $16.25 billion from timber and wood products and another $1.05 billion through non-timber forest products, including bamboo and rattan, Vietnam's furniture sector set a record export revenue of $17.5 billion in 2024. The rising interest in Vietnamese-made furniture on international markets is shown in the $3.1 billion earned by wooden furniture alone.

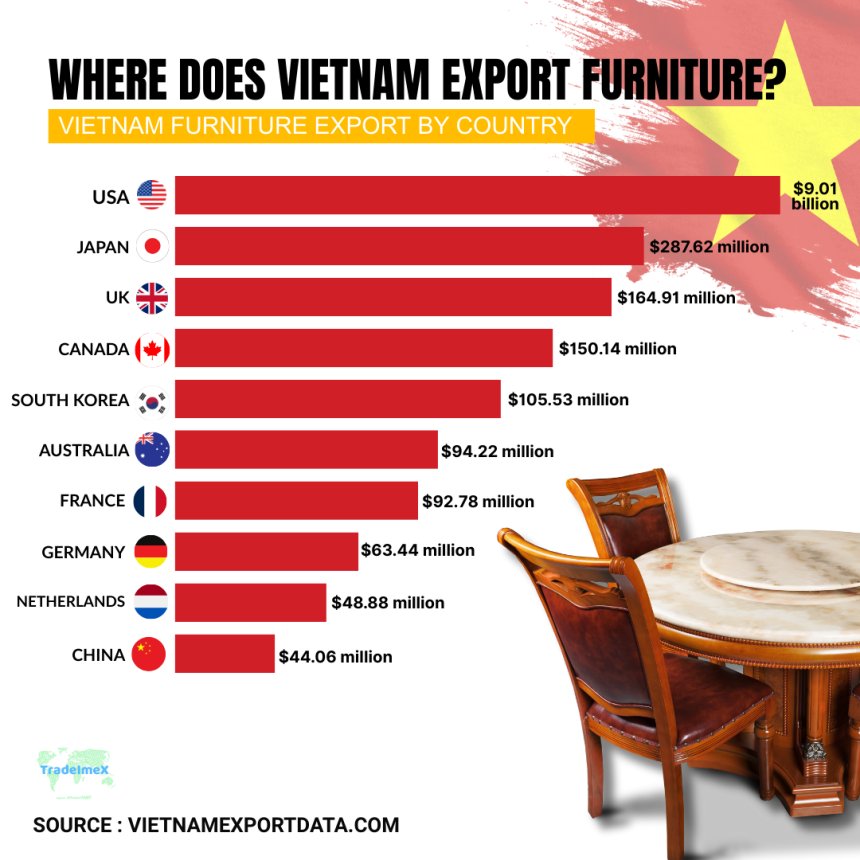

Vietnam Furniture Export by Country: Where Does Vietnam Export Furniture?

Vietnam has emerged as a key player in furniture exports, with a diverse range of countries benefiting from its high-quality products. Some major destinations for Vietnam's furniture exports include the United States, Japan, the United Kingdom, and Germany, as per Vietnam customs data. These countries appreciate Vietnam's skilled craftsmanship, competitive pricing, and adherence to international quality standards. With its skilled workforce, competitive pricing, and high-quality products, Vietnam has become a top choice for countries around the world looking to source furniture. The top 10 export destinations for Vietnamese furniture exports, as per the Vietnam furniture export data by country, and Vietnam shipment data for 2024-25, include:

1. USA: $9.01 billion (56%)

The United States is the largest importer of Vietnamese furniture, accounting for a staggering 56% of Vietnam's total furniture exports, as per the customs data on Vietnam furniture exports to the USA. American consumers appreciate the craftsmanship and affordability of Vietnamese furniture, making it a popular choice for both residential and commercial projects.

2. Japan: $287.62 million (4.5%)

Japan is another significant market for Vietnamese furniture, importing over $287 million worth of products annually, as per the data on Vietnam furniture exports to Japan by HS code. Japanese consumers value the unique designs and high-quality materials used in Vietnamese furniture, contributing to its popularity in the country.

3. United Kingdom: $164.91 million (2.6%)

The United Kingdom is a growing market for Vietnamese furniture, with imports totaling over $164 million. British consumers are drawn to the stylish and modern designs of Vietnamese furniture, making it a preferred choice for interior decorating projects.

4. Canada: $150.14 million (2.3%)

Canada is also a key importer of Vietnamese furniture, with imports reaching $150 million. Canadian consumers appreciate the eco-friendly practices and sustainability of Vietnamese furniture, driving demand for these products in the country.

5. South Korea: $105.53 million (1.6%)

South Korea is a growing market for Vietnamese furniture, with imports exceeding $105 million. Korean consumers are attracted to the versatility and functionality of Vietnamese furniture, making it a popular choice for both residential and commercial spaces.

6. Australia: $94.22 million (1.5%)

Australia is a significant market for Vietnamese furniture, importing over $94 million worth of products. Australian consumers value the durability and craftsmanship of Vietnamese furniture, contributing to its success in the country's competitive market.

7. France: $92.78 million (1.4%)

France is a traditional market for Vietnamese furniture, with imports totaling $92 million. French consumers appreciate the timeless designs and elegance of Vietnamese furniture, making it a popular choice for classic and contemporary interiors alike.

8. Germany: $63.44 million (1%)

Germany is a growing market for Vietnamese furniture, with imports reaching $63 million. German consumers are drawn to the innovative designs and high-quality standards of Vietnamese furniture, driving demand for these products in the country.

9. Netherlands: $48.88 million (0.8%)

The Netherlands is a key importer of Vietnamese furniture, with imports exceeding $48 million. Dutch consumers value the sustainability and eco-friendly practices of Vietnamese furniture, making it a preferred choice for environmentally conscious individuals.

10. China: $44.06 million (0.7%)

Despite being a major player in the global furniture market, China also imports Vietnamese furniture, with imports totaling over $44 million. Chinese consumers appreciate the affordability and unique designs of Vietnamese furniture, making it a popular choice for a wide range of applications.

List of Top Furniture Exporters in Vietnam: Vietnam Furniture Exporters Database

Vietnam’s export success isn’t only about aggregated numbers; it’s powered by major players in the furniture manufacturing space, as per the Vietnam furniture manufacturer exporter data. Here are the leading exporters, ranked by export value, as per Vietnam furniture exporters data & Vietnam suppliers list for 2024-25:

|

Rank |

Company Name |

Export Value 2024 (Approx.) |

Main Furniture Products |

Top Markets |

|

1 |

Kaiser Group |

$3.6 billion |

Bedroom, dining, upholstered, commercial |

USA |

|

2 |

Inni Home |

$600 million |

Dining sets, accent furniture, chairs |

USA |

|

3 |

Rochdale Spears Ltd |

$400 million |

Kitchen, bedroom, office furniture |

USA |

|

4 |

KEESON Co. Ltd |

$355 million |

Smart/adjustable furniture (beds, sofas) |

USA, EU |

|

5 |

Savimex Corp |

$350 million |

Tables, chairs, beds, shelving |

USA, EU, Japan |

|

6 |

Phu Tai JSC |

$300 million |

Wooden indoor & outdoor furniture |

USA, EU |

|

7 |

$250 million |

Office, school, and home furniture |

USA, SE Asia |

|

|

8 |

AA Corporation |

$200 million |

Hotel, retail, custom luxury furniture |

Japan, Korea, EU |

|

9 |

Thuan An Wood JSC |

$11 million |

Wooden beds, dining, and outdoor furniture |

USA, EU, Australia |

|

10 |

Best Furniture Vietnam Co. Ltd |

$8.6 million |

Wooden home furniture |

USA, EU |

This list highlights how export volumes are concentrated among a few giants like Kaiser Group ($3.6 billion in exports) and Inni Home ($600 million).

Additionally, Savimex Corp is notable, not just for its volume (US $350 million), but for its vertical integration. Based in Ho Chi Minh City, Savimex processes timber and exports a wide variety of wooden furniture (tables, chairs, beds, shelving, etc.) to major markets like the U.S., EU, and Japan.

Vietnam Furniture Export Data in the Last 10 Years

|

Year of Exports |

Vietnam Furniture Export Value ($) |

|

2014 |

$3.43 billion |

|

2015 |

$3.74 billion |

|

2016 |

$3.90 billion |

|

2017 |

$4.27 billion |

|

2018 |

$4.60 billion |

|

2019 |

$5.51 billion |

|

2020 |

$6.94 billion |

|

2021 |

$7.59 billion |

|

2022 |

$8.09 billion |

|

2023 |

$6.40 billion |

|

2024 |

$17.50 billion |

Vietnam Furniture Export Data 2024–25: Insight at a Glance

Vietnam has firmly established itself as a global furniture powerhouse. In 2024, the country ranked as the 6th-largest furniture producer globally, a leap from 13th in 2014, an impressive trajectory powered by export-led growth. Approximately 93% of furniture production is exported. Exporters have generated significant revenue: for instance, wood and wood-product exports comprised US $8.4 billion in 2023, equating to 82.9% of all wood-industry export earnings. In Q1 2025 alone, Vietnam’s indoor and outdoor furniture exports topped US $3.93 billion, up 11.6% year-on-year. Of this, indoor furniture accounted for around US $2.5 billion.

Vietnam Furniture Exports by Country (2023–2025)

Vietnam exports furniture (wooden, metal, plastic, parts) to over 120 countries across major global markets.

a. Key Export Markets

Based on HS codes and product categories:

-

Wood and wood products (HS code 44, 94)

-

United States: $7.1 billion; 53.9% of total wood products exports.

-

By mid-2024, wooden furniture exports to the U.S. surged to US $3.45 billion (a 30% year-over-year increase)

-

China: US $1.73 billion; 13.1% share, mostly non-furniture wood products (HS 44).

-

Japan: US $1.65 billion; 12.6% share.

-

South Korea: US $796.8 million; 6.1% share, high in plywood exports.

-

European Union (17 countries): US $455.5 million; 3.5% share, focused on furniture (HS 94, 9401 & 9403).

-

Metal furniture (HS code 940320):

Top partners by quantity: -

Cambodia: 360,743 kg

-

Thailand: 325,803 kg

-

Bulgaria: 303,319 kg

-

New Zealand: 263,637 kg

-

Russia: 193,406 kg

-

Wooden furniture (HS code 940360):

Top destinations by export value (in thousands USD): -

Malaysia: 5,109.76

-

Chile: 4,666.00

-

Sweden: 4,096.48

-

Singapore: 3,340.86

-

South Africa: 2,961.43

-

Saudi Arabia: 2,779.89

-

Plastic furniture (HS code 940370):

Global exports in 2023: $26.7 million total. -

United States: $18.6 million (dominant).

-

Others: Cambodia $1.5 million, China $0.98 million, Chile $0.64 million.

-

Furniture parts (HS code 940390):

Leading recipients (quantity in kg, value in thousands USD): -

United Kingdom: 1.46 million kg ($6.68 million).

-

France: 1.08 million kg ($5.12 million).

-

China: 915,786 kg ($4.08 million).

-

Cambodia: 782,578 kg (US $3.21 million).

-

Thailand: 696,235 kg ($2.95 million).

b. Q1 2025 Highlights & Trends

Q1 2025 exports:

-

Total wood & wood products: US $3.93 billion (+11.6% YoY).

-

To the United States: $2.14 billion (+12.9% YoY). The U.S. remains Vietnam’s largest market (second only to China in some categories).

-

To Japan: Around $511 million; robust growth.

-

Exports to the EU and China showed stagnation, affected by weak demand and economic conditions.

Trends, Drivers & Challenges

a. Drivers

-

Export-led growth: Furniture accounts for 93% of production, growth averaging 10% annually, while exports grow at 11%.

-

Strategic clusters: Regions such as Binh Duong (contributing over 40% of wood-product exports), HCM City, Hanoi, Da Nang, and Dong Nai act as vibrant manufacturing hubs.

-

Rising global demand, particularly from the U.S., Japan, and emerging markets.

-

Green credentials: Increasing demand for FSC and PEFC-certified furniture; sustainable manufacturing is a priority.

b. Challenges

-

Concentration risk: Overdependence on the U.S. (over 50% of exports) leaves Vietnam vulnerable to demand downturns.

-

Compliance pressure: Tighter import standards (e.g., EPR, ISO 14001) in key markets increase costs and complexity.

-

Trade friction & logistics: Tariffs and volatile shipping/logistics costs impact margins.

-

Limited design depth: The industry still lacks strong branding and original design capabilities; many exports focus on cost rather than premium value.

-

Market diffusion: Efforts are underway to expand into the EU and other markets to reduce overreliance on single-country demand.

-

Regulatory pressure: Upcoming rules like the EU Carbon Border Adjustment Mechanism (CBAM) and strict timber origin legality checks add compliance burden.

Looking Ahead: Vietnam Furniture Export Outlook

As of mid-2025, early signals remain positive:

-

Continued growth in Q1 2025 suggests momentum is enduring, especially in the U.S. and Japan markets.

-

The industry is encouraged to:

-

Invest in green certifications and eco-friendly production.

-

Elevate design and branding, especially in high-end segments.

-

Broaden market reach beyond the US-centric focus.

Summary Snapshot

-

Production scale: Vietnam is now the 6th-largest furniture producer and 2nd-largest furniture exporter worldwide, supported by export-driven expansion.

-

Exports by value:

-

2024: Wood-product exports worth $8.4 billion; non-wood worth $3.41 billion.

-

Q1 2025: Wood-product exports worth $3.93 billion.

-

Top exporters: Kaiser Group, Inni Home, Savimex, Phu Tai, and others dominate export volumes.

-

Key markets:

-

U.S. (by far largest at >50%)

-

Japan, China, South Korea

-

EU (still small but growing)

-

Emerging markets include Malaysia, Chile, Sweden, Singapore, and South Africa, among others.

-

Risks: Heavy reliance on a single market, regulatory changes, and higher standards.

Conclusion and Final Words

In conclusion, the Vietnam furniture export data for 2024-25 highlights the country's growing dominance in the global furniture market. With top Vietnam furniture exporters leading the way and strong demand for Vietnam furniture products in key export destinations, Vietnam's furniture export industry is poised for continued success in the coming years in global trade. Vietnam’s furniture industry is firing on all cylinders, but success in 2025 and beyond will hinge on sustainable innovation, market diversification, and upgraded design and branding. If it masters these, Vietnam may soon be moving to the top to challenge long-established leaders.

We hope that you liked our insightful and data-driven blog on Vietnam furniture export data 2024-25. To access the latest Vietnam import-export data or to search live data on Vietnam furniture exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade data reports, a verified Vietnam furniture exporters list, and market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0