Vietnam Smartphone Exports Data 2024-25: Top Mobile Phone Export Brands in Vietnam Revealed

Explore Vietnam smartphone export data 2024-25, top mobile phone brands, major export destinations, and market trends shaping Vietnam's mobile industry.

In recent years, Vietnam has emerged as a major player in the global smartphone market, with a significant increase in smartphone exports. The country's favorable business environment, skilled labor force, and strategic location have attracted many foreign companies to set up manufacturing facilities in Vietnam. As a result, Vietnam has become one of the top mobile phone export destinations in the world. According to Vietnam export data and Vietnam smartphone export data, Vietnam’s smartphone exports reached a total value of $53.89 billion in 2024, an increase of 2.9% from the previous year. Vietnam is the 2nd largest smartphone exporter in the world, only behind China, as per the global trade data.

As per Vietnam customs data & trade data on Vietnam mobile phone exports, Vietnam exported smartphones & mobile phones worth $19.25 billion in the first quarter of 2025. In this article, we will unveil the top mobile phone export brands in Vietnam and provide you with all the essential information on Vietnam smartphone export data for 2024-25, so you stay informed about this thriving industry in Southeast Asia.

Vietnam Smartphone Exports by Country: Vietnam's top 10 Mobile Phone Export Destinations

Vietnam's smartphone exports showcase a dynamic global presence with diverse export destinations, as per the reports of GSMA and Vietnam Digital Communications Association. As per recent data on Vietnam Smartphone Exports by Country, th e nationhas seen significant export volumes to key markets such as the United States, China, South Korea, and Japan. The country's prowess in smartphone manufacturing has resulted in a diverse range of international markets where Vietnamese mobile phones are highly sought after.

This list of the top 10 export destinations showcases the global reach of Vietnam's smartphone industry and the significant role it plays in the broader landscape of technology exports. The major countries where Vietnam exports smartphones and mobile phones, as per Vietnam shipment data and Vietnam smartphone export statistics for 2024-25, include:

1. China: $16.8 billion (28.5%)

China tops the list as Vietnam's largest mobile phone export destination, accounting for a substantial 28.5% of the total exports, as per the data on Vietnam smartphone exports to China. With a strong demand for smartphones in the Chinese market, Vietnam has been able to capture a significant share of this lucrative market.

2. USA: $7.9 billion (13.4%)

The United States comes in second place, with $7.9 billion worth of mobile phone exports from Vietnam, as per the customs data on Vietnam phone exports to USA. The American market is known for its tech-savvy consumers who are always on the lookout for the latest smartphones, making it a key destination for Vietnam's mobile phone exports.

3. South Korea: $5 billion (8.5%)

South Korea, a leading player in the global technology industry, is another important market for Vietnam's smartphone exports, as per the data on Vietnam smartphone exports to South Korea. With a strong demand for high-quality traded smartphones, South Korea has emerged as a major destination for Vietnamese mobile phone manufacturers.

4. Hong Kong: $4.68 billion (7.9%)

Hong Kong, as a major trading hub in Asia, is a crucial destination for Vietnam's mobile phone exports, as per Vietnam smartphone exports to Hong Kong by HS code. With its strategic location and developed infrastructure, Hong Kong serves as a gateway for Vietnamese smartphones to reach markets across the world.

5. United Arab Emirates: $1.4 billion (2.3%)

The United Arab Emirates has also emerged as a significant market for Vietnam's mobile phone exports, with $1.4 billion worth of shipments. The UAE's affluent population and growing demand for smartphones make it an attractive destination for Vietnamese manufacturers.

6. India: $1.2 billion (2%)

India, with its large and diverse consumer base, is a key market for Vietnam's smartphone exports. The country's booming smartphone market presents a wealth of opportunities for Vietnamese manufacturers looking to expand their reach.

7. Netherlands: $1 billion (1.7%)

The Netherlands, known for its advanced technology sector, is a key destination for Vietnam's mobile phone exports. With a strong demand for high-tech gadgets, the Dutch market offers Vietnamese manufacturers a lucrative opportunity for growth.

8. Singapore: $950 million (1.6%)

Singapore, a major financial and technology hub in Southeast Asia, is an important market for Vietnam's smartphone exports. The country's tech-savvy population and high disposable income levels make it a prime destination for Vietnamese mobile phone manufacturers.

9. Czech Republic: $880 million (1.5%)

The Czech Republic, with its strong manufacturing base and tech-savvy consumers, is a key market for Vietnam's mobile phone exports. With $880 million worth of shipments, the Czech market offers Vietnamese manufacturers a valuable opportunity for expansion.

10. United Kingdom: $750 million (1.3%)

The United Kingdom wraps up the list of Vietnam's top 10 mobile phone export destinations, with $750 million worth of shipments. The UK market, known for its tech-savvy consumers and high smartphone adoption rates, presents Vietnamese smartphone manufacturers with a lucrative opportunity for growth.

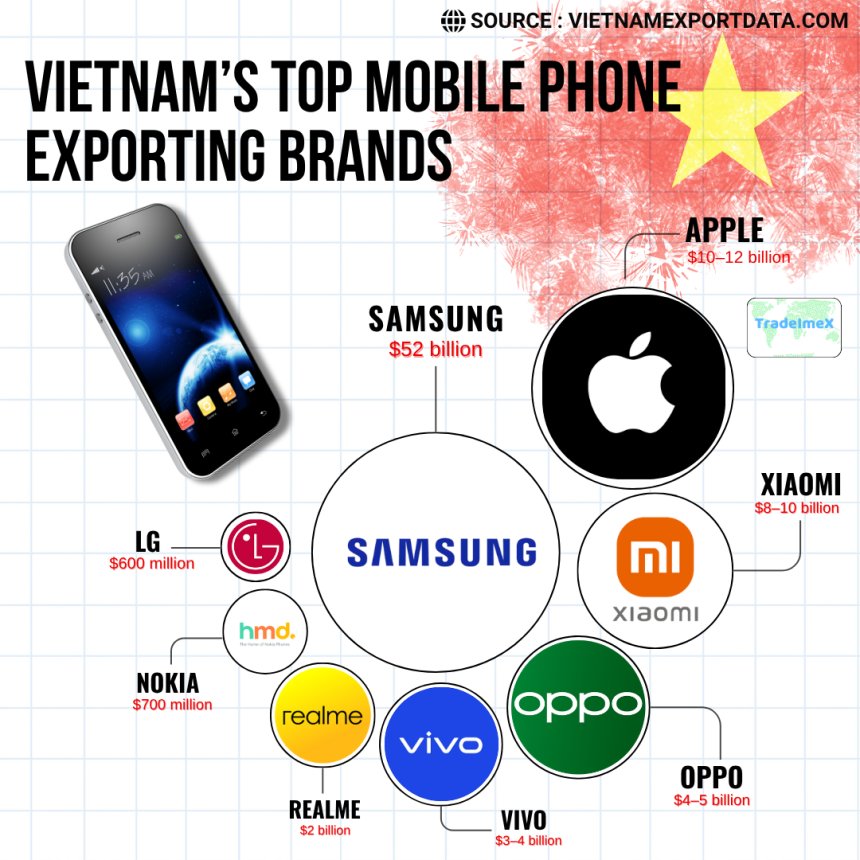

List of Vietnam’s Top Mobile Phone Exporting Brands in 2025

In 2025, Vietnam's mobile phone industry is flourishing with several top exporting brands making their mark on the global market. These brands have managed to secure a strong position in the international market, catering to the increasing demand for Vietnamese mobile phones. These top smartphone brands reflect Vietnam's growing importance in the global mobile phone market, showcasing the country's technological expertise and exporting prowess. The top 10 mobile phone exporting brands of Vietnam in 2024-25, as per Vietnam customs export data and Vietnam smartphone export statistics, include:

|

Rank |

Brand |

Approx. Export Value (2024) |

Top Models |

Top Export Markets |

|

1 |

Samsung |

$52 billion |

Galaxy A14, A04, S24 Ultra, Z Fold5 |

USA, EU, China, UAE, South Korea |

|

2 |

Apple |

$10–12 billion |

iPhone 16 Pro Max, iPad, Apple Watch |

USA, EU, UAE, China |

|

3 |

Xiaomi |

$8–10 billion |

Redmi Note 14, Redmi 13C, POCO X5 |

India, EU, Latin America |

|

4 |

Oppo |

$4–5 billion |

A17, A38, Reno 11 |

Southeast Asia, EU, Middle East |

|

5 |

Vivo |

$3–4 billion |

Y36, V29e, X100 |

Asia, Middle East, Africa |

|

6 |

Realme |

$2 billion |

Narzo 60x, C55 |

South Asia, Southeast Asia |

|

7 |

Nokia (HMD) |

$700 million |

Nokia 105, 110 (feature phones) |

Africa, Eastern Europe, South Asia |

|

8 |

LG |

$600 million |

Stylo 6, K52 |

USA, Latin America |

|

9 |

Huawei |

$200 million |

P60, Nova 11 |

China, grey market regions |

|

10 |

Tecno |

$200 million |

Pova 5, Camon 20 |

Africa, South Asia |

Vietnam Smartphone Exports in the Last 10 Years: Yearly Phone Export Data of Vietnam

|

Year of Exports |

Vietnam Smartphone Export Value ($) |

|

2014 |

$24.39 billion |

|

2015 |

$31.31 billion |

|

2016 |

$36.10 billion |

|

2017 |

$47.70 billion |

|

2018 |

$53.85 billion |

|

2019 |

$56.35 billion |

|

2020 |

$61.93 billion |

|

2021 |

$72.69 billion |

|

2022 |

$78.50 billion |

|

2023 |

$52.10 billion |

|

2024 |

$53.89 billion |

|

2025 quarter 1 |

$19.25 billion |

In-Depth Analysis of Top Vietnamese Mobile Export Brands (2024–25)

Vietnam’s smartphone market faced a tough start in 2024, with Q1 seeing a modest 5% year-over-year decline in domestic shipments. While not as severe as the drop in 2023, the market still felt the impact of economic uncertainty, cautious consumer spending, and slowed demand following the Tet holiday. Despite this, Vietnam’s smartphone export industry remained strong, supported by global orders and large-scale manufacturing from leading tech brands. Here’s a brand-wise analysis of the top mobile phone export brands in Vietnam in 2024, based on export value, popular models, and their strategic moves.

1. Samsung: Holding the Crown

Despite a 7% YoY drop in domestic shipments in 2024, Samsung continues to dominate both local and export markets from Vietnam. With more than 60% of its global production done in Vietnamese factories, the company shipped high volumes of models like the Galaxy A14 5G, A05, and premium S24 Ultra. These phones dominated the $200–$400 segment, which accounted for the majority of Vietnam’s exports.

Samsung maintained a 28% market share in Q1 2024 and ranked as the top smartphone exporter from Vietnam, buoyed by demand in the US, EU, and the Middle East. Its lead is sustained by scale, brand trust, and dominance in budget and mid-range segments.

2. OPPO: Mid-Range Master

OPPO continues to scale exports through Vietnam, driven by mass production of its A38 and A17 series, which together made up over 26% of its total exports in Q1 2024. The brand also made a move in the premium market by launching the Find N3 Flip, priced in the $600+ bracket, and backed it with aggressive early-bird discounts of up to USD 150.

In Vietnam’s export ecosystem, OPPO maintains a solid mid-range base, with steady demand from India, Southeast Asia, and the EU, and contributes around USD 4–5 billion annually in export value.

3. Apple: Premium Growth Engine

Apple climbed to the second spot in overall export value from Vietnam in 2024, thanks to expanding local production through partners like Foxconn, Luxshare, and BYD. Apple’s Vietnam-based facilities exported large volumes of iPads, AirPods, and increasingly, the iPhone 15 and 16 Pro Max, which performed strongly across North America and Europe.

To correct oversupply and drive volume, Apple slashed prices of older models by 10–15% in Q1, pushing its shipment volume up 15% YoY. As a result, the $600+ price bracket reached a record 27% market share by export value.

4. Xiaomi: Volume Player in the Budget Segment

Xiaomi faced challenges in Q1 2024, with a 6% YoY decline in export volume, largely due to lower demand in the sub-$200 category. However, it still maintains a significant presence in India, Latin America, and Southeast Asia, exporting popular models like the Redmi Note 14, Redmi 13C, and POCO X5.

Xiaomi’s export strategy focuses on volume-driven performance, with Vietnam serving as a key manufacturing and assembly point through EMS partners. The brand contributed an estimated USD 8–9 billion in export value during the year.

5. Vivo: Steady with a Niche Strategy

Vivo faced a slower Q1, with exports down 8% YoY, impacted by weak demand in entry-level segments. However, the company stayed relevant with the Y36 and camera-centric V29e and X100 models, which remained popular in Middle Eastern and African markets.

Vivo’s exports out of Vietnam contributed roughly USD 3–4 billion, as the brand focuses on youth and photography-oriented niches in global emerging markets.

6. Realme: Fast, Flexible, and Affordable

Realme, part of the BBK family, maintained a lean export model through shared infrastructure with OPPO. Its best-selling models in Q1 2024 included the Narzo 60x and C55, targeting budget buyers in India, Bangladesh, and Indonesia.

Although Realme faced a 10% dip in export volume, it remained an important contributor to Vietnam’s export economy, adding over USD 2 billion in annual export value.

7. Nokia (HMD Global): Feature Phone Legacy

Nokia continues to export a surprising volume of feature phones and entry-level Android devices from Vietnam. Models like the Nokia 105, 110, and C32 still hold demand in Africa, South Asia, and Eastern Europe.

While its global smartphone share is low, Nokia still contributes around USD 700 million to Vietnam’s exports, thanks to long-lasting demand in the offline and rural sectors.

8. LG: Declining but Active

Although LG exited smartphone manufacturing in 2021, it still shipped legacy inventory and replacement parts from Vietnam in early 2024. Shipments included models like Stylo 6 and K52, mostly to the US and Latin America.

LG’s export activity is now minor and mostly transitional, with a total value of around USD 600 million in 2024.

9. Huawei: Minimal Export Activity

Huawei faced major headwinds globally but maintained a limited export presence from Vietnam, primarily through regional assembly or packaging of devices like the P60 and Nova 11. These units are mostly intended for China or shipped via indirect channels to parts of Asia and Africa.

10. Tecno: Budget Export Builder

Tecno focuses on price-sensitive emerging markets, exporting models like the Pova 5 and Camon 20 via Vietnam’s low-cost assembly hubs. The company has quietly grown its base in Africa, South Asia, and the Philippines, using Vietnam as a final-stage production and testing location.

Why Vietnam Continues to Lead in Smartphone Exports

Vietnam's rise as a global smartphone export leader isn’t accidental. Several key factors have aligned to drive its growth:

1. Robust Manufacturing Infrastructure

Vietnam’s tech parks and industrial zones support end-to-end production. Global brands benefit from low operational costs, tax incentives, and FTA-backed tariff relief. Samsung, Foxconn, and BYD all operate some of their largest plants here.

2. Skilled Labor Force

Vietnam’s manufacturing workforce is technically trained and competitively priced, allowing brands to maintain quality without massive labor costs. This has proven especially effective in scaling precision assembly for high-value devices.

3. Business-Friendly Policies

Vietnam’s government continues to attract foreign investment through streamlined licensing, stable regulations, and infrastructure development. With strong FDI inflows, the electronics and mobile device sectors are top beneficiaries.

4. Strategic Location

Vietnam’s location near China, India, and ASEAN markets enables fast shipping, regional supply access, and lower costs. This makes it ideal for both component imports and global exports.

Vietnam Smartphone Export Overview

-

Vietnam ranks as the second-largest smartphone exporter globally, following China, capturing roughly 13% of global export volume.

-

Annual exports exceeded $53 billion in 2024, with a modest 2.9% YoY increase.

-

Samsung dominates (60% of output, contributing 15% of national exports, equating to $52 billion in electronics).

- Other major contributors include Xiaomi, Apple, Oppo, Vivo, and component-focused contract manufacturers (e.g., Foxconn).

Leading Export Brands

Samsung

-

Produces 60% of its global smartphone output in Vietnam, at factories in Bac Ninh and Thai Nguyen.

-

2024 Samsung Electronics exports from Vietnam totaled $52 billion (15% of national exports).

-

In Q1 2025, held 28% shipment share, bolstered by aggressive A‑series launches.

Xiaomi

-

2024 saw record exports centered on the Redmi Note 14 series.

-

In Q1 2025, it grew by 9% YoY, moving into 2nd place in Vietnam’s local shipment rankings.

-

Manufactures through contract partners in Vietnam.

Apple

-

Suppliers like Foxconn are ramping up iPhone production in Vietnam.

-

Q1 2025 shipments grew 37% YoY, solidifying top‑3 status in the local market.

-

Premium models like the iPhone 16 Pro Max drove growth amid Tet‑festival discounts.

Oppo, Vivo, Realme

-

Oppo and Vivo have significant manufacturing presence via contract firms.

-

Oppo A17 series performed well in 2023.

-

Vivo, present since 2017, is expanding output and launching in new markets.

Recent Trends & Challenges in Vietnam Mobile Phone Exports

-

Q1 2025 shipments dropped 5% YoY, reflecting post-Tet spending patterns and macroeconomic tightening.

-

5G models accounted for 46% of shipments in Q1 2025, the highest share ever.

-

Tariff risks: The US proposed up to 46% tariffs, temporarily paused at 10%, clouding export growth and prompting potential supply shifts to India/South Korea.

-

Rising wages, energy shortages, and reduced tax incentives threaten Vietnam’s cost advantages.

-

Component exports (panels, batteries, chipsets) now form a significant part of the output, powered by South Korean, Japanese, and Taiwanese supplier investment.

Export Ecosystem and Supply Chain

-

Vietnam’s industrial parks (Hai Phong, Bac Ninh, Vinh Phuc) house hundreds of component manufacturers.

-

Suppliers underpin Samsung’s global production: first‑/second‑tier partners grew from 25 to 257 between 2014–2022.

-

Free‑trade agreements (CPTPP, RCEP, EVFTA) and customs reforms bolster import/export efficiency.

Forecast & Outlook

-

Premium and 5G smartphone segments expected to sustain growth, offsetting lower tiers.

-

Export value may rebound if tariff negotiations conclude favorably; however, short-term uncertainty may shift production to India.

-

The government's focus on digital infrastructure and tax policies will shape the future investment climate.

Key Takeaways

-

Vietnam is a global smartphone export powerhouse, led by Samsung, with Xiaomi and Apple rapidly scaling up.

-

Export volumes exceeded $52 billion in 2023, with 2024 showing resilience despite macro challenges.

-

Risks: trade tariffs, rising domestic costs, and evolving supply incentives could influence future trajectories.

-

Opportunities: rising 5G adoption, premium model demand, and global supply chain diversification favor Vietnam’s role.

Samsung in talks on smartphone production shift from Vietnam to India

Samsung is reportedly exploring plans to relocate a portion of its smartphone and electronics manufacturing operations from Vietnam to India. This consideration follows the recent imposition of a 46% tariff on Vietnamese exports by the United States, in contrast to the 10% duty levied on Indian goods, currently subject to a 90-day grace period. Vietnam has long served as a major export hub for Samsung, with the company exporting approximately $52 billion worth of smartphones during the 2023–24 fiscal year. The potential shift toward India aligns with a growing global strategy among tech giants to diversify supply chains and capitalize on India’s production-linked incentive (PLI) schemes.

Future Outlook

Looking ahead to the year 2025, Vietnam's smartphone export industry is expected to continue its upward trajectory. The country's favorable business environment, skilled workforce, and strategic location make it an attractive destination for mobile phone manufacturers looking to expand their global footprint. With leading brands like Samsung, Apple, Xiaomi, and Oppo leading the way, Vietnam is poised to become a major player in the global smartphone market.

Conclusion and Final Thoughts

In conclusion, Vietnam's smartphone export data for the years 2024-25 paints a promising picture for the country's mobile phone export industry. With top mobile phone export brands like Samsung, Apple, Xiaomi, and Oppo driving growth, Vietnam is well-positioned to solidify its status as a key player in the global smartphone market.

Vietnam is no longer just a backup to China; it's a strategic epicenter for global smartphone exports. With Samsung anchoring production, Apple expanding its footprint, and Xiaomi, Oppo, and Vivo leveraging cost efficiencies, Vietnam has carved out a powerful export identity. The country’s mix of government policy, trade agreements, and fast-moving infrastructure makes it a key player in the future of global tech manufacturing.

We hope that you liked our insightful and data-driven blog report on Vietnam’s smartphone export data for 2024-25. For more such mobile phone trade trends or to access the latest Vietnam import-export data, visit VietnamExportdata. Contact us at info@tradeimex.in to get a customized database report, along with a verified list of the top smartphone exporters in Vietnam.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0