What the New Vietnam–Brazil Trade Promotion MoU Means for Businesses: Bilateral Trade Data & Key Insights

Explore what the new Vietnam–Brazil Trade Promotion MoU means for businesses, including bilateral trade data, top traded goods, & strategic opportunities.

Vietnam and Brazil have entered a new phase in their economic relationship. The recently signed Trade Promotion Memorandum of Understanding (MoU) is more than a symbolic diplomatic step. The MoU signing ceremony, held in São Paulo on February 7, was attended by Vietnamese Ambassador to Brazil Bui Van Nghi, Head of the Vietnam Trade Office in Brazil Pham Hong Trang, along with leaders and members from both chambers. It formalizes cooperation between trade promotion agencies, supports business matchmaking, and signals deeper strategic integration between Southeast Asia and Latin America’s two most dynamic emerging markets. According to the latest Vietnam export data & Brazil import data, the total Vietnam-Brazil trade accounted for $7.95 billion in 2024 and around $7.63 billion in 2025.

For businesses, the real question is simple: Does this change anything in practical terms? The short answer is yes. But the impact depends on sector, supply chain positioning, and how proactively companies respond.

This article breaks down:

-

The latest bilateral trade data

-

Sector-level trade patterns

-

Structural complementarities

-

Investment flows

-

Policy direction, including potential MERCOSUR negotiations

-

Strategic business implications over the next 5–10 years

Overview: What’s Happening Between Vietnam & Brazil?

The New Trade Promotion MoU

Vietnam and Brazil have signed a memorandum of understanding (MoU) on trade promotion cooperation between their leading business promotion organizations, a diplomatic initiative aimed at deepening economic and commercial ties between the two countries.

While the specific provisions of the MoU have not yet been fully released publicly, they sit within a much larger strategic context in which both governments are actively expanding trade cooperation. This includes actions such as:

-

Vietnam’s elevation of ties with Brazil to a Strategic Partnership in late 2024.

-

Agreements to increase agricultural market access, including beef, hides, and pet food products.

-

Talks on joint coffee exchange initiatives between the world’s two top coffee producers.

Together, these efforts create a multi-layered framework for business engagement across sectors.

Trade Dynamics: How Big Is Vietnam–Brazil Trade?

Recent Bilateral Trade Data

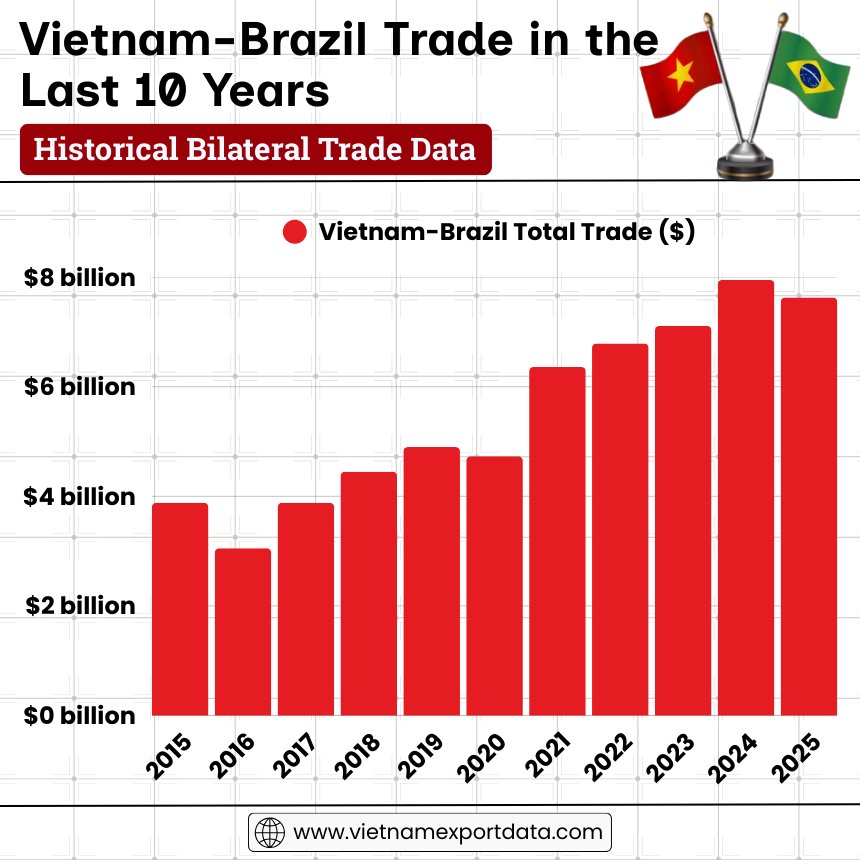

Vietnam and Brazil have seen steady expansion in trade volumes over the past decade:

-

Bilateral trade reached around US$7.9 billion in 2024, up from roughly US$7.1 billion in 2023 and about US$1.5 billion in 2011, a fivefold increase over 13 years, as per the Vietnam customs data.

-

Vietnam’s imports from Brazil notably include soybeans, corn, wheat, cotton, animal feed, minerals, and hides.

-

Vietnam’s exports to Brazil consist of electronics, machinery, seafood, rubber, textiles, footwear, and steel products.

Recent trade figures show Vietnam’s December 2025 exports to Brazil at roughly US$247 million and imports from Brazil reaching around US$475 million, illustrating continued month-to-month flows in late 2025–early 2026.

Interpretation: Brazil remains one of Vietnam’s largest partners in Latin America, with trade volumes consistently climbing and a target of US$10 billion by 2025 and US$15 billion by 2030.

Brazil is currently:

-

Vietnam’s largest trading partner in Latin America

-

Among Vietnam’s top 20 global trade partners

-

A strategic gateway into the MERCOSUR bloc (Brazil, Argentina, Paraguay, Uruguay)

Vietnam, in turn, is:

-

Brazil’s most important ASEAN trading partner

-

A fast-growing export market for Brazilian agriculture

Both governments have publicly targeted:

-

US$10 billion in bilateral trade in the near term

-

US$15 billion by 2030

If growth continues at even 8–10% annually, that target is realistic.

Sectoral Breakdown (2025 data)

|

Category |

Vietnam’s Exports to Brazil |

Vietnam’s Imports from Brazil |

|

Agriculture & Food |

Seafood, rubber, and coffee inputs |

Soybeans, wheat, corn, cotton |

|

Manufacturing & Industrial |

Electronics, machinery, footwear |

Raw materials, feed |

|

Services & Investment |

Limited direct data yet |

Growing interest in investment flows |

This shows complementarity: Brazil is a dominant agricultural exporter, while Vietnam exports manufactured goods, electronics, and processed products.

Top Traded Goods Between Vietnam and Brazil

The top traded goods between Vietnam and Brazil are varied and robust, reflecting the strong economic relationship between the two countries. Some of the key goods exchanged include agricultural products such as coffee, soybeans, and rice, along with electronic equipment, textiles, and footwear.

Vietnam's imports from Brazil encompass a range of key goods that significantly contribute to its economy. Among the top goods that Vietnam imports from Brazil are soybeans, coffee, meat, machinery, and iron ore. These imports play a crucial role in meeting Vietnam's domestic demand and supporting various industries within the country. Vietnam imported goods worth $5.36 billion from Brazil in the 2024-25 fiscal year.

Vietnam's exports to Brazil encompass a diverse range of goods, with some of the top products being electronic devices, footwear, textiles, seafood, and coffee. These export categories reflect both Vietnam's strong manufacturing capabilities and its agricultural strength. Vietnam's exports to Brazil showcase a diverse range of top goods that contribute significantly to bilateral trade. Vietnam exported goods worth $2.59 billion to Brazil in the 2024-25 fiscal year.

Top Goods Vietnam Imports from Brazil

The major goods that Vietnam imports from Brazil, as per the Vietnam import data for 2025, include:

1. Cereals (HS code 10): $1.48 billion

2. Cotton (HS code 52): $990.98 million

3. Ores, slag, & ash (HS code 26): $801.88 million

4. Oil seeds & oleaginous fruits (HS code 12): $561.75 million

5. Prepared animal fodder (HS code 23): $552.09 million

Top Goods Vietnam Exports to Brazil

The top products that Vietnam exports to Brazil, as per the Vietnam shipment data for 2025, include:

1. Electrical machinery & equipment (HS code 85): $1.02 billion

2. Rubber & articles thereof (HS code 40): $328.23 million

3. Nuclear reactors & machinery (HS code 84): $220.47 million

4. Iron & steel (HS code 72): $198.04 million

5. Footwear (HS code 64): $181.41 million

Vietnam-Brazil Trade in the Last 10 Years: Historical Bilateral Trade Data

|

Year of Trade |

Vietnam-Brazil Total Trade ($) |

|

2015 |

$3.88 billion |

|

2016 |

$3.05 billion |

|

2017 |

$3.88 billion |

|

2018 |

$4.45 billion |

|

2019 |

$4.90 billion |

|

2020 |

$4.73 billion |

|

2021 |

$6.36 billion |

|

2022 |

$6.79 billion |

|

2023 |

$7.11 billion |

|

2024 |

$7.95 billion |

|

2025 |

$7.63 billion |

What the Vietnam-Brazil MoU Means for Businesses

The new Trade Promotion MoU is a strategic enabler rather than a binding tariff-cutting agreement. Its business implications fall into several key streams:

1. Market Access and Trade Facilitation

Regulatory Alignment & Promotion as the MoU is designed to:

-

Increase information sharing between export promotion agencies.

-

Facilitate trade missions, business delegations, and joint exhibitions.

-

Reduce non-tariff barriers through advisory, capacity building, and market intelligence.

For businesses, that means:

-

Faster market entry intelligence is particularly important in complex agriculture, food safety, and trade sectors.

-

Higher visibility at key trade fairs, expos, and bilateral commercial events.

-

Improved navigation of customs and sanitary/phyto-sanitary (SPS) requirements, especially for agricultural and processed food exports.

Actionable Insight: Companies planning to export to either market should align with national trade promotion agencies or chambers of commerce to access facilitated export promotion programs.

2. Strategic Sectors Poised for Growth

Agriculture & Food Processing

Brazil is a dominant agricultural exporter; Vietnam is a key market for:

-

Soybeans and animal feed: integral inputs for livestock and aquaculture industries in Vietnam.

-

Beef and hides: vast potential after Vietnam opened its market to Brazilian beef following years of negotiations.

-

Pet food and processed goods: newly certified imports offer diversified product streams.

Opportunity for Vietnamese exporters:

-

Aquatic products, coffee, and rice can increasingly find demand in Brazil, particularly where dietary profiles or ethnic consumer niches exist.

Sector insight: Food security, supply chain diversification, and rising middle-class demand in both countries make agricultural trade a high-growth node for the next decade.

Technology, Smart Agriculture, and Sustainable Value Chains

Both countries are investing heavily in:

-

Smart agriculture solutions (IoT, precision farming, traceability).

-

Climate-resilient crop research (e.g., joint coffee cooperation).

-

AI and data analytics for supply chain optimization.

This opens doors for:

-

Agtech firms (software + sensors + analytics).

-

Green tech and renewable solution providers.

-

Cold chain, trade, and sustainability consulting services.

Business insight: Partnerships between agricultural research institutes, agribusinesses, and tech companies will be especially valuable.

Manufacturing, Electronics & Consumer Goods

Vietnam’s electronics and machinery exports, integrated into global value chains, can find new routes into Brazil’s expanding consumer market.

Brazil’s presence in Latin America offers an export hub effect for Vietnamese-manufactured goods targeting:

-

MERCOSUR countries

-

And later, potentially broader South American free trade links.

3. Investment and Strategic Partnership

The MoU also reinforces investment cooperation, as part of broader agreements that:

-

Encourage Brazilian investment in Vietnam’s meat processing infrastructure (e.g., JBS investments).

-

Facilitate Vietnamese firms exploring the Brazilian market via entities like InvestSP and Vietnam Chamber partnerships.

For investors: Joint ventures, distribution agreements, and manufacturing partnerships are becoming more feasible, supported by institutional frameworks.

4. Free Trade Agreement (FTA) Talks & Long-Term Integration

Vietnam and Brazil (through MERCOSUR) have moved to officially begin negotiations on a preferential trade agreement (PTA), a precursor to a broader FTA.

An eventual FTA could:

-

Reduce tariffs and import taxes.

-

Harmonize standards.

-

Spur vibrant cross-border supply chains.

Strategic pointer: Firms that prepare now, especially in compliance, standards, and trade, will be steps ahead when such trade agreements take effect.

Challenges and Risks

While the MoU and cooperation momentum are positive, firms should remain aware of risks:

Non-Tariff Barriers and SPS Regulations

-

Agriculture and food products face stringent SPS checks.

-

Certification and traceability issues can delay exports.

Currency & Payment Risks

Brazil uses the Brazilian real, and Vietnam uses the Vietnamese dong. FX volatility and international payment infrastructure gaps can affect pricing and trade finance. The MoU could help explore local currency settlement frameworks over time.

Competition from Other Global Partners

Brazil and Vietnam already trade extensively with:

-

China

-

United States

-

EU markets

Hence, competitive pricing and supply reliability will remain key.

Practical Next Steps for Businesses

To take advantage of the MoU and broader trade momentum:

1. Exporters Seeking Brazil Market Access

-

Participate in trade missions and expos organised under the MoU.

-

Engage Brazilian importers early to tailor products to local standards and preferences.

-

Leverage market data provided by trade promotion agencies.

2. Brazilian Companies Entering Vietnam

-

Prioritize sectors like food processing, agribusiness, and smart tech.

-

Partner with Vietnamese firms for local distribution and regulatory navigation.

3. Investors

-

Consider joint ventures or greenfield investments in sectors with mutual demand.

4. Global Supply Chain Managers

-

Evaluate Vietnam–Brazil routes as alternatives to traditional Asia–Europe and Asia–North America corridors.

Long-Term Strategic Impacts

The MoU, combined with broader agreements, points to four transformative trends:

Southeast–Latin America Economic Bridge

Vietnam–Brazil cooperation could form a gateway linking ASEAN and MERCOSUR markets.

Shared Leadership in Coffee and Agricultural R&D

Joint initiatives could shape global coffee value chains and resilient agriculture.

Potential MERCOSUR-Vietnam FTA

If concluded, such an agreement could be a game-changer for tariffs and supply integration.

Enhanced South-South Cooperation Model

This partnership exemplifies growing emerging market economic alliances outside traditional Western trade blocs.

Conclusion: Bigger Than an MoU

In conclusion, the new Vietnam–Brazil Trade Promotion MoU is not merely a line in a diplomatic communiqué. It’s:

-

A catalyst for deeper commercial engagement

-

A support mechanism for businesses

-

A signpost toward future preferential trade agreements

-

A platform for strategic sector cooperation

For companies willing to invest time, adapt products, and forge partnerships, this is an excellent moment to accelerate entry into these two complementary & expanding markets. Whether you’re an exporter, investor, supply chain manager, or agribusiness entrepreneur, the Vietnam–Brazil corridor, now backed by government frameworks and trade promotion mechanisms, is poised for significant growth in the coming decade.

We hope that you liked our data-driven & insightful blog report on the Vietnam-Brazil trade promotion MoU. For more information on the latest Vietnam trade data, or to search live Vietnam import-export data by country, simply visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade database reports and market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0