Vietnam Electronics Exports Data 2025: Breaking Down Vietnam's $100B+ in Electronics Exports

Explore Vietnam’s $140B+ electronics exports in 2025, key markets, HS codes, top companies & trends. Download Vietnam export data now.

In recent years, Vietnam has emerged as a major player in the global electronics market, with an impressive export value of over $100 billion. According to Vietnam export data and Vietnam electronics export data, Vietnam’s electronics exports accounted for $126.5 billion in 2024, which made up more than one-third of the total Vietnam exports worth $403 billion. China, the United States, South Korea, and Europe are the main export destinations for Vietnamese electronics. Vietnam exports phones, computers, laptops, and electronic components as part of its electronics industry. The total value of Vietnam electronics exports reached $29.26 billion in the first quarter of 2025, as per Vietnam customs data.

Electronic components alone accounted for $72.56 billion in export value, a 27% rise from the previous year. Additionally, exports of phones and components performed well, totaling $53.9 billion. Due to economic disputes of the US-China trade war, and political stability and security, Vietnam has emerged as a preferred destination for the production of electronics. Vietnam is the 4th largest electronics exporter in the world, as per the global trade data. This article will explore the key factors driving Vietnam's success in the electronics industry and break down the country's electronics export data for the year 2025.

Key Players in Vietnam's Electronics Industry

Vietnam is home to several key players in the electronics industry, including multinational corporations such as Samsung, LG, and Intel, which have set up manufacturing facilities in the country. These companies have played a crucial role in driving Vietnam's electronics exports to new heights.

Breakdown of Vietnam's Electronics Exports Data for 2025

-

Total Export Value: Vietnam's electronics exports are projected to exceed $140 billion in 2025, making it one of the leading electronics exporters in the world.

-

Product Categories: The country's electronics exports are diverse, including products such as smartphones, computers, televisions, and electronic components.

-

Top Export Destinations: Vietnam's electronics exports are primarily destined for markets in North America, Europe, and Asia, with the United States, the European Union, and China being the top export destinations.

-

Export Growth: Vietnam's electronics exports have been growing steadily over the years, thanks to increasing demand for electronic products globally and the country's competitive cost advantage.

-

Key Challenges: Despite its remarkable growth, Vietnam's electronics industry faces challenges such as intensifying competition from other low-cost manufacturing hubs and the need for continuous innovation and technological upgrading.

Vietnam Electronics Export Data by HS Code: What are the Top Electronic Exports of Vietnam in 2024-25?

Acquiring Vietnam's electronics export data by HS Code reveals the top electronic exports for 2024-25. The key electronic exports from Vietnam during this period include smartphones, computer parts, integrated circuits, electronic components, and communication equipment. The Vietnam electronic products contribute significantly to Vietnam's economy and solidify its position as a vital player in the global electronics market. The top 10 electronics exports of Vietnam under HS code 85, as per Vietnam shipment data and Vietnam electronics export statistics for 2024-25, include:

1. Telephone & smartphones (HS code 8517): $78.5 billion (21.17%)

Unsurprisingly, telephone sets & smartphones take the lead as Vietnam's top electronic export, accounting for a substantial share of the country's total electronic exports, as per Vietnam phone export data. With the rise of digital communication and technology, Vietnam has become a major producer of telecommunication devices, contributing significantly to the global market, as per the recent reports of Vietnam smartphone exports data.

2. Electronic integrated circuits (HS code 8542): $13.25 billion (3.57%)

Electronic integrated circuits and parts follow closely behind, showcasing Vietnam's expertise in semiconductor manufacturing. As one of the leading export products, electronic integrated circuits play a crucial role in various electronic devices, driving the growth of Vietnam's electronics industry, as per Vietnam customs export data of electronic integrated circuits.

3. Semiconductor devices (HS code 8541): $7.53 billion (2.03%)

Semiconductor devices hold a significant share in Vietnam's electronic exports, highlighting the country's proficiency in semiconductor manufacturing. With a strong focus on innovation and technology, Vietnam continues to expand its presence in the global semiconductor market.

4. Insulated wires & cables (HS code 8544): $6.25 billion (1.69%)

Insulated wires and cables represent another key electronic export from Vietnam, catering to the demand for electrical and communication infrastructure. The high-quality manufacturing standards in Vietnam have positioned the country as a reliable supplier of insulated wires and cables worldwide.

5. Monitors & projectors (HS code 8528): $5.64 billion (1.52%)

Monitors and projectors form an essential part of Vietnam's electronic exports, reflecting the country's proficiency in display technologies. With a focus on innovation and design, Vietnam has carved a niche for itself in the global market for monitors and projectors.

6. Transmission apparatus for radio/TV (HS code 8525): $5.38 billion (1.4%)

Transmission apparatus for radio and TV serves as a significant electronic export category for Vietnam, emphasizing the country's role in broadcasting and communication technologies. Vietnam's expertise in manufacturing transmission apparatus has enabled it to meet the global demand for radio and TV equipment.

7. Electrical transformers & static converters (HS code 8504): $4.01 billion (1.08%)

Electrical transformers and static converters represent a crucial segment of Vietnam's electronic exports, supporting the efficient distribution and utilization of electricity. With a focus on energy-efficient technologies, Vietnam has established itself as a key supplier of electrical transformers and static converters.

8. Flat panel display parts (HS code 8529): $3.79 billion (1.02%)

Flat panel display parts play a vital role in Vietnam's electronic exports, reflecting the country's expertise in display panel manufacturing. With a growing demand for flat panel displays, Vietnam has emerged as a major player in the global market for display technologies.

9. Microphones & loudspeakers (HS code 8518): $2.55 billion (0.69%)

Microphones and loudspeakers constitute an essential electronic export category for Vietnam, highlighting the country's specialization in audio equipment manufacturing. Vietnam's high-quality microphone and loudspeaker products have gained recognition in the global market for their performance and reliability.

10. Electric accumulators (batteries) (HS code 8507): $2.15 billion (0.58%)

Electric accumulators, also known as batteries, represent a significant electronic export for Vietnam, supporting the growing demand for battery-powered devices, as per Vietnam battery export data by HS code. Vietnam's expertise in battery manufacturing has positioned the country as a key supplier of electric accumulators to various industries worldwide.

Vietnam Electronics Exports by Country: Where does Vietnam Export Electronics?

Vietnam's electronics exports have been steadily on the rise, with the country becoming an increasingly prominent player in the global market. Major destinations for Vietnam's electronics exports include the United States, Japan, China, South Korea, and European Union countries, as per the data on Vietnam electronics exports by country. The advanced manufacturing capabilities and competitive labor costs in Vietnam have made it an attractive hub for electronics production. The top 10 countries where Vietnam exports electronics, as per Vietnam shipment data and Vietnam customs data for electronics exports in 2024-25, include:

1. China: $54.91 billion (45.9%)

When it comes to electronics exports, China is at the top of the list for Vietnam. A significant amount of Vietnam's electronics, including smartphones, TVs, and computers, are exported to China, as per the data on Vietnam electronics exports to China. The proximity between the two countries and the strong trade relationship make China a key market for Vietnam's electronics industry.

2. United States: $41.77 billion (34.9%)

The United States is another major destination for Vietnam's electronics exports. Products such as electronic components, appliances, and audio equipment are sent to the United States from Vietnam, as per the customs data on Vietnam electronics exports to USA. The demand for high-quality electronics in the US market has helped Vietnam establish itself as a reliable supplier.

3. Hong Kong: $13.64 billion (11.4%)

Hong Kong is a crucial hub for electronics trade, and Vietnam has a significant share in this market. Electronics such as semiconductors, integrated circuits, and telecommunications equipment are some of the main products exported to Hong Kong from Vietnam. The strong business ties between the two regions have helped foster this relationship.

4. South Korea: $9.64 billion (8.1%)

South Korea is not only a major manufacturer of electronics but also a key importer of electronics from Vietnam. Vietnam exports a variety of electronics to South Korea, including electronic components, consumer electronics, and telecommunication devices. The demand for high-tech products in South Korea has led to a growing trade partnership between the two countries.

5. Netherlands: $6.68 billion (5.6%)

The Netherlands is a significant market for Vietnam's electronics exports, with products such as computer hardware, electronic accessories, and lighting products being sent to this European country. The advanced infrastructure and technology in the Netherlands make it an attractive market for Vietnam's electronics industry.

6. Japan: $6.90 billion (5.8%)

Japan is known for its high-tech gadgets and electronics, and Vietnam is a key supplier of electronics to this market. Products such as televisions, cameras, and electronic components are exported to Japan from Vietnam. The reputation for quality and innovation in Vietnamese electronics has helped solidify this trade relationship.

7. Germany: $4.15 billion (3.5%)

Germany is another major importer of electronics from Vietnam, with products such as automotive electronics, medical devices, and industrial equipment being exported to this European country. The strong engineering and manufacturing capabilities in Germany make it a key market for Vietnam's electronics industry.

8. United Kingdom: $3.60 billion (3%)

The United Kingdom has a growing demand for electronics, and Vietnam has become a key supplier to this market. Electronics such as smartphones, tablets, and home appliances are some of the main products exported to the UK from Vietnam. The competitive pricing and quality of Vietnamese electronics have helped drive this trade relationship.

9. Canada: $3.48 billion (2.9%)

Canada is an important market for Vietnam's electronics exports, with a variety of products such as automotive electronics, consumer electronics, and electronic components being sent to this North American country. The increasing demand for electronics in Canada has created opportunities for Vietnam to expand its exports in this market.

10. Thailand: $2.61 billion (2.2%)

Thailand is a neighboring country to Vietnam and a key market for electronics exports. Products such as electronic components, consumer electronics, and electrical equipment are exported to Thailand from Vietnam. The proximity and strong economic ties between the two countries have facilitated the growth of this trade relationship.

Top Electronics Exporters & Manufacturers in Vietnam: Vietnam Electronics Exporters Database 2024-25

|

Company |

Approx Export Value (2024) |

Top Products |

Top Markets |

|

Samsung Electronics |

$54 billion |

Smartphones, displays |

USA, EU, Korea |

|

Intel Products Vietnam |

$13 billion |

Chips, semiconductors |

USA, EU |

|

LG Electronics & Display |

$8 billion |

OLED panels, home appliances |

EU, USA, Asia |

|

Foxconn (Hon Hai) |

$4.5 billion |

iPhones, electronics assembly |

USA, China |

|

GoerTek Vietnam |

$2 billion |

AirPods, microphones |

USA, China, Korea |

|

Luxshare ICT Vietnam |

$2 billion |

iPhone parts, cables |

USA, EU |

|

Hanyang Digitech Vina |

$1.5 billion |

Electronic components |

Korea, Japan |

|

Jabil Vietnam |

$1.2 billion |

PCBs, consumer electronics |

USA, EU |

|

Pegatron Vietnam |

$1 billion |

Laptop, phone components |

USA, Taiwan |

|

Amkor Technology Vietnam |

$1 billion |

Chip packaging, semiconductors |

USA, Korea, Japan |

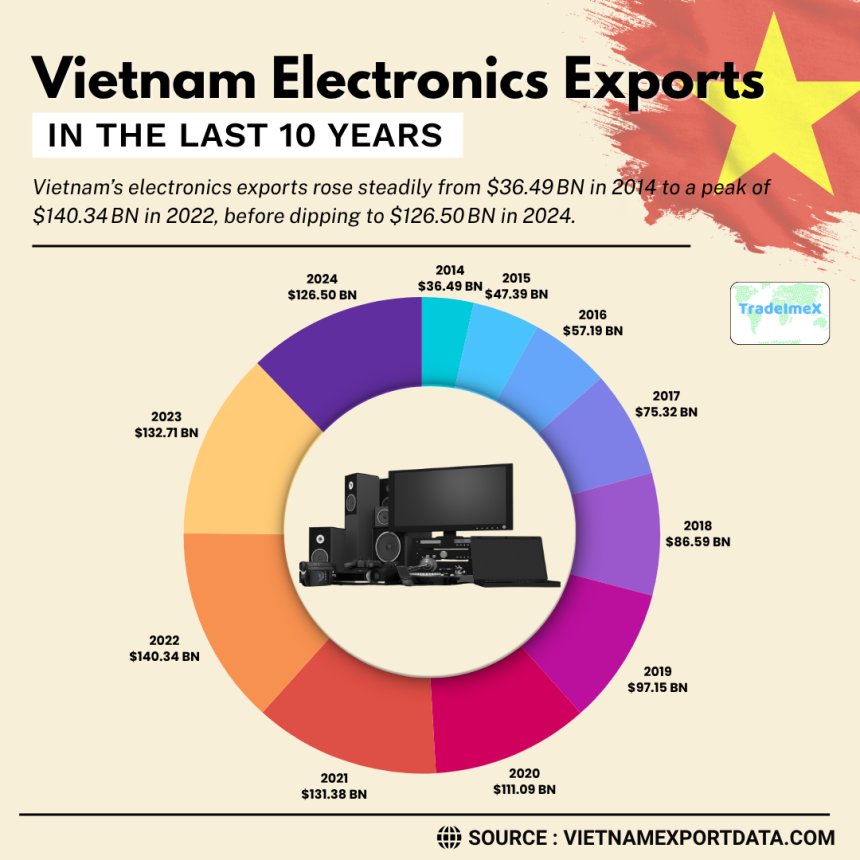

Vietnam Electronics Exports in the Last 10 Years: Historical Vietnam Export Data

|

Year of Exports |

Vietnam Electronics Export Value ($) |

|

2014 |

$36.49 billion |

|

2015 |

$47.39 billion |

|

2016 |

$57.19 billion |

|

2017 |

$75.32 billion |

|

2018 |

$86.59 billion |

|

2019 |

$97.15 billion |

|

2020 |

$111.09 billion |

|

2021 |

$131.38 billion |

|

2022 |

$140.34 billion |

|

2023 |

$132.71 billion |

|

2024 |

$126.50 billion |

The Big Picture: Scale & Growth of Vietnam Electronics Exports

Estimates point toward a possible $140–160 billion in electronics exports by the end of 2025. Here's a clear breakdown of what's, why's, and what's next in Vietnam’s electronics sector.

-

Total electronics exports (2024): $126.5 billion.

-

Phones & components: $53.9 billion (+2.9% YoY)

-

Computers, electronics & components: $72.56 billion (+26.6% YoY).

Electronics made up 33% of all Vietnamese exports, a jump from 30% in prior years. This places Vietnam firmly in the global electronics supply chain, ranking only behind bigger players but boasting some of the fastest export growth rates in the region.

Export Composition & Market Destinations

A. What’s Being Exported

-

Phones & components ($53.9 b)

-

Steady growth (+2.9%) led by smartphone assembly via Samsung, Luxshare, Foxconn, DBG.

-

Computers, electronic products & parts ($72.56 b)

-

Strongest segment (+26.6%), including semiconductors (~$20 b market in 2025), integrated circuits, cables, and display panels.

B. Who’s Buying

Top export markets (2024):

-

United States & Europe: $56.9 b combined (45% of total).

-

China, South Korea: Large importers of components and assembly-ready parts.

-

Others: Japan, ASEAN, global markets via trade agreements

Vietnam relies heavily on North America and Europe, with phone/computer exports to those regions surging nearly 37% in early 2025.

What’s Fueling Vietnam’s Electronics Export Rise

A. Strategic FDI & Corporate Expansion

-

Samsung: Largest foreign investor; 60% of its 220 million annual phones are now made in Vietnam, much destined for the US.

-

Apple’s partners: Foxconn, Luxshare, DBG, GoerTek—major plants produce iPhones, AirPods; Luxshare confirmed it’s staying despite potential US tariffs.

-

Other giants: LG, Intel, Panasonic, and Pegatron, are investing heavily.

B. Global Supply Diversification & Trade Strategy

-

The “China‑plus‑one” model shifted production to Vietnam amid US–China trade friction.

-

Vietnam’s free trade agreements (CPTPP, EVFTA, RCEP, AANZFTA) deliver lower tariffs and expanded market access.

C. Domestic Stability & Competitive Edge

-

Government incentives: tax breaks, IP protections, R&D hubs, support for industrial zones.

-

Political stability and improving infrastructure attract investment.

-

Rising middle class (13 million) and booming e-commerce widened the domestic market and service support.

Risks & Roadblocks

Despite momentum, challenges loom:

-

Tariffs from the US: Trump-era reciprocal tariffs (up to 46%, currently paused at 10%) threaten Vietnam’s electronics exports, especially Samsung and Luxshare products.

-

Input dependency: Major reliance on imported raw materials (chips, components); domestic firms remain largely within assembly roles.

-

Rising labor costs & power constraints: Wage inflation, energy shortages, and higher corporate taxes risk eroding Vietnam’s appeal.

-

Geopolitical uncertainty: Supply chain shuffles to India, Mexico, Eastern Europe could divert investment.

Early Signals & Outlook for 2025

A. Early 2025 (Jan–Apr)

-

Total exports hit $140.3 billion, with $29.26 billion from electronics/computers, up 36.2% YoY.

-

Vietnam’s trade surplus narrowed to $3.8 b (Jan-Apr), reflecting faster imports than exports.

B. Projections for 2025

-

Electronics export goal: $140–145 billion—based on steady 2024 growth.

-

Broader export target (by MoIT): +6% growth, a mix of electronics, textiles, machinery, and agriculture.

C. Strategic Shifts

-

Tariff pressure spurring dual strategies:

-

Red‑Ocean defense: Negotiating tariff relief, offering tax breaks, and boosting imports to reduce trade surplus.

-

Blue‑Ocean innovation: Moving up the value chain into design and R&D, national branding, semiconductors, automation, green tech.

Strategic Implications

For Foreign Corporations

-

Vietnam offers competitive capacity, reliable FTA networks, strong investor base.

-

Yet, dual risks persist: tariffs and domestic cost inflation could impact strategy, and companies should keep options open (India, Mexico, US plants).

For Vietnamese Companies

-

Assembly firms need to transition toward design, R&D, and higher-value segments.

-

Investment in local supply chains and technical skills will be crucial to break out of assembly-only roles and retain margins.

For Government & Policy-Makers

-

Enhance policies to stabilize energy supply, mitigate wage inflation, and strengthen FTA enforcement.

-

Support localization via subsidies, cluster development, and tech incubation.

-

Maintain trade diplomacy to manage tariffs and defend against retaliatory measures.

For Investors & Global Buyers

-

Vietnam remains an appealing sourcing hub, though volatility may persist.

-

Diversification and adaptable contracts (e.g., dual-sourcing) will protect against disruptions.

Final Takeaways

-

Strength & Scale

-

Electronics exports hit a record $126.5 billion in 2024, making up ~33% of national export volume.

-

Segment Leaders

-

Computers/components: $72.6 b (+26.6%)

-

Phones/components: $53.9 b (+2.9%)

-

Market Reach

-

US & Europe dominate (45%), with China, South Korea, Japan, and ASEAN also significant.

-

Growth Pillars

-

Multinational investment (Samsung, Apple partners), trade diversification, free trade agreements, and domestic stability.

-

Risks Loom

-

US tariffs, input dependency, rising domestic cost pressures, and geopolitical swings.

-

Looking Ahead

-

2025 target: $140–145 billion in electronics; momentum remains strong (first four months up 36%).

Vietnam’s electronics export story is more than numbers; it’s a strategic pivot. By leveraging global supply chain shifts, bold investment, and thoughtful policy, Vietnam is transforming from an assembly hub to an emerging tech leader. But emerging tariff storms and supply chain fragilities call for caution, resilience, and innovation.

Highlights of Vietnam Electronics Exports Statistics

-

2024: $126 billion in electronics exports (33% of all exports).

-

Breakdown: $53.9 b in phones, $72.6 b in computer/electronic components.

-

Gains: Phones: +2.9%; Computers/components: +26.6%.

-

Key partners: US, China, EU.

-

Drivers: Samsung, Foxconn, Apple partners, policy support, trade deals.

-

Risks: Input dependency, value-chain trap, trade barriers.

-

Outlook: Target $140–160 b in 2025 with continued acceleration.

Future Outlook for Vietnam's Electronics Industry

Looking ahead, Vietnam's electronics industry is poised for further growth and success, driven by factors such as ongoing investments in infrastructure, research and development, and skilled workforce training. The country's strategic partnerships with key players in the industry will also play a crucial role in maintaining its competitiveness on the global stage.

Conclusion

In conclusion, Vietnam's electronics export data for 2025 reflects a thriving industry that is set to continue its upward trajectory in the years to come. Vietnam’s electronics export industry in 2024 showcased remarkable strength and resilience, crossing the $126 billion mark and accounting for over a third of the country’s total exports. Powered by global giants like Samsung and Apple’s suppliers, along with strategic trade partnerships and a robust FDI pipeline, Vietnam has solidified its role as a key node in the global tech supply chain. With strong government support, a skilled workforce, and strategic partnerships, Vietnam is well-positioned to solidify its position as a key player in the global electronics market.

We hope that you liked our data-driven blog report on Vietnam electronics exports in 2025. To access the latest Vietnam import-export data or to search live data on Vietnam electronics exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in to get a list of the top electronics exporters in Vietnam, along with a customized database report, as per your business needs.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0