Latest Vietnam Headphones Export Report: HS Code 851830 Export Trends & Headphone Suppliers Database

Explore the latest Vietnam Headphones Export Report for HS Code 851830, including export trends, top destinations, supplier database, & market insights.

Introduction: Vietnam’s Headphones Export Industry (HS Code 851830)

Vietnam has quickly emerged as a major exporter of consumer electronics, including headphones, earphones, and combined microphone/s sets classified under HS Code 851830, a product category covering a broad range of wired and wireless audio devices. Global demand for audio tech remains steady due to remote work trends, increased digital content consumption, and sustained interest in consumer gadgets. According to the latest Vietnam export data & Vietnam customs export data of headphones, the total value of Vietnam headphone exports reached $1.24 billion in 2024, a 55% increase from the previous year. Vietnam exported headphones worth over $2 billion in 2025.

Vietnam is the 2nd largest headphone exporter in the world, with key markets like the United States, China, and the Netherlands among the top recipients, according to global trade data and Vietnam customs data. Across 2025, Vietnam’s headphone exports continued to show dynamic trends driven by demand cycles, tariff environments, and production scaling. In this article, we will explore the latest Vietnamese headphone exports, the headphone suppliers database, major export trends, and market insights.

Vietnam Headphones 2025 Export Trends: Monthly & Quarterly

January–April 2025: Early-Year Momentum

-

January 2025: Headphones exports under HS 851830 saw the US market dominate with about 62.31% of value but only 45% of quantity, indicating a focus on higher-value products shipped to the US.

-

February 2025: Exports hit approximately US$508.9 million, with the US remaining the largest buyer, now holding 65.88% of export value, showcasing strong premium demand.

-

March 2025: Exports increased to approximately US$538.8M, though shipments remained highly concentrated toward a few markets, higher quartiles went to the US, while regional hubs like the Netherlands and South Korea showed moderate volumes.

-

April 2025: Headphones shipments stayed robust with US$527.2M, though slightly down from March, but still showing resilience in demand and strategic positioning in global supply chains.

Overall, Q1 and early Q2 2025 displayed seasonal stability in headphone shipments, with manufacturers managing volumes effectively despite typical post-holiday and tariff-driven inventory adjustments.

Mid-Year Export Dynamics: Q2 & Q3 2025

Q2 2025: Growth Continues

-

Total HS 851830 export value in Q2 2025 reached approximately US$1.68 billion, with the United States accounting for roughly 63.8% of export value, reflecting the strong reliance on North American markets.

-

European partners like the Netherlands and Germany acted as secondary hubs for distribution, while Asian nations showed interest in lower-value or component imports.

Q3 2025: Seasonal Dip and Rebound

-

In Q3 2025, Vietnam’s exports of HS 851830 products, i.e., headphones and earphones, reached US$1.72 billion, a net quarter-over-quarter increase after a mid-period dip.

-

The trend reflects a seasonal slowdown in July/August, followed by a strong September rebound as manufacturers prepare for the holiday season. Premium segments and unit prices also contributed to value growth.

August–September 2025 Observations

-

August 2025 saw a sharp drop (US$392M), partly due to tariff adjustments and inventory shifts.

-

September 2025 rebounded significantly with US$797.4M, signaling restocking ahead of Q4 and confirming strong seasonal demand.

Vietnam Headphone Exports by Country: Top Export Destinations for Vietnamese Headphones

Vietnam is a key player in the headphone industry, with its headphone exports reaching various countries worldwide. The top export destinations for Vietnamese headphones include the United States, Japan, Germany, the United Kingdom, and South Korea. These nations have shown a strong demand for Vietnam's headphones, vouching for the quality and competitiveness of Vietnam's headphone manufacturing sector. The top 10 destinations for Vietnam headphone exports, as per the Vietnam shipment data for 2025, include:

1. USA: $529.51 million (42.5%)

The United States is the largest market for Vietnamese headphone exports, accounting for a staggering 42.5% of the total export value, as per the data on Vietnam headphone exports to the USA. With a strong consumer base and a growing demand for innovative audio products, Vietnamese headphone manufacturers have found a lucrative market in the US. Brands such as Bose, Sony, and JBL have become household names in the American market, further boosting Vietnam's headphone exports to the country.

2. Netherlands: $151.77 million (12.2%)

The Netherlands is another significant market for Vietnamese headphone exports, accounting for 12.2% of the total export value. With a strong focus on technology and innovation, Dutch consumers have shown a keen interest in Vietnamese audio products. The country's strategic location in Europe also makes it an ideal gateway for Vietnamese headphone manufacturers to reach other European markets.

3. China: $129.71 million (10.4%)

China, as one of the largest consumer electronics markets in the world, has also emerged as a key destination for Vietnamese headphone exports. With a growing middle-class population and a strong demand for premium audio products, Vietnamese headphone manufacturers have found success in tapping into the Chinese market. Brands such as Xiaomi, Huawei, and Oppo have gained popularity in China, further driving the demand for Vietnamese headphones.

4. Hong Kong: $52.57 million (4.2%)

Hong Kong, known for its vibrant retail sector and tech-savvy consumers, is a key market for Vietnamese headphone exports. With a strong emphasis on quality and design, Vietnamese headphone manufacturers have found a niche in the Hong Kong market. The city's strategic location also provides easy access to other markets in Asia, further boosting Vietnam's headphone exports to the region.

5. United Kingdom: $44.47 million (3.6%)

The United Kingdom is a key market for Vietnamese headphone exports in Europe, accounting for 3.6% of the total export value. With a strong music culture and a tech-savvy consumer base, Vietnamese headphone manufacturers have found success in tapping into the UK market. Brands such as Sennheiser, Beats, and AKG have gained traction in the UK, further driving the demand for Vietnamese headphones.

6. Czech Republic: $38.05 million (3.1%)

The Czech Republic is another emerging market for Vietnamese headphone exports, accounting for 3.1% of the total export value. With a growing demand for high-quality audio products, Czech consumers have shown a keen interest in Vietnamese headphones. The country's central location in Europe also provides opportunities for Vietnamese headphone manufacturers to expand their reach to other European markets.

7. Italy: $36.49 million (2.9%)

Italy, known for its rich cultural heritage and design-focused consumers, is a key market for Vietnamese headphone exports. With a strong emphasis on style and innovation, Vietnamese headphone manufacturers have found success in tapping into the Italian market. Brands such as Bang & Olufsen, Skullcandy, and Urbanears have gained popularity in Italy, further driving the demand for Vietnamese headphones.

8. South Korea: $34.20 million (2.7%)

South Korea, as a tech-savvy nation with a strong demand for high-quality audio products, is a key market for Vietnamese headphone exports. With a growing consumer base and a preference for innovative audio solutions, Vietnamese headphone manufacturers have found success in tapping into the South Korean market. Brands such as Samsung, LG, and AKG have gained traction in South Korea, further driving the demand for Vietnamese headphones.

9. Japan: $30.65 million (2.5%)

Japan, known for its advanced technology and high standards for quality, is a key market for Vietnamese headphone exports. With a strong consumer base and a preference for premium audio products, Vietnamese headphone manufacturers have found a niche in the Japanese market, as per the data on Vietnam headphone exports to Japan by HS code. Brands such as Sony, Audio-Technica, and Pioneer have gained popularity in Japan, further boosting Vietnam's headphone exports to the country.

10. United Arab Emirates: $23.59 million (1.9%)

The United Arab Emirates is a key market for Vietnamese headphone exports in the Middle East, accounting for 1.9% of the total export value. With a growing demand for luxury audio products and a preference for premium brands, Vietnamese headphone manufacturers have found success in tapping into the UAE market. Brands such as Bang & Olufsen, Bose, and Bowers & Wilkins have gained traction in the UAE, further driving the demand for Vietnamese headphones.

Key takeaways from this list:

-

China and the US remain core markets, together representing a large share of both volume and value.

-

European countries serve as distribution hubs or mid-range consumers.

-

Emerging markets like India and the UAE contribute smaller volumes but are growing.

2025 Market Focus

-

The US market continued to lead as the single largest destination for high-value headphone shipments across multiple months in 2025.

-

The Netherlands and Germany worked as European entry points, often redistributing into broader EU markets.

-

Asian partners such as South Korea and Japan participated in mid-tier imports or OEM supply chains.

This geographic mix highlights Vietnam’s strategic position within global electronics supply chains.

Vietnam Headphone Suppliers & Manufacturers Database

Vietnam’s headphone export ecosystem includes both multinational facilities and local manufacturers. According to the Vietnam headphone suppliers & exporters database for 2025, major headphone suppliers and manufacturers in Vietnam include:

1. Samsung Electronics Vietnam Co., Ltd.

-

Approx. Export Value (2025): $1.9 Billion

-

Top Products: TWS earbuds, Bluetooth headphones, wired earphones with mic

-

Top Destinations: USA, China, Netherlands

2. Goertek Technology Vina Co., Ltd.

-

Approx. Export Value (2025): $1.4 Billion

-

Top Products: TWS earbuds, noise-cancelling headphones, OEM audio devices

-

Top Destinations: USA, China, Germany

3. Luxshare-ICT (Vietnam) Co., Ltd.

-

Approx. Export Value (2025): $1 Billion

-

Top Products: Premium wireless earbuds, headset assemblies

-

Top Destinations: USA, China, Netherlands

4. Cresyn Hanoi Co., Ltd.

-

Approx. Export Value (2025): $520 Million

-

Top Products: Wired earphones, OEM headphones with a microphone

-

Top Destinations: USA, Japan, South Korea

5. New Wing Interconnect Technology (Vietnam)

-

Approx. Export Value (2025): $450 Million

-

Top Products: Headphones, earphones, audio cable-integrated headsets

-

Top Destinations: China, USA, Germany

6. Phonak Operation Center Vietnam Co., Ltd.

-

Approx. Export Value (2025): $360 Million

-

Top Products: Headphones, hearing-assist audio devices

-

Top Destinations: USA, Switzerland, Germany

7. AAC Technologies Vietnam Co., Ltd.

-

Approx. Export Value (2025): $330 Million

-

Top Products: Acoustic components, premium headphone modules

-

Top Destinations: China, USA, Singapore

8. Ampacs International Vietnam Co., Ltd.

-

Approx. Export Value (2025): $240 Million

-

Top Products: Wired headphones, gaming headsets

-

Top Destinations: USA, Mexico, Japan

9. Seosin Electronics Vina Co., Ltd.

-

Approx. Export Value (2025): $200 Million

-

Top Products: Mid-range wired & wireless earphones

-

Top Destinations: South Korea, USA, Vietnam-ASEAN

10. Horn Vietnam Co., Ltd.

-

Approx. Export Value (2025): $110 Million

-

Top Products: Entry-level headphones, headset components

-

Top Destinations: China, Thailand, Indonesia

Key Notes & Insights

1. Export Value Concentration

-

The top 3 exporters alone account for over 60% of Vietnam’s total headphone export value in 2025.

-

Samsung, Goertek, and Luxshare operate primarily as global OEM/ODM hubs, supplying major consumer electronics brands.

2. Product Mix Trends

-

TWS earbuds and wireless headphones dominate export value.

-

Wired headphones remain relevant for gaming, enterprise, and cost-sensitive markets.

-

Premium noise-cancelling and integrated microphone headsets show the fastest YoY growth.

3. Destination Markets

-

The United States remains the largest value destination.

-

China functions both as a consumption market and a redistribution hub.

-

The Netherlands and Germany act as EU entry points.

-

Japan and South Korea favor high-quality OEM audio products.

4. Why Vietnam Leads in 2025

-

China-plus-one sourcing strategies

-

Strong electronics manufacturing ecosystem

-

Competitive labor costs

-

Stable export infrastructure for HS 851830 products

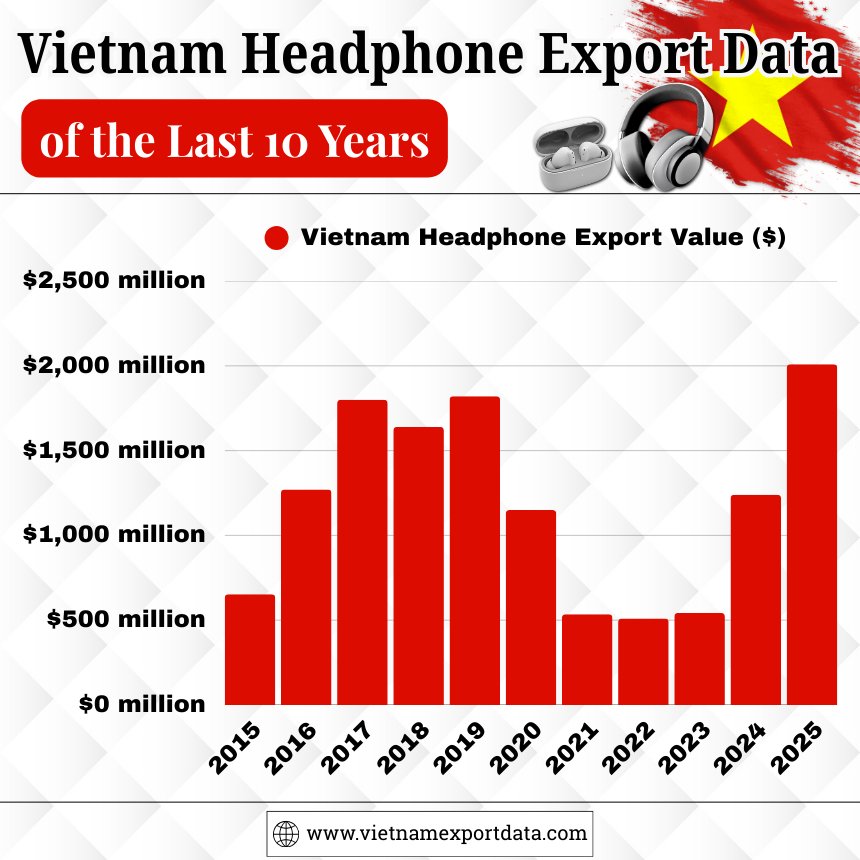

Vietnam Headphone Export Data of the Last 10 Years

|

Year of Exports |

Vietnam Headphone Export Value ($) |

|

2015 |

$653.01 million |

|

2016 |

$1.27 billion |

|

2017 |

$1.80 billion |

|

2018 |

$1.64 billion |

|

2019 |

$1.82 billion |

|

2020 |

$1.15 billion |

|

2021 |

$534.23 million |

|

2022 |

$509.13 million |

|

2023 |

$542.76 million |

|

2024 |

$1.24 billion |

|

2025 |

$2.01 billion |

Product Insights: What’s Being Exported?

Under HS Code 851830, Vietnam’s exports cover a range of headphone products:

Key Segments Observed

-

Mid-Range Headphones & Earphones (85183020)

-

This sub-code consistently accounts for the majority of value and volume, typically representing consumer headphones/earphones with or without microphones.

-

Premium Headphones (e.g., 85183059)

-

Smaller in overall quantity but commanding significantly higher unit prices, often destined for premium sectors.

-

Low-Cost/Component-Level Items (85183090)

-

Represents entry-level or basic headphones, often shipped regionally.

This tiered structure, premium, mid, and basic, supports diverse global demand patterns.

Export Strategy Implications

Diversification & Market Risks

-

Heavy reliance on the US market exposes exporters to tariff risk (noted tariffs around 20% from mid-2025) and demand shifts.

-

Diversification into EU markets (Netherlands, Germany, UK) and Asian partners (Japan, South Korea, India) can mitigate concentration risks.

Product Positioning

-

Mid-range products (like 85183020) provide volume stability.

-

Premium segments offer higher margins.

-

Entry-level units serve cost-sensitive regions, balancing portfolio risk.

Conclusion: Vietnam’s HS 851830 Export Landscape

In conclusion, Vietnam’s headphone exports have shown robust performance throughout 2024 and 2025, balancing:

-

Strong US demand with premium product shipments.

-

Regional export diversification into Europe and Asia.

-

Supplier network expansion, with multinational & local manufacturers scaling production.

Vietnam’s strategic role in global electronics value chains, backed by efficient manufacturing, competitive labor, and customs reforms, positions it to remain a key headphone exporter through the mid-2020s.

For more information on the latest Vietnam import-export data, or to search live data on Vietnam headphone exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports along with brand or model-wise specification data, verified Vietnam headphone suppliers & exporters database, and market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0