Vietnam Rice Export Statistics 2024-25: Vietnam Rice Exporter Data & Rice Export Trends

Discover the latest Vietnam rice export statistics 2024–25, including verified Vietnam rice export data, top destinations like the Philippines, and a complete Vietnam rice exporters list. Learn how much rice Vietnam exports, major trends, and insights on the top 10 rice exporters in Vietnam.

With its lush rice paddies stretching across the Mekong Delta, Vietnam has long been known as a major player in the global rice market. The country's favorable climate and fertile soil make it an ideal location for rice cultivation, leading to impressive growth in rice production and exports over the years. According to Vietnam export data and Vietnam rice export data, the total value of Vietnam rice exports reached $5.7 billion in 2024, a 24% increase from the previous year. According to Vietnam customs data on rice exports, Vietnam exported rice worth $1.14 billion, at a total quantity of 2.2 million tons in the first quarter of 2025.

Vietnam exported rice of around 9 million metric tons in 2024-25, an increase of 11% in volume from the previous year. The Ministry of Agriculture and Rural Development in Vietnam reported that the average export price also hit a high of more than $600 per ton. The Philippines continues to be the biggest Vietnamese rice importer. Vietnam is the 3rd largest rice exporter in the world, as per the global trade data. In this article, we will take a closer look at the Vietnam rice export statistics for 2024-25, delve into Vietnam rice exporter data, and explore the latest rice export trends in the country.

Vietnam Rice Exports by Country: Top 10 Vietnam Rice Export Destinations

Vietnam, a major player in global rice production, consistently ranks among the top rice-exporting countries worldwide. Specifically, the top ten destinations for Vietnam's rice exports include traditional markets like the Philippines, Indonesia, and Malaysia, which often rely on Vietnamese rice for their food supply. In recent years, new markets such as China and Africa have also emerged as significant importers of Vietnam's rice products. The top 10 countries where Vietnam exports rice, or the leading rice export destinations of Vietnam, as per the customs data on Vietnam rice exports by country and Vietnam rice shipment data for 2024-25, include:

1. Philippines: $1.52 billion (38.4%)

The Philippines tops the list of Vietnam's rice export destinations, accounting for a significant 38.4% of total exports, as per the customs data on Vietnam rice exports to Philippines. The proximity of the Philippines to Vietnam, coupled with a strong demand for rice in the country, has made it a key market for Vietnamese rice exporters. The two countries have a long history of trade relations, with Vietnam consistently supplying high-quality rice to meet the demand in the Philippines.

2. Indonesia: $716 million (18.1%)

Indonesia is another major destination for Vietnam's rice exports, with imports amounting to $716 million in 2024-25, as per the data on Vietnam rice exports to Indonesia. The country's large population and high rice consumption make it a lucrative market for Vietnamese exporters. Indonesia's diverse culinary culture, which heavily relies on rice as a staple food, further drives the demand for Vietnamese rice in the country.

3. China: $494 million (12.5%)

China, one of the world's largest rice consumers, is also a key destination for Vietnam's rice exports. With a growing population and an increasing demand for high-quality rice, China has emerged as a significant market for Vietnamese rice. Proximity and trade agreements between the two countries have further facilitated the growth of Vietnam's rice exports to China.

4. Ghana: $186 million (4.7%)

Ghana is a growing market for Vietnamese rice, with imports amounting to $186 million in 2024-25. The country's stable economic growth and increasing demand for rice have made it an attractive destination for Vietnamese exporters. Ghana's commitment to food security and self-sufficiency has also driven the demand for imported rice, with Vietnam emerging as a reliable rice supplier.

5. Malaysia: $173 million (4.4%)

Malaysia is another important destination for Vietnam's rice exports, with imports totaling $173 million in 2024-25. The country's diverse culinary landscape and high rice consumption have created a strong demand for Vietnamese rice in Malaysia. The proximity between the two countries and existing trade agreements have further facilitated the growth of rice exports from Vietnam to Malaysia.

6. Ivory Coast: $168 million (4.2%)

Ivory Coast is a key destination for Vietnam's rice exports, with imports amounting to $168 million in 2024-25. The country's growing population and rising middle class have led to an increase in rice consumption, creating opportunities for Vietnamese exporters. Ivory Coast's efforts to boost domestic rice production have also driven the demand for imported rice, with Vietnam meeting this demand with its high-quality grains.

7. Singapore: $113 million (2.9%)

Singapore is an important market for Vietnam's rice exports, with imports totaling $113 million in 2024-25. The country's affluent population and diverse culinary scene have created a demand for premium-quality rice, making Vietnam a preferred supplier. Singapore's strategic location as a regional trade hub has further strengthened its position as a key destination for Vietnamese rice exports.

8. Iraq: $97 million (2.5%)

Iraq is a growing market for Vietnam's rice exports, with imports amounting to $97 million in 2024-25. The country's recovering economy and increasing demand for rice have made it an attractive destination for Vietnamese exporters. Iraq's reliance on rice as a staple food has further boosted the demand for high-quality imported rice, with Vietnam meeting this demand effectively.

9. Hong Kong: $79 million (2%)

Hong Kong is a significant destination for Vietnam's rice exports, with imports totaling $79 million in 2024-25. The country's vibrant culinary scene and high rice consumption have created a demand for premium-quality rice, making Vietnam a preferred supplier. Hong Kong's role as a major international trade center has further facilitated the growth of rice exports from Vietnam to the region.

10. UAE: $68 million (1.7%)

The UAE is an emerging market for Vietnam's rice exports, with imports amounting to $68 million in 2024-25. The country's diverse population and strong demand for rice have created opportunities for Vietnamese exporters. The UAE's strategic location as a trade gateway between East and West has further boosted its position as a key destination for Vietnamese rice exports.

List of Top Rice Exporters in Vietnam: Vietnam Rice Exporter Database 2025

The Vietnam Rice Exporter Database provides valuable insights into the leading players in the Vietnamese rice export industry. This comprehensive database showcases the key exporters driving Vietnam's rice trade, offering detailed information on their market share, export volume, and trading patterns. The top 10 Rice exporters in Vietnam, as per Vietnam rice exporters data and Vietnam customs data for rice exports in 2024-25, include:

|

Rank |

Company Name |

Export Value (2024) |

Top Export Markets |

|

1 |

$582 million |

Philippines, Malaysia, Africa |

|

|

2 |

Vinafood 1 |

$546 million |

China, Philippines |

|

3 |

Mekong Food |

$501 million |

Africa, Middle East |

|

4 |

Gia International |

$236 million |

Africa, Southeast Asia |

|

5 |

Vinafood 2 |

$231 million |

Philippines, Malaysia |

|

6 |

Kien Giang Import-Export |

$206 million |

Africa, Middle East |

|

7 |

Phuong Dong Food |

$172 million |

Southeast Asia, Africa |

|

8 |

Tan Thanh An |

$148 million |

Asia, Africa |

|

9 |

Tien Phat Nong |

$139 million |

Southeast Asia, Middle East |

|

10 |

Panoramas Co. Ltd |

$135 million |

Middle East, Africa |

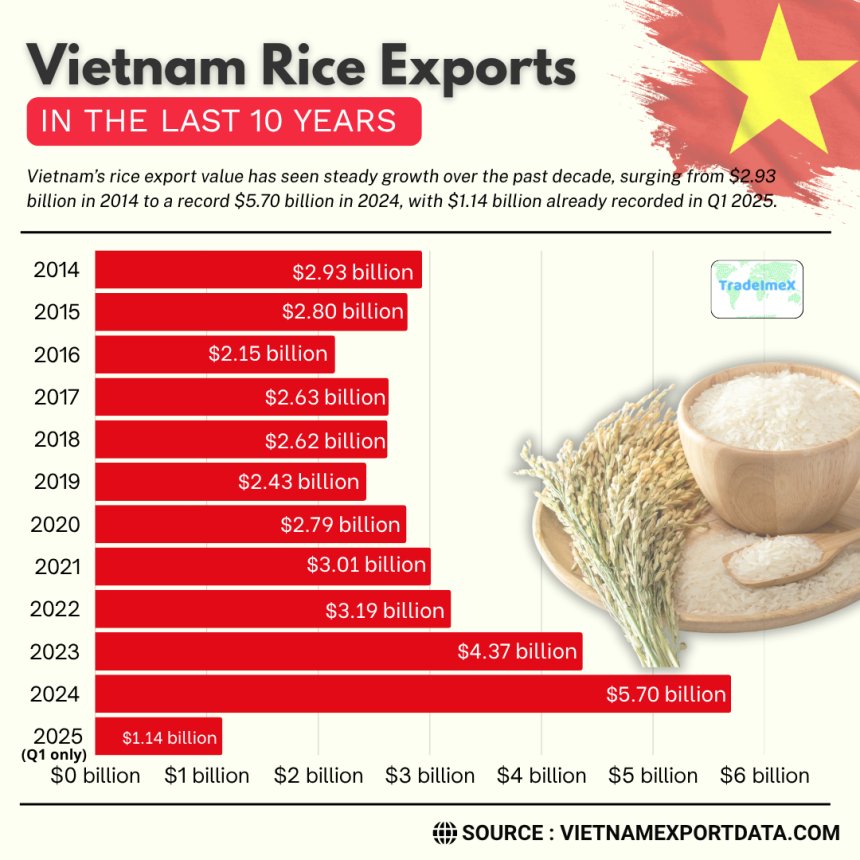

Vietnam Rice Exports in the Last 10 Years: Historical Vietnam Rice Export Data

|

Year of Exports |

Vietnam’s Rice Export Value ($) |

|

2014 |

$2.93 billion |

|

2015 |

$2.80 billion |

|

2016 |

$2.15 billion |

|

2017 |

$2.63 billion |

|

2018 |

$2.62 billion |

|

2019 |

$2.43 billion |

|

2020 |

$2.79 billion |

|

2021 |

$3.01 billion |

|

2022 |

$3.19 billion |

|

2023 |

$4.37 billion |

|

2024 |

$5.70 billion |

|

2025 quarter 1 |

$1.14 billion |

Vietnam Rice Export Overview (2024–2025)

-

2024 exports: 9.04 million tons (record high)

-

2024 value: $5.7 billion

-

2025 forecast: 7.9 million tons

-

Avg price (2024): $600/ton

-

Price drop in 2025: Down to $390/ton by mid-year

Yearly Vietnamese Rice Export Comparison

|

Year |

Volume (MMT) |

Value ($) |

Avg. Price (USD/t) |

Note |

|

2023 |

8.15 million metric tons |

$4.86 billion |

$597/ton |

Strong year |

|

2024 |

9.04 million metric tons |

$5.7 billion |

$600/ton |

Highest ever |

|

2025 |

7.9 million metric tons |

TBD |

$390–500/ton |

Price pressure from India |

Top Vietnamese Rice Buyers in 2024

-

Philippines: 3.6–4.2 MMT

-

Indonesia: 1.26 MMT

-

Others: China, Malaysia, Ghana, Côte d’Ivoire, Singapore

Major Vietnam Rice Export Types

Vietnam's rice export portfolio is dominated by white rice, which accounts for approximately 70% of total rice exports. This is followed by fragrant rice varieties like Jasmine, representing about 16% of the total. Glutinous rice, commonly used in traditional Asian dishes, makes up around 6%, while Japonica rice, popular in Japan and Korea, contributes 4%. The remaining 4% falls under other specialized or mixed rice categories. The top 10 exported rice categories in Vietnam, as per Vietnam shipment data and Vietnam rice export data for 2024-25, include:

|

Rank |

Rice Type |

Approx. Export Value (2024) |

Notes |

|

1 |

White Rice (5% broken) |

$2.96 billion |

Main export type, sold widely to Asia and Africa. |

|

2 |

Fragrant Rice (e.g., ST24, ST25) |

$1.13 billion |

Premium aromatic rice for high-end markets. |

|

3 |

White Rice (25% broken) |

$450 million |

Lower-grade rice, used in budget markets. |

|

4 |

Glutinous Rice |

$360 million |

Sticky rice for desserts and traditional dishes. |

|

5 |

Japonica Rice |

$230 million |

Short-grain rice, mainly for Japan and Korea. |

|

6 |

100% Broken Rice |

$150 million |

Cheap rice for processing and animal feed. |

|

7 |

Husked Brown Rice |

$120 million |

Imported and re-exported after milling. |

|

8 |

Brown Rice |

$100 million |

Whole grain rice for health-focused markets. |

Quick Notes

-

White rice dominates export volumes, especially the 5% broken grade sent mainly to the Philippines and Indonesia.

-

Fragrant/premium varieties (like ST25 & Jasmine) account for ~16–20% of exports, targeting high-end markets in the EU, U.S., and Japan.

-

Glutinous and Japonica serve regional preferences and niche segments.

-

Husked brown rice is a unique re-export model: imported, milled, then sent as white rice.

-

Brown rice reflects growing health trends abroad.

-

Broken rice grades serve industrial and feed markets, leveraging lower prices (25% and 100% broken).

Vietnam Rice Export Price Trend Snapshot

|

Month |

5% Broken Rice Price (USD/t) |

Note |

|

Dec 2024 |

$485/ton |

Slight drop |

|

Feb 2025 |

$500/ton (Fragrant Rice) |

Buyers delayed shipments |

|

May 2025 |

$390/ton |

Lowest in 5 years |

Vietnam Rice Production 2024-25 (Estimated)

Vietnam is expected to produce around 43 million tonnes of paddy rice in 2024–25. This translates to approximately 27 million tonnes of milled rice, grown on about 7 million hectares of farmland. Average yield stands at around 6.16 tonnes per hectare. Vietnam is expected to become the second-largest rice exporter in the world, overtaking Thailand, at the same time. In 2024–2025 and 2025–2026, the nation is expected to export 7.9 million tons of rice, surpassing Thailand's exports of 7.2 million and seven million tons, respectively.

Vietnam's Rice Export Volume Increased, but a decline in Value

According to a report by Vietnam News Agency, which cited the Ministry of Agriculture and Environment, Vietnam's rice exports rose in volume but saw a decrease in value during the first five months of 2025. During the mentioned period, the nation exported about 4.5 million tons of rice, up 12.2% year over year, bringing in an estimated $2.34 billion in income. However, a sharp reduction in average export prices, which fell to roughly 0.516 USD per kg, down 18.7% from the same time the previous year, caused the export value to drop by 8.9%. From January to May, the Philippines continued to be Vietnam's top importer of rice, making up 41.4% of all shipments.

Rice Export Trends in Vietnam

The global rice market is constantly evolving, with changing consumer preferences, trade policies, and economic conditions shaping the demand for rice products. In Vietnam, several key trends are driving the country's rice export industry and influencing the market dynamics.

1. Diversification of Rice Varieties: In response to shifting consumer demands, Vietnamese rice exporters are expanding their product offerings to include a wider range of rice varieties, such as fragrant rice, glutinous rice, and organic rice. This diversification strategy helps cater to different market segments and enhance Vietnam's competitiveness in the global rice market.

2. Sustainable Practices: As sustainability becomes a growing concern for consumers and businesses worldwide, Vietnam's rice exporters are increasingly adopting eco-friendly practices in rice cultivation and production. From water-saving techniques to organic farming methods, these sustainability initiatives not only benefit the environment but also contribute to the overall quality and appeal of Vietnamese rice products.

3. Digitalization of Trade: With the rise of e-commerce and digital platforms, rice trade in Vietnam is becoming more streamlined and efficient. Online marketplaces, blockchain technology, and digital payment systems are revolutionizing the way rice exporters conduct business, facilitating smoother transactions & faster.

Conclusion and Final Take

In conclusion, Vietnam's rice export industry is thriving, with strong growth rates, a diverse range of exporters, and promising trends shaping the market. Vietnam’s rice export performance in 2024 hit a historic high in both volume and value, driven by strong demand from Asia and favorable global pricing.

However, the outlook for 2025 signals tighter competition, softer prices, and shifting trade dynamics as India returns to the market and global supply increases. Exporters will need to focus on quality, branding, and trade agreements to stay competitive. Tracking specific rice types, destination markets, and pricing trends will be key to making informed business decisions in this changing landscape.

We hope that you liked our insightful and interactive blog report on Vietnam Rice Exports for 2025. Need the latest Vietnam rice export data by type, buyer, or HS code? Get detailed, verified stats from VietnamExportdata now. Contact us at info@tradeimex.in to get an exclusive & customized report on Vietnam import-export data, and get a verified list of the top rice exporters in Vietnam.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

1

Funny

1

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0