Exports of Black Pepper from Vietnam: Vietnam Black Pepper Exporters List 2025

Discover Vietnam's black pepper export data for 2024–25, including key destinations, and the top Vietnam black pepper exporters and suppliers for 2025

In recent years, Vietnam has emerged as one of the top exporters of black pepper in the world. The country's favorable climate and skilled farmers have contributed to the growth of the black pepper industry. Despite a minor decline in export volume, Vietnam's black pepper exports hit a record high in terms of export value in 2024. According to the Vietnam export data and Vietnam black pepper export data, the total export value of black pepper from Vietnam reached a record $1.32 billion in 2024-25. According to the Vietnam Pepper and Spice Association (VPSA) and Vietnam customs data, export value increased by 45.4% year over year, despite a 5.1% decline in export volume. The sharp spike in pepper costs was the main cause of this increase.

Vietnam is the largest black pepper exporter in the world, as per the global trade data. Vietnam dominates the global black pepper market, accounting for nearly one-third of worldwide production and exports. In 2024, amidst volatility, Vietnam delivered an eye-opening performance; export volumes dipped modestly, yet total export value skyrocketed to record highs. This blog explores pivotal export data, trends, emerging markets, and challenges shaping the 2024–25 landscape. In this article, we will discuss the exports of black pepper from Vietnam and provide a list of the top Vietnam black pepper exporters for the year 2025.

Important information on Vietnam Black Pepper Exports in 2024

-

Value of Record Export: In 2024, Vietnam's pepper exports hit a record high of around $1.32 billion, as per Vietnam black pepper export statistics.

-

Export Volume: According to the Vietnam Pepper and Spice Association, 250,600 tons of pepper, including black and white pepper, were exported overall as per Vietnam spices export data.

-

White Pepper & Black Pepper: There were 30,331 tons of white pepper and 220,269 tons of black pepper out of the total Vietnam exports.

-

With an average cost of $5,280 per ton, export prices for pepper, particularly black pepper, reached previously unheard-of levels.

-

Price of Black Pepper: The export price of black pepper in 2024 was $5,154 per ton, a 49.7% rise from 2023.

-

Important Export Destinations: Vietnam's top export destination is still the United States, which is followed by the United Arab Emirates, Germany, the Netherlands, and India.

-

China's Role: Although it imported less pepper from Vietnam, China was still one of the top six export destinations.

-

Production: Around 225,000 tons of pepper were produced in Vietnam in 2024.

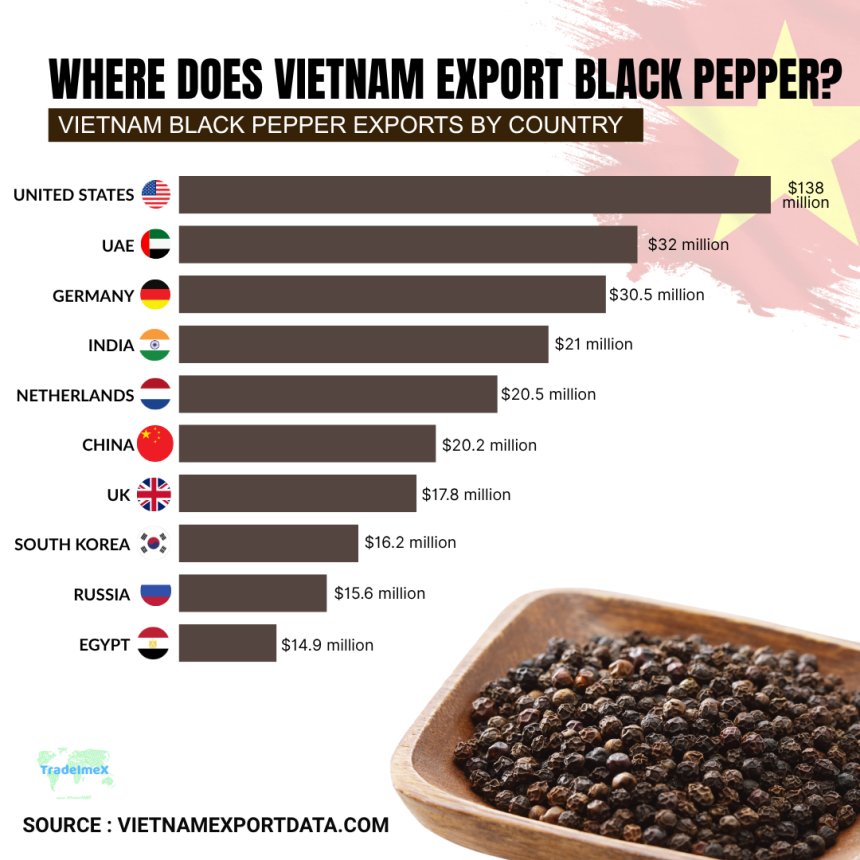

Vietnam Black Pepper Exports by Country: Where Does Vietnam Export Black Pepper?

Vietnam is a prominent player in the global black pepper market, with a significant amount of its production being exported to various countries worldwide. The top destinations for Vietnam's black pepper exports include the United States, India, Germany, and the United Arab Emirates. These countries rely on Vietnam for high-quality black pepper due to its rich flavor profile and competitive pricing. According to the data on the export of black pepper from Vietnam and Vietnam shipment data for black pepper exports in 2024-25, the top 10 export destinations for Vietnam black pepper include:

1. United States: $138 million (28.5%)

The United States is one of the largest importers of Vietnamese black pepper, accounting for a significant portion of Vietnam's black pepper exports, as per the data on Vietnam black pepper exports to USA. With a whopping $138 million worth of black pepper imports from Vietnam, the United States remains a key market for Vietnamese black pepper producers.

2. United Arab Emirates: $32 million (6.6%)

The United Arab Emirates is another important market for Vietnam's black pepper exports, with $32 million worth of imports in 2024-25. The demand for Vietnamese black pepper in the UAE is driven by its use in the local cuisine as well as its popularity in the food industry.

3. Germany: $30.5 million (6.3%)

Germany is a major market for Vietnamese black pepper, with imports totaling $30.5 million in 2024-25, as per the data on Vietnam black pepper exports to Germany by HS code. The country's strong economy and thriving food industry make it a prime destination for Vietnamese black pepper exports.

4. India: $21 million (4.3%)

Despite being a major producer of black pepper itself, India imports a significant amount of black pepper from Vietnam, with imports reaching $21 million in 2024-25. The demand for Vietnamese black pepper in India is driven by its unique flavor profile and high quality.

5. Netherlands: $20.5 million (4.2%)

The Netherlands is a key player in the European black pepper market and imports $20.5 million worth of black pepper from Vietnam. The country's strategic location and well-established trade networks make it an attractive market for Vietnamese black pepper exporters.

6. China: $20.2 million (4.2%)

China is a growing market for Vietnamese black pepper, with imports reaching $20.2 million in 2024-25. The increasing demand for foreign spices in China, coupled with Vietnam's reputation for high-quality black pepper, has fueled the growth of this market.

7. United Kingdom: $17.8 million (3.7%)

The United Kingdom remains a significant market for Vietnamese black pepper, with imports totaling $17.8 million in 2024-25. The country's diverse culinary scene and increasing demand for exotic spices drive the import of Vietnamese black pepper.

8. South Korea: $16.2 million (3.3%)

South Korea is an emerging market for Vietnamese black pepper, with imports reaching $16.2 million in 2024-25. The country's growing food industry and changing consumer preferences have created opportunities for Vietnamese black pepper exporters.

9. Russia: $15.6 million (3.2%)

Russia is an important market for Vietnamese black pepper, with imports amounting to $15.6 million in 2024-25. The country's large population and growing interest in international cuisines drive the demand for Vietnamese black pepper.

10. Egypt: $14.9 million (3.1%)

Egypt is a significant importer of Vietnamese black pepper, with imports totaling $14.9 million in 2024-25. The country's rich culinary tradition and use of spices in traditional dishes make it a key market for Vietnam black pepper exporters.

List of Top Black Pepper Exporters in Vietnam: Vietnam Black Pepper Exporters Database

The Vietnam Black Pepper Exporters Database, or Vietnam black pepper exporters list, is a comprehensive resource for those seeking high-quality black pepper suppliers in Vietnam. This database showcases the top exporters in the country, providing valuable information for businesses looking to source premium black pepper products. The leading black pepper exporters in Vietnam, as per the Vietnam black pepper suppliers list and the Vietnam black pepper exporters data for 2025, include:

1. Olam Vietnam

-

Approx. Export Value (2024): Exported $143 million (27,800 tons)

-

Top markets: United States, UAE

-

Notes: Led in both exports (27,800 t) and imports; gained 10.4% share of total as of May 2025.

2. Phuc Sinh Corporation

-

Approx. Export Value (2024): $118 million (22,923 tons)

-

Top markets: Europe, U.S.

-

Notes: Known as a "pepper king"; awarded top pepper/spice exporter; strong quality control.

3. Nedspice Vietnam

-

Approx. Export Value (2024): $104 million (20,240 tons)

-

Top markets: Europe

-

Notes: Foreign-invested (Netherlands); volume rose 8.8% in 2024; top 3 exporter of black pepper in Vietnam overall.

4. Haprosimex JSC

-

Approx. Export Value (2024): $92 million (17,899 tons)

-

Top markets: Middle East, Africa

-

Notes: Surged 63% YoY; among top 5 exporters

5. Pearl Group

-

Approx. Export Value (2024): $84 million (16,210 tons)

-

Top markets: Asia

-

Notes: Slight volume decline (6.5%); still a leading exporter.

6. Lien Thanh

-

Approx. Export Value (2024): $68 million (13,252 tons)

-

Top markets: Asia

-

Notes: Volume up 32%; among fastest-growing black pepper exporters in Vietnam.

7. Tran Chau

-

Approx. Export Value (2024): $65 million (12,634 tons)

-

Top markets: Europe

-

Notes: Experienced slight drop (4.5%); historically among top exporters

8. Simexco Dak Lak

-

Approx. Export Value (2024): $56 million (10,768 tons)

-

Top markets: Middle East

-

Notes: Explosive growth (20% YoY)

9. Sinh Loc Phat

-

Approx. Export Value (2024): $28 million (5,396 tons)

-

Top markets: Domestic and international

-

Notes: Volume up 51%; notable SME growth

10. Pitco / Unispice Vietnam (tied)

-

Approx. Export Value (2024): Pitco $16 million (3,092 tons); Unispice $13 million (2,545 tons)

-

Top markets: Asia

-

Notes: Pitco dropped 37%, Unispice 11%; still in top ten range.

Summary

|

Rank |

Company |

Volume (tons) |

Approx Value (USD) |

Markets |

Notes |

|

1 |

27,800 tons |

$143 million |

U.S., UAE |

#1 exporter & importer |

|

|

2 |

Phuc Sinh |

22,923 tons |

$118 million |

Europe, U.S. |

Awarded top exporter |

|

3 |

Nedspice Vietnam |

20,240 tons |

$104 million |

Europe |

Netherlands-invested, steady growth |

|

4 |

Haprosimex JSC |

17,899 tons |

$92 million |

Middle East, Africa |

+63% YoY growth |

|

5 |

Pearl Group |

16,210 tons |

$84 million |

Asia |

Slight decline |

|

6 |

Lien Thanh |

13,252 tons |

$68 million |

Asia |

+32% YoY growth |

|

7 |

Tran Chau |

12,634 tons |

$65 million |

Europe |

Minor YoY drop |

|

8 |

Simexco Dak Lak |

10,768 tons |

$56 million |

Middle East |

+203% YoY surge |

|

9 |

Sinh Loc Phat |

5,396 tons |

$28 million |

Various |

+51% YoY growth |

|

10 |

Pitco / Unispice |

3,092 tons |

$16 million |

Asia |

Notable YoY declines |

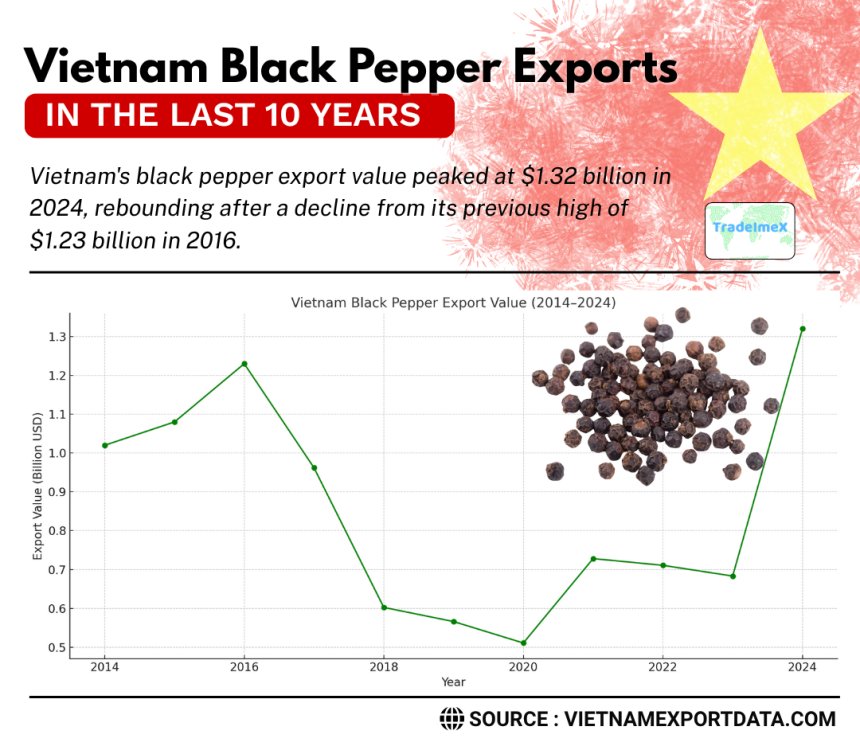

Vietnam Black Pepper Exports in the Last 10 Years: Historical Vietnam Export Data

|

Year of Exports |

Vietnam Black Pepper Export Value ($) |

|

2014 |

$1.02 billion |

|

2015 |

$1.08 billion |

|

2016 |

$1.23 billion |

|

2017 |

$961.99 million |

|

2018 |

$602.44 million |

|

2019 |

$566.09 million |

|

2020 |

$510.85 million |

|

2021 |

$728.18 million |

|

2022 |

$710.82 million |

|

2023 |

$683.21 million |

|

2024 |

$1.32 billion |

Annual Export Snapshot: Volume vs. Value

2024 Performance

-

Total pepper exports: 250,600 tons

-

Black pepper: 220,269 tons

-

White pepper: 30,331 tons

-

Total earnings: $1.32 billion

-

Black pepper: $1.118 billion

-

White pepper: $200.6 million

Volume Decline

Vietnamese Pepper Export volume declined 5–6% year-over-year. Sources vary: VPSA cites a 5.1% drop; customs data notes a 6.2% lower tonnage. This aligns with a global downtrend driven by reduced production in Vietnam and other top exporters.

Record-Breaking Prices

-

Average black pepper price: $5,154–5,269/ton (+49–51%)

-

Average white pepper price: $6,884/ton (+39%)

The premium stems from tighter global supplies, rising production costs, quality improvements, and branding efforts.

Monthly Dynamics of Vietnam Black Pepper Export: December & Early 2025

December 2024

-

Volume: 12,771 tons

-

Revenue: $100.6 million

-

Avg prices: $6,476/ton

December, typically a lull for pepper shipments, held steady with robust price retention. The U.S. accounted for 29.5% of exports at 4,509 tons.

Early 2025 (Jan–Feb)

-

Feb 2025: 14,331 tons shipped, $97.3 million (+5.4% vol, +77.5% value vs. Feb 2024).

-

Jan–Feb cumulative: 27,416 t, ~$184.9 million (–11.9% vol, +48.1% value).

-

Avg price early 2025: ~$6,746/t (+68.2% YoY).

Vietnam targets $1.5 billion in black pepper exports for 2025, driven by continued high prices and stable demand.

Vietnam Black Pepper Export Flow by Region & Impact

-

Americas: U.S. demand fueled overall volume; +53% for the entire Americas.

-

Europe: Germany (+87%), Netherlands (+35%), as export hubs expand.

-

Asia: Declines in China (–84%), India slight reduction; offset by rising demand in UAE, South Korea, and India.

Drivers Behind Price Surge

Production Cuts & Supply Constraints

-

In early 2024, production fell sharply; much was harvested in the first half, leaving tight supplies toward year-end.

-

Global pepper output is down for the fourth consecutive year, focus on Vietnam and Brazil.

-

Farmers reduced planting after the price collapse in 2018; pepper vines take years to mature.

-

Climate change added unpredictability with erratic rainfall patterns.

Market Forces & Higher Margins

-

Brands moved up the value chain, with better quality, organic, traceable grades, boosting average export prices.

-

Government support via the Vietnam Pepper and Spice Association has pushed product upgrades and certifications.

Trade & Tariff Conditions

-

U.S. tariffs (notably 46% on Vietnamese black pepper from July 9, 2025) raise cost barriers, but markets are absorbing the price increase.

-

Elevated shipping rates and trade constraints inflate FOB pricing.

2025 Outlook: Expectations & Targets

Projected Exports

-

Vietnam aims for $1.5 billion in pepper export revenue in 2025, with a great opportunity to break the black pepper export record.

-

Early 2025 price momentum continues: $6,746/t avg for Jan–Feb.

-

With global production forecasted to decline as well, high prices are likely to persist.

Risks Ahead

-

Tariffs: The U.S.’s 46% levy may suppress demand; buyers may seek alternative origins.

-

Regression: Pressure on farmers to replant following past price crashes remains a structural concern.

-

Climate volatility: Continued erratic weather could compress yield cycles further.

-

Geopolitical shifts: Trade tensions, shipping costs, and currency swings pose external threats.

Sectoral Implications

Farmers & Rural Communities

-

Farmers face conflicting signals: price-induced planting incentives, but crop maturity delays, and tariff weight.

-

Investment in high-quality, certified, organic pepper offers profitable avenues.

-

Government extension services and financial support are vital for recovery from previous downturns.

Vietnamese Processing & Export Firms

-

Exporters like Olam Vietnam, Phuc Sinh, Nedspice, Haprosimex, and Phuc Thinh coped well, leading suppliers in 2024.

-

Demand for value-added products (ground pepper, organic, cracked mesh) is growing.

-

Port capacity critically influences competitiveness; past concerns surfaced over shipment integrity.

Trade & Economy

-

Pepper contributes significantly to Vietnam’s agricultural export GDP.

-

Price volatility warrants diversification of export markets, particularly decreasing reliance on China.

-

Further value-chain upgrades (certifications, branding, packaging, traceability) will strengthen export resilience.

A Transformational Phase for Vietnamese Black Pepper Exports

Vietnam’s black pepper export performance of 2024–25 marks a dramatic pivot, from volume growth to value-focused. Despite a 5–6% volume decline, staggering price increases resulted in a 45% jump in revenue, heralding a new era of quality-led, high-margin exports.

Key headlines:

-

Record revenue: $1.3–1.32 billion for 250k t in 2024.

-

Price boom: +50% black pepper, +39% white pepper.

-

Dominant buyers: U.S., Europe, Middle East.

-

Forecast: $1.5 billion target for 2025.

However, this success faces tests: tariff barriers, supply contraction, and climate impacts. Sustained investment in quality, farmer support, and market diversity will define future resilience.

Vietnam's trajectory, from quantity to quality, sets a new blueprint. Should the sector maintain strong branding, traceability, and environmental stewardship, pepper may evolve from a commodity to a premium agritech success.

Strategic Outlook: What to Watch

-

Planting Recovery – Will higher prices motivate durable replanting and volume recovery?

-

Market Diversification – Can Vietnam offset U.S./China dips by expanding into new markets?

-

Tariff Diplomacy – How will trade negotiations influence pepper access and price?

-

Climate Adaptation – Will resilience measures sustain production stability?

-

Premium Branding – Can Vietnamese firms establish a global identity beyond bulk pepper?

Conclusion and Final Word

In conclusion, Vietnam's black pepper industry has experienced significant growth in exports, with the country emerging as a key player in the global market. Vietnam’s black pepper industry stands at an inflection point: from commodity-driven volumes to differentiation-led growth. The 2024‑25 cycle shows promising results, record turnover, better farmer incomes, and export maturity. Still, realizing this potential demands purposeful investment, adaptive strategy, and sustained quality control.

For exporters, brands, and agribusiness leaders, this era offers a powerful lesson: Value trumps volume in global commodity markets. Strong narrative, traceability, and consistent quality can shape the future; now, Pepper’s turn to shine.

We hope that you liked our informative and data-driven blog report on the export of black pepper from Vietnam and the top Vietnam black pepper exporters in 2025. To get access to the latest Vietnam import-export data or to search live data on Vietnam black pepper exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in to get a customized database report along with a verified list of the top black pepper exporters in Vietnam.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0