Vietnam Phone Exports to US Hit Five-Year Low Amid Trade Uncertainty: Yearly Export Data & Trends

Vietnam phone exports to the US hit a five-year low in 2025 amid trade uncertainty, weaker demand, & production shifts. Explore data & insights.

Vietnam’s mobile phone industry has been one of the most dynamic components of its broader economic transformation over the past decade. Once a modest exporter of electronics, Vietnam became a central hub for global mobile phone production, especially for large multinational brands. That rapid growth helped fuel export-led development, contributed significantly to employment, and kept Vietnam near the top of global electronics supply chains. According to the latest Vietnam export data & Vietnam customs export data of phones, the total value of Vietnam phone exports to the US reached $21.18 billion in 2024, accounting for 36.6% of the total Vietnamese phone exports, an 18% increase from the previous year.

According to the Vietnam phone export data and the US import data, Vietnam exports the most phones to the USA. But in November 2025, official data showed a stark change: US imports of telephones and parts from Vietnam dropped below $410 million, the lowest monthly level in more than five years, a sign of deepening trade uncertainty and slowing global demand. This decline followed months of contraction and punctuated an unusual year in Vietnam’s export performance. Vietnam’s phone production and shipments have been sliding since mid-2025, reflecting broader shifts that policymakers and industry watchers are now trying to unpack. This blog uses the latest trade data and context around recent policy developments to tell the story behind the numbers.

A snapshot of the November slump

In November 2025, Vietnam’s monthly phone exports to the United States fell below $410 million, the lowest monthly export value recorded since May 2020. This figure also marked the fourth straight month of declines in shipments to the U.S. market. On the ground, this was reflected both in reduced volumes leaving Vietnamese factories and in annual production figures that have been declining since August 2025.

A notable outcome was that Vietnam’s total exports in November also fell to their lowest level since April, with total goods exports dropping to around $4 billion for the month, a level that underscored the spillover effects from the phone sector’s downturn.

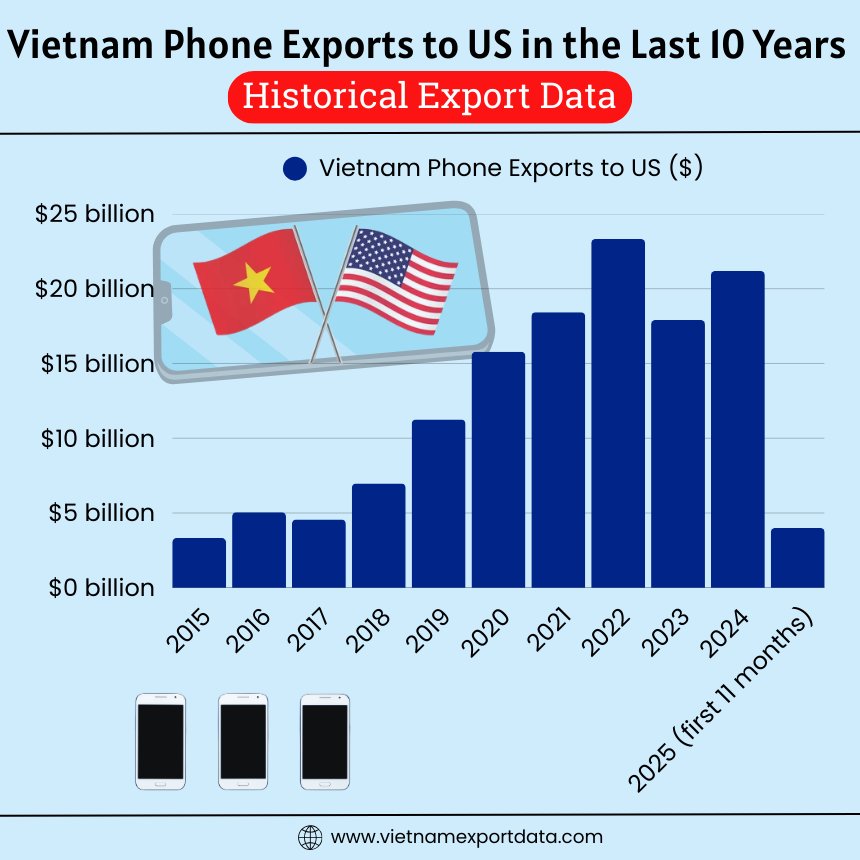

Vietnam Phone Exports to US in the Last 10 Years: Historical Export Data

|

Year of Exports |

Vietnam Phone Exports to US ($) |

|

2015 |

$3.32 billion |

|

2016 |

$5.05 billion |

|

2017 |

$4.56 billion |

|

2018 |

$6.97 billion |

|

2019 |

$11.25 billion |

|

2020 |

$15.79 billion |

|

2021 |

$18.42 billion |

|

2022 |

$23.32 billion |

|

2023 |

$17.91 billion |

|

2024 |

$21.18 billion |

|

2025 (first 11 months) |

$4 billion |

Understanding the core drivers

Several interrelated forces explain why Vietnam’s phone exports to the U.S. have fallen so sharply.

1) Trade uncertainty and tariffs

One of the most significant pressures on Vietnam’s export trajectory has been the evolving U.S. trade policy landscape in 2025. Earlier in the year, U.S. import tariffs were expanded to many Vietnamese products, including a 20% tariff on certain goods starting in August, creating substantial uncertainty among U.S. buyers and importers. While smartphones and related electronics were exempted from the steepest levies earlier in the year, the broader uncertainty in trade policy appears to have dampened ordering and shipment decisions. Exporters, especially those shipping to the US, delayed or reduced new contracts as buyers reassessed risk.

Vietnamese businesses and analysts have noted that even with tariff exemptions, uncertainty about potential future duties on other product categories made it harder for importers to plan inventories or secure long-term contracts. This type of hesitation can ripple through supply chains quickly. Uncertainty is itself a cost, as buyers & trade partners delay shipments or reroute orders to manage risks.

2) Weaker consumer demand in key markets

Global smartphone demand has cooled in 2025, particularly in mature markets like the United States, where most consumers already own advanced devices. Replacement cycles have lengthened, meaning people keep phones longer and upgrade less frequently. This trend, combined with weaker macroeconomic conditions, has reduced the need for sustained high shipment volumes. Exporters reported that manufacturers were adjusting production and global supply schedules to reflect the softer demand, which pushed down the volume of phones sent to the U.S. in recent months.

3) Production adjustments by major manufacturers

Samsung Electronics accounts for the largest share of Vietnam’s smartphone exports and production. Because Samsung does not publicly break down its export figures by country of origin, trade analysts look at Vietnamese customs data as a proxy for the company’s shipment trends. According to industry insiders, Samsung has been modifying production levels at its Vietnamese facilities in response to softer global demand, including the U.S. slowdown. These shifts help explain why Vietnam’s export figures have decelerated sharply since mid-2025.

Samsung’s Vietnam Smartphone Exports to the US Decline

A significant portion of Vietnam’s phone exports is tied to a small number of manufacturers, with Samsung Electronics accounting for more than half of the total output. Samsung operates massive production facilities in Vietnam and uses them as a primary base for exporting smartphones to global markets, including the U.S.

Recent data shows that Samsung-linked smartphone shipments from Vietnam to the U.S. have declined sharply, contributing to a five-year low in overall exports. Industry sources indicate that Samsung adjusted production and export volumes in response to softer global demand and heightened trade uncertainty. While the company does not publish country-specific shipment figures, changes at Samsung’s Vietnamese plants tend to show up clearly in national export data.

Earlier in 2025, temporary tariff exemptions helped boost shipments, particularly around May. However, from August onward, volumes dropped steadily as manufacturers recalibrated supply chains and responded to weaker U.S. demand.

Data trends over the first 11 months of 2025

Despite the recent dip, the annual picture for 2025 remained relatively stable compared with 2024 for most of the year. Strong shipments earlier in 2025, particularly in January and May, when tariff exemptions boosted order volumes, helped keep overall export values for the first 11 months roughly flat year-on-year. This contrast shows that the contraction was not uniform throughout the year: exports peaked early and then slid sharply later in the year as trade friction and demand weakness converged.

Annual comparisons also highlight that Vietnam’s phone output was falling on an annual basis from August onward, underscoring that November’s decline was part of a sustained trend rather than an isolated monthly shock.

The US remains Vietnam’s largest export market, but trends are shifting

Vietnam’s exports to the United States across all goods have continued to grow for much of 2025, even as individual categories like phones have turned down. In fact, Vietnam recorded record annual export figures to the U.S. in the first 10 months of 2025, with over $120 billion shipped across sectors. Electronics & technology-related products have been a major driver of this surge.

However, the specific slump in phone exports shows that growth is no longer automatic and that certain sectors are now vulnerable to external shocks, whether policy-driven or demand-driven.

Broader implications for supply chains and production

The five-year low in U.S. phone imports from Vietnam points to broader structural challenges:

1. Shift in global manufacturing footprints

Vietnam is not alone in facing shifts in supply chain strategies. Some overseas manufacturers have been expanding production in countries like India to gain tariff advantages and diversify risk. This diversification means that Vietnam may face greater competition for shipment volumes from alternative production hubs. (Industry commentary has noted the rise of India in supply networks for phones destined for Western markets.)

2. Inventory management and buyer behavior

Longer replacement cycles and high inventory levels at retail and carrier channels have made buyers more cautious. Instead of placing large forward orders, buyers are running leaner inventories, contributing to month-by-month export volatility.

3. Policy influence on trade routing

Even when tariffs do not apply directly to smartphones, broader trade measures can influence routing decisions and cost calculations. Trade partners and multinational firms may reroute products through different markets to minimize risk, eroding Vietnam’s share of U.S. imports over time.

What this means for Vietnam’s economy

Phones have been a central engine for Vietnam’s export growth. A sustained downturn would have implications for:

-

Manufacturing employment: Production adjustments may lead to slower hiring or reduced hours in electronics clusters.

-

Sector revenues: Export values for mobile phones contribute significantly to Vietnam’s total export earnings; steep declines can influence trade balance and currency stability.

-

Investment decisions: Both foreign and domestic investors may reassess the attractiveness of Vietnamese production hubs if uncertainty persists.

The recent data, especially the weak November figure and the series of consecutive declines, have pushed these considerations into sharper focus for policymakers and corporate planners.

Looking Ahead: What to Watch

The key question now is whether the downturn is a temporary correction or the start of a longer structural shift. Important indicators to monitor in early 2026 include:

-

Monthly export figures for phones and other electronics

-

Ordering and production guidance from major manufacturers

-

Trade policy announcements from the U.S. or other large markets

-

Demand indicators such as consumer spending, replacement cycles, and carrier sales promotions

A rebound in early 2026 would suggest the late-2025 slump was cyclical. Continued declines could signal bigger changes in global supply chains.

Conclusion and Final Thoughts

In conclusion, Vietnam’s phone exports to the United States, falling to their lowest level in more than five years, are a clear signal that the dynamics that drove rapid growth earlier in the decade have eased. Trade uncertainty, tariff changes, weaker consumer demand, and production adjustments by major manufacturers all contributed to the downturn.

This isn’t simply a short-term blip. The pattern of declines since August 2025 and the unusually low November export figure suggest that Vietnam’s phone sector, once a near-constant growth story, is now at a turning point. Policymakers, manufacturers, and exporters will need to adapt to new realities in global demand and trade policy if Vietnam is to maintain its place at the forefront of mobile phone supply chains.

For more insights into the latest Vietnam import-export data, or to search live data on Vietnam phone exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top phone exporters in Vietnam, as per your needs.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0