Vietnam-ASEAN Trade Dynamics: A Growing Intra‑Regional Trade of Vietnam in ASEAN

Explore Vietnam’s growing trade with ASEAN, including top imports, exports, trade partners, & intra-regional trade data of Vietnam in ASEAN.

Introduction

Vietnam’s economic story has long been tied to global trade. Over the past two decades, investors, analysts, and policymakers have viewed Vietnam as one of the most dynamic export-driven economies in Asia. The country’s early integration into global supply chains helped it build a manufacturing base that is now central to sectors like electronics, textiles, food processing, and machinery. According to the Vietnam import data, the total value of Vietnam imports from ASEAN members reached $46.85 billion in 2024, while Vietnam exports to ASEAN reached $36.50 billion in 2024-25, a 13.3% increase from the previous year, as per the Vietnam export data.

The total Vietnam-ASEAN trade value accounted for $83.35 billion in 2024-25, showing an increase of 14.7% from the previous year, as per the Asia trade data. Vietnam had a trade deficit with ASEAN in 2024, despite the region being its 3rd largest trading partner, as per the global trade data. While the world tends to watch Vietnam’s trade with the United States, China, the EU, and South Korea, its commercial ties inside Southeast Asia have grown rapidly. From 2024 to 2025, Vietnam’s trade with the ASEAN region reached new highs, tightened supply-chain interdependence, and reinforced ASEAN’s role as a primary trading bloc for Vietnam.

This detailed article looks at how intra-ASEAN trade has changed, why it matters, what sectors and countries are shaping it, and what risks and opportunities Vietnam faces as this trend continues.

Vietnam–ASEAN Trade Overview in 2024–25

Vietnam’s two-way trade with ASEAN has been expanding steadily for years, but 2024 marked a clear acceleration. Total bilateral trade between Vietnam and ASEAN reached a record high of 83.3 billion USD in 2024. This was the highest level ever recorded, driven by strong imports and healthy export performance across multiple ASEAN partners.

Vietnam-ASEAN 2025 Trade Momentum Builds on 2024 Strength

The momentum did not slow as 2025 began.

-

In the first half of 2025, Vietnam–ASEAN trade reached about 45.4 billion USD, accounting for roughly one tenth of Vietnam’s total global trade.

-

By August 2025, bilateral trade exceeded 60 billion USD, reflecting double-digit growth on the import side and moderate growth on the export side.

Growing Trade Deficit with ASEAN

A clear pattern emerged across 2024 and 2025. Vietnam ran a large and growing trade deficit with ASEAN.

In 2025:

-

By March, the deficit was close to 4 billion USD.

-

In the first five months, the deficit widened to more than 6.5 billion USD, a sharp year-on-year increase.

-

Imports consistently outpaced exports, often by margins of 30 to 40 percent.

This imbalance is not inherently negative. Much of what Vietnam imports from ASEAN is intermediate goods. These imports feed Vietnam’s factories, which then export finished or assembled goods to markets worldwide. Still, the size and speed of the growing deficit are worth deeper examination.

Why Vietnam’s Trade with ASEAN Is Growing Fast

Intra-ASEAN trade has been rising for structural, policy-driven, and market-driven reasons. Several overlapping forces have pushed 2024–25 numbers to record levels.

1. Regional Trade Agreements

The ASEAN Free Trade Area (AFTA), the ASEAN Trade in Goods Agreement (ATIGA), and the broader Regional Comprehensive Economic Partnership (RCEP) all reduce tariffs and simplify cross-border trade procedures. Vietnam has benefited heavily from these agreements because they favor regional production networks.

The rules of origin under RCEP, for example, make it easier for firms to count inputs from ASEAN members as “regional content,” which helps qualify their products for preferential tariff treatment in other markets. This has directly encouraged more intra-ASEAN sourcing.

2. Production Chain Interdependence

ASEAN countries have similar production structures, especially in electronics, food processing, chemicals, metals, rubber, and industrial components. Vietnam sits at the center of several of these supply chains. For example:

-

Vietnamese manufacturers import materials and parts from Thailand, Malaysia, and Singapore.

-

They process, assemble, or package the goods.

-

The final products are exported either within ASEAN or to major global markets.

As Vietnam’s manufacturing scale expands, its demand for regional intermediate inputs naturally increases.

3. Rapid Industrial Upgrade in Vietnam

Vietnam’s manufacturing sector is upgrading fast. Electronics account for a large share of exports, and these industries require high-precision parts, chemicals, plastics, and machinery sourced predominantly from ASEAN partners. Each time Vietnam climbs the ladder of technological sophistication, its need for more complex intermediate goods rises. Much of that demand is met by ASEAN suppliers.

4. ASEAN’s Growing Consumer Market

ASEAN’s population of about 700 million people continues to see steady income growth. This makes regional markets increasingly attractive for Vietnamese exports, especially:

-

Processed food

-

Construction materials

-

Household goods

-

Textiles

-

Consumer electronics

-

Agricultural products

Proximity, cultural similarities, and low logistics costs all increase Vietnam’s competitiveness within ASEAN.

5. Trade Diversification Strategy

Vietnam’s government has been conscious about reducing reliance on a few large markets. ASEAN fits neatly into this strategy because:

-

It is geographically close

-

It provides a predictable demand

-

Trade frameworks are stable and well-established

-

It reduces exposure to global shocks, especially tariffs or geopolitical tension between major economies

Top Vietnam Imports from ASEAN Members: What Does Vietnam Import from ASEAN?

Vietnam's significant imports from ASEAN members encompass a diverse range of products, highlighting the robust trade relationships within the region. Among the top imports from ASEAN countries are electronic components, machinery, oil, and steel, indicating the substantial trade flow between Vietnam and its neighboring nations. These imports play a pivotal role in supporting Vietnam's industrial and economic development, showcasing the country's reliance on ASEAN partners for essential goods and materials. The top 10 goods that Vietnam imports from ASEAN countries, as per the Vietnam customs data & Vietnam-ASEAN trade data for 2024-25, include:

1. Mineral fuels & oils (HS code 27): $8.62 billion

Mineral fuels and oils are among the top imports that Vietnam acquires from ASEAN countries. These resources are crucial for Vietnam's energy requirements and industrial growth. The country's growing economy demands a steady supply of these resources to fuel its various sectors.

2. Electrical machinery & equipment (HS code 85): $7.24 billion

Electrical machinery and equipment form a significant portion of Vietnam's imports from ASEAN members. Vietnam relies on these imports to support its expanding electronics industry, which has been a major driver of economic growth in the country.

3. Nuclear reactors & machinery (HS code 84): $3.19 billion

Vietnam's imports of nuclear reactors and machinery from ASEAN members highlight the country's focus on developing its infrastructure and energy capabilities. These imports play a critical role in enhancing Vietnam's technological capabilities and supporting its long-term development goals.

4. Vehicles (HS code 87): $3.05 billion

The automotive sector is another key area where Vietnam imports significant amounts of goods from ASEAN countries. Vehicles are essential for meeting the transportation needs of Vietnam's growing population and supporting its economic activities.

5. Rubber & articles thereof (HS code 40): $2.09 billion

Rubber and related articles are important imports for Vietnam, which has a thriving rubber industry. ASEAN members supply Vietnam with the necessary raw materials to support its rubber manufacturing sector, which plays a crucial role in the country's export industry.

6. Plastics & articles thereof (HS code 39): $2.05 billion

Plastics and plastic articles are essential imports for Vietnam, supporting various industries such as packaging, construction, and automotive. Vietnam relies on ASEAN members for a steady supply of these materials to meet its domestic demand and facilitate its manufacturing activities.

7. Iron & steel (HS code 72): $1.64 billion

Iron and steel are vital imports for Vietnam's construction and manufacturing sectors. These materials are crucial for infrastructure development and industrial production, making them essential components of Vietnam's import portfolio from ASEAN members.

8. Copper & articles thereof (HS code 74): $1.45 billion

Copper and copper articles are important imports for Vietnam's electrical and electronics industry. These materials are essential for the production of various electronic components, supporting Vietnam's position as a key player in the global electronics supply chain.

9. Cereals (HS code 10): $1.26 billion

Cereals are a significant import for Vietnam, given the country's large population and growing demand for food products. Vietnam imports cereals from ASEAN members to support its domestic food supply and ensure food security for its population.

10. Animal or vegetable fats & oils (HS code 15): $1.26 billion

Animal or vegetable fats and oils are essential imports for Vietnam's food processing industry. These products are used in a wide range of food products, highlighting their importance in Vietnam's import trade with ASEAN members.

Top Vietnam Exports to ASEAN Members: What Does Vietnam Export to ASEAN?

Vietnam is a significant player in the ASEAN market, boasting a diverse range of top exports to its fellow member countries. Some of the key exports from Vietnam to ASEAN members include electronics, textiles, footwear, and agricultural products. With a strong manufacturing sector and strategic geographic location, Vietnam has established itself as a vital trade partner within the region. The top 10 products that Vietnam exports to ASEAN nations, as per the Vietnam shipment data for 2024-25, include:

1. Electrical Machinery & Equipment (HS Code 85): $6.87 Billion

One of the leading exports from Vietnam to ASEAN members is electrical machinery and equipment, amounting to a substantial $6.87 billion, as per the Vietnam electronics export data by HS code. This category includes items such as electrical transformers, circuit boards, and electrical capacitors.

2. Cereals (HS Code 10): $4.07 Billion

Cereals also play a crucial role in Vietnam's exports to ASEAN, with a total value of $4.07 billion. This category encompasses products like rice, wheat, corn, and other cereal grains that are in high demand among ASEAN countries.

3. Nuclear Reactors & Machinery (HS Code 84): $2.35 Billion

Vietnam's exports of nuclear reactors and machinery to ASEAN members amount to $2.35 billion, showcasing the country's expertise in this sector. This category includes items such as industrial machinery, reactors, and boilers.

4. Iron & Steel (HS Code 72): $2.14 Billion

Iron and steel products are also significant exports from Vietnam to ASEAN, totaling $2.14 billion. These products include iron bars, rods, angles, and steel structures used in various industries across ASEAN countries.

5. Mineral Fuels & Oils (HS Code 27): $1.79 Billion

Vietnam's exports of mineral fuels and oils to ASEAN members stand at $1.79 billion, highlighting the country's role in the energy sector. This category includes products like petroleum oils, natural gas, and coal.

6. Plastics & Articles Thereof (HS Code 39): $1.41 Billion

Plastics and their associated products are another significant export category for Vietnam to ASEAN, with a total value of $1.41 billion. This includes items such as plastic plates, sheets, film, and other plastic articles.

7. Knitted or Crocheted Fabrics (HS Code 60): $1.08 Billion

Vietnam's exports of knitted or crocheted fabrics to ASEAN amount to $1.08 billion, showcasing the country's expertise in the textile industry. This category includes products like knitted or crocheted clothing items and fabrics.

8. Vehicles (HS Code 87): $953.23 Million

Vehicles, including cars, buses, and motorcycles, are essential exports from Vietnam to ASEAN members, totaling $953.23 million. This category highlights Vietnam's growing automotive industry.

9. Miscellaneous Chemical Products (HS Code 38): $884.06 Million

Miscellaneous chemical products also play a significant role in Vietnam's exports to ASEAN, with a total value of $884.06 million. This category includes items such as fertilizers, pesticides, and other chemical compounds.

10. Footwear (HS Code 64): $865.03 Million

Finally, footwear is a popular export category from Vietnam to ASEAN members, with a total value of $865.03 million. This includes various types of shoes, sandals, and other footwear products.

Top Trade Partners of Vietnam in ASEAN

Vietnam has established strong trade relationships within the ASEAN region, with key partners including Malaysia, Thailand, and Singapore emerging as the top trade partners of Vietnam in ASEAN. These countries play a significant role in Vietnam's economy, contributing to the growth and diversification of trade activities. The major Vietnam trade partners in ASEAN, as per the ASEAN trade data & Vietnam customs data for 2024-25, include:

|

Top import partners |

Import Value ($) |

Top export partners ($) |

Export value ($) |

|

1. Thailand |

$12.41 billion |

1. Thailand |

$7.61 billion |

|

2. Indonesia |

$10.49 billion |

2. Indonesia |

$6.17 billion |

|

3. Malaysia |

$9.04 billion |

3. Philippines |

$6.16 billion |

|

4. Singapore |

$5.32 billion |

4. Cambodia |

$5.16 billion |

|

5. Cambodia |

$4.77 billion |

5. Singapore |

$5.14 billion |

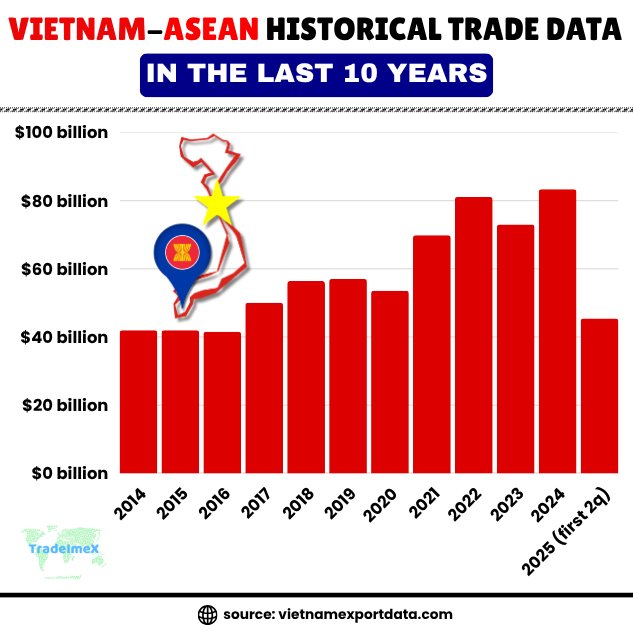

Vietnam-ASEAN Historical Trade Data in the Last 10 Years

|

Year of Trade |

Total Vietnam-ASEAN Trade Value ($) |

|

2014 |

$42.01 billion |

|

2015 |

$41.94 billion |

|

2016 |

$41.52 billion |

|

2017 |

$50.04 billion |

|

2018 |

$56.44 billion |

|

2019 |

$57.02 billion |

|

2020 |

$53.57 billion |

|

2021 |

$69.88 billion |

|

2022 |

$81.09 billion |

|

2023 |

$72.99 billion |

|

2024 |

$83.35 billion |

|

2025 (first 2 quarters) |

$45.40 billion |

Sectoral and National Trade Patterns

The strength of Vietnam–ASEAN trade isn’t spread evenly. Some sectors and partner countries dominate the data.

Vietnam’s Major Exports to ASEAN

The most important export categories include:

1. Agricultural goods: Vietnam supplies rice, fruits, vegetables, coffee, pepper, and seafood to ASEAN neighbors. Many of these goods compete well in terms of price and quality.

2. Consumer goods and light manufacturing products: Household items, garments, footwear, personal care products, and food products all find strong demand in the Philippines, Cambodia, Laos, and Indonesia.

3. Electronics and components: Vietnam has become a regional re-export hub for electronics. Some components are assembled in Vietnam and then shipped to ASEAN markets, where final assembly takes place.

4. Construction materials and industrial goods: Cement, steel, cables, plastic products, and packaging materials are exported widely in the region.

Export Leaders in 2024–25

Exports from Vietnam to the ASEAN market saw several standout trends:

-

Thailand was consistently the largest ASEAN buyer of Vietnamese goods, as per the customs data on Vietnam exports to Thailand.

-

Laos showed exceptional growth with an export surge exceeding 100 percent in early 2025, reflecting stronger energy, construction, and consumer goods trade.

-

The Philippines and Malaysia remained stable but experienced fluctuations depending on domestic demand cycles.

-

Indonesia saw mixed results, with some months showing slight declines, though long-term demand remains strong.

Vietnam’s Major Imports from ASEAN

The import structure helps explain the rising deficit. Vietnam imports a high volume of industrial inputs, such as:

1. Machinery and equipment: Most are used in electronics, automotive components, textiles, and food processing.

2. Intermediate components: Printed circuit boards, wiring, chips, transformers, plastics, metals, rubber, and industrial chemicals come primarily from Thailand, Malaysia, and Singapore.

3. Agricultural and resource-based goods: These include rice from Thailand, corn and palm oil from Indonesia and Malaysia, natural rubber, and energy products.

4. Fuel and petrochemicals: Singapore and Malaysia are major suppliers of fuels and refined petroleum products.

Import Leaders in 2024–25

Several partners drove the import surge:

-

Thailand remained the largest source of Vietnam’s ASEAN imports.

-

Indonesia saw strong, double-digit growth in exports to Vietnam, especially in raw materials and consumer goods, as per the customs data on Vietnam imports from Indonesia.

-

Cambodia recorded a sharp rise due to increased agricultural and raw material shipments.

-

Singapore continued to be a key partner for high-value goods such as electronics, fuels, and machinery.

-

Laos saw a jump in exports to Vietnam, largely based on energy and mineral products.

Key Trade Dynamics and Structural Patterns

1. Vietnam’s Persistent Trade Deficit with ASEAN

The deficit is not a one-off spike. It is structural. Vietnam buys more high-value intermediate inputs from ASEAN than it sells in return. This is common for emerging manufacturing hubs. South Korea and China, at earlier stages of development, ran similar deficits with industrialized neighbors. The deficit reflects:

-

Vietnam’s growing manufacturing scale

-

Strong import demand for inputs

-

Uneven value-added distribution within ASEAN supply chains

-

Vietnam’s role as an assembly hub rather than a full-cycle producer of advanced goods

2. Upstream vs Downstream Asymmetry

Vietnam is downstream in many regional production chains. This means:

-

ASEAN neighbors supply high-value inputs

-

Vietnam assembles

-

Vietnam exports externally (to the US, EU, Japan, etc.)

This structure is effective for export growth, but it also locks Vietnam into dependence on imported inputs, which increases vulnerability to supply disruptions or price swings.

3. Market Diversification and Risk Management

The global trade environment in 2024–25 remained unpredictable. Tariff changes, geopolitical tensions, and slowdowns in large economies posed risks. In this environment, strengthening ASEAN trade is a natural hedge for Vietnam.

Opportunities, Risks, and Policy Considerations

Opportunities for Vietnam

1. More secure and resilient supply chains: ASEAN integration helps Vietnam avoid over-dependence on distant suppliers. Regional sourcing shortens supply chains and reduces risk.

2. A wider export base: ASEAN offers Vietnam a stable market that absorbs agricultural goods, food products, construction materials, electronics, and consumer goods.

3. Stronger manufacturing ecosystem: The more intermediate goods Vietnam imports, the more it can produce and export. ASEAN’s advanced manufacturing base, particularly in Thailand and Malaysia, helps Vietnam upgrade its own capabilities through spillovers, technology transfer, and competition.

4. Growth in cross-border investment: Trade and investment often reinforce each other. As trade grows, so do joint ventures, supply-chain partnerships, and regional manufacturing networks.

Risks Vietnam Must Manage

1. Dependence on imported intermediate goods: Too much dependence on upstream suppliers limits Vietnam’s ability to upgrade and narrows its profit margins.

2. Growing trade deficit: A large deficit is manageable when export growth is strong, but it becomes a concern if global demand slows or if key import prices rise.

3. Vulnerability to regional disruptions: Supply shortages in Thailand or Malaysia, border disruptions, or political instability in any ASEAN member can interrupt Vietnam’s production cycles.

4. Slow advancement in domestic value-added: If Vietnam remains locked into assembly-heavy roles, it may struggle to capture higher value in global supply chains.

Policy Recommendations

1. Upgrade domestic upstream industries: Vietnam needs more investment in semiconductors, industrial materials, petrochemicals, and machinery production.

2. Expand exports with higher value-added: Moving beyond low-cost manufacturing will help Vietnam narrow its deficit and increase long-term competitiveness.

3. Strengthen cross-border infrastructure: Better roads, ports, and rail links with Cambodia, Laos, and Thailand will cut logistics costs and improve trade flow.

4. Deepen ASEAN and RCEP integration: Vietnam should push for digital customs systems, harmonized standards, and broader trade facilitation within the region.

5. Encourage regional industrial clusters: Coordinated ASEAN manufacturing zones can help distribute value-added more evenly and open opportunities for Vietnamese firms to climb the technological ladder.

Looking Ahead: Trade Future of Vietnam in ASEAN

Vietnam’s trade with ASEAN in 2024–25 is defined by growth, deeper integration, and rising interdependence. The region is becoming a central part of Vietnam’s industrial ecosystem. As global supply chains continue to shift, ASEAN’s importance will only grow.

Several long-term dynamics support this outlook:

-

ASEAN’s expanding consumer market.

-

Ongoing improvements in regional infrastructure.

-

Fast technological adoption among Southeast Asian manufacturers.

-

Diversification strategies pursued by global companies looking for China-plus-one alternatives.

-

Vietnam’s increasingly skilled labor force and strong export record.

If Vietnam addresses its structural weaknesses and upgrades its manufacturing capacity, it can turn intra-ASEAN trade from a purely functional supply-chain relationship into a strategic advantage.

Conclusion and Final Verdict

The 2024–25 period has confirmed a clear shift in Vietnam’s trade profile. While the country remains a global exporter with strong ties to the US, China, Japan, and Europe, its most dynamic and structurally important trade growth is found closer to home. ASEAN now supplies much of the intermediate goods that power Vietnam’s factories, and it absorbs an expanding share of Vietnamese exports.

This is more than a statistical trend. It signals the rise of a more integrated Southeast Asian production network, where Vietnam is a key manufacturing hub. With deeper cooperation, better infrastructure, and continued economic reforms, Vietnam can strengthen its position in ASEAN’s supply chains and ensure that intra-regional trade becomes not just a contributor to export growth but a pillar of long-term resilience and competitiveness.

We hope that you liked our insightful blog report on the Vietnam-ASEAN trade dynamics & the relevance of Vietnam in ASEAN in 2025. For more information on the latest Vietnam trade data, or to search live Vietnam import-export data by country, product, or HS code, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade data reports and Vietnamese market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0