Vietnam Pharmaceutical Export Data: Vietnam’s Pharma Exports Reach $312 Million in 2025

Vietnam pharmaceutical export data 2025 highlights pharma exports reaching $312 million, top markets, exporters, product segments, & future outlook.

Introduction

Vietnam’s pharmaceutical industry has entered a new phase of global relevance. Once largely focused on meeting domestic healthcare needs, the country has steadily expanded its pharmaceutical manufacturing capabilities and export footprint. By 2025, Vietnam’s pharmaceutical exports reached USD 312 million, reflecting growing confidence in Vietnamese drug manufacturing, regulatory progress, and cost competitiveness. According to the Vietnam export data and Vietnam customs export data of pharmaceuticals, the total value of Vietnam pharmaceutical exports reached $279.20 million in 2024, an 8% increase from the previous year. According to the Vietnam pharmaceutical export data and Vietnam customs data, Vietnam exported pharmaceuticals worth $312 million in 2025, an 11% growth from the previous year.

Vietnam is now the 4th largest pharmaceutical exporter in Southeast Asia, as per the latest global trade data. This milestone is significant not only in numerical terms but also in what it represents: Vietnam is transitioning from a low-cost drug producer to a credible regional supplier of generic medicines, APIs, vaccines, herbal products, and medical preparations. While Vietnam is not yet a global pharmaceutical powerhouse, its export momentum signals strong long-term potential.

This article provides a deep, data-driven analysis of Vietnam’s pharmaceutical export performance in 2025, covering export value trends, product segmentation, destination markets, leading manufacturers, regulatory drivers, challenges, and future outlook.

Overview of Vietnam’s Pharmaceutical Export Performance (2020–2025)

Vietnam’s pharmaceutical exports have grown steadily over the past five years, supported by healthcare demand, regional trade integration, and industrial investment. According to the Drug Administration of Vietnam, Vietnam's pharmaceutical market is expected to increase at a consistent rate of 6-8% annually, with a predicted total market value of $8 billion by 2026, up from roughly $2.7 billion in 2015. This makes Vietnam one of Asia's fastest-growing drug markets.

Export Value Growth

-

2020: USD 206 million

-

2021: USD 174 million

-

2022: USD 261 million

-

2023: USD 258 million

-

2024: USD 279 million

-

2025: USD 312 million

This growth reflects a compound annual growth rate (CAGR) of roughly 7–8 percent, outperforming many other manufacturing segments in Vietnam.

Key drivers include:

-

Rising regional demand for affordable generic medicines

-

Expansion of GMP-certified production facilities

-

Improved quality control and regulatory alignment

-

Increased exports to ASEAN, Africa, and emerging Asian markets

Vietnam’s Pharmaceutical Export Performance & Industry Overview (2025)

Export value and regional ranking

-

Vietnam’s pharmaceutical and drug ingredient exports reached USD 312 million in 2025

-

Ranked 4th in Southeast Asia for pharmaceutical exports

Export growth context

-

Exports increased from USD 279.20 million to USD 312 million

-

Reflects steady growth despite regional competition

Market size and growth

-

Vietnam’s pharmaceutical market is growing at an annual rate of 6–8%

-

Market size expanded from USD 2.7 billion in 2015

-

Expected to reach approximately USD 8 billion by 2026

-

Considered one of the fastest-growing pharma markets in Asia

Exporting companies and ownership structure

-

67 companies are involved in pharmaceutical and drug ingredient exports

-

Foreign-invested enterprises contribute about 75% of the export value (USD 230 million)

-

Domestic companies contribute approximately USD 82 million

Key export destinations

-

Primary export markets are Asian countries

-

Followed by Europe and Japan

Manufacturing capacity and quality standards

-

243 pharmaceutical manufacturing plants meet WHO-GMP standards

-

Increased significantly from 158 plants in 2015

-

29 plants meet higher international standards, such as EU-GMP or PIC/S-GMP

-

Domestic production supplies:

-

60% of local demand by volume

-

46% of local demand by value

Product capabilities

-

Ability to manufacture all 13 essential drug groups defined by the World Health Organization

-

Production of 11 out of 12 vaccines in Vietnam’s national Expanded Immunization Program

-

Growing capabilities in:

-

Active pharmaceutical ingredients (APIs)

-

Biological materials

-

Pharmaceutical excipients

Distribution and supply network

-

245 facilities supporting drug export, import, and storage

-

Nearly 8,000 wholesale distributors

-

Over 95,600 retail drug outlets, including:

-

More than 40,500 pharmacies

-

Around 54,000 drug counters

-

Approximately 800 commune-level medicine cabinets

Regulatory reforms and digital transformation

-

Administrative procedures reduced from 124 to 75, cutting compliance burden by about 40%

-

A new regulatory framework was introduced under updated decrees and circulars

-

Expansion of online public services:

-

47 pharmaceutical-related public services are available online

-

37 fully digital services

-

24 services integrated into the national one-stop portal

Administrative performance in 2025

-

Over 40,000 applications processed for drug import, export, and registrations

-

94% of new drug registrations completed on time

-

Average processing time reduced to approximately 114.5 days

Vietnam Pharmaceutical Exports by Country: Where Does Vietnam Export Pharmaceuticals?

Vietnam's pharmaceutical industry has been steadily growing, and the country has become a significant player in the global pharmaceutical market. When it comes to Vietnam Pharmaceutical Exports by Country, key destinations include the United States, Japan, South Korea, and the European Union. These regions are major importers of Vietnamese pharmaceutical products, reflecting the country's quality standards and competitive pricing. The top 10 export destinations for Vietnam's pharmaceutical exports, as per the data on Vietnam pharma exports by country and Vietnam shipment data for 2024-25, include:

1. Japan: $60.74 million (21.8%)

Japan is one of the largest markets for pharmaceutical products in the world, making it a lucrative destination for Vietnam's pharmaceutical exports. With a strong demand for high-quality medications and healthcare products, Japan offers a valuable opportunity for Vietnamese pharmaceutical companies to expand their reach and increase their market share.

2. South Korea: $27.61 million (9.9%)

South Korea is another important market for Vietnam's pharmaceutical exports, with a growing demand for affordable and effective medications, as per the data on Vietnam pharmaceutical exports to South Korea by HS code. The proximity between the two countries and the strong trade relations have helped facilitate the export of pharmaceutical products from Vietnam to South Korea.

3. Cyprus: $26.69 million (9.6%)

Cyprus might not be the first country that comes to mind when thinking about pharmaceutical exports, but it has emerged as a significant destination for Vietnam's pharmaceutical products. The strategic location of Cyprus as a gateway to Europe and the Middle East has made it an attractive market for Vietnamese pharmaceutical companies looking to expand their global presence.

4. Cambodia: $23.45 million (8.4%)

Vietnam's neighboring country, Cambodia, has also become a key destination for its pharmaceutical exports, as per the customs data on Vietnam pharmaceutical exports to Cambodia by HS code. The growing healthcare sector in Cambodia and the increasing demand for quality medications have created opportunities for Vietnamese pharmaceutical companies to establish a strong presence in this market.

5. Philippines: $20.63 million (7.4%)

The Philippines is another important market for Vietnam's pharmaceutical exports, with a large population and a growing healthcare sector. The two countries have established strong trade relations, making it easier for Vietnamese pharmaceutical companies to export their products to the Philippines.

6. Germany: $10.05 million (3.6%)

Germany, known for its high standards in healthcare and pharmaceutical products, is a coveted market for Vietnam's pharmaceutical exports. Vietnamese companies have been able to tap into the German market by offering competitive prices and high-quality medications, making Germany a key destination for Vietnam's pharmaceutical exports.

7. Saudi Arabia: $9.32 million (3.3%)

Saudi Arabia, with its growing healthcare sector and increasing demand for pharmaceutical products, has become an important market for Vietnam's pharmaceutical exports. The strategic location of Vietnam in the Middle East has helped facilitate the export of pharmaceutical products to Saudi Arabia.

8. China: $7.99 million (2.9%)

China, being one of the largest markets for pharmaceutical products in the world, presents a valuable opportunity for Vietnam's pharmaceutical exports. With a large population and a growing middle-class segment, Chinese consumers are increasingly seeking high-quality medications, creating opportunities for Vietnamese pharmaceutical companies to expand into the Chinese market.

9. Hong Kong: $7.81 million (2.8%)

Hong Kong, known for its strong trade relations and strategic location as a gateway to Asia, is a key destination for Vietnam's pharmaceutical exports. Vietnamese companies have been able to leverage Hong Kong's position as a major trading hub to export their pharmaceutical products to other Asian markets.

10. Malaysia: $7.72 million (2.8%)

Malaysia, with its growing healthcare sector and increasing demand for pharmaceutical products, has emerged as an important market for Vietnam's pharmaceutical exports. The two countries' strong trade relations and geographical proximity have made it easier for Vietnamese pharmaceutical companies to export their products to Malaysia.

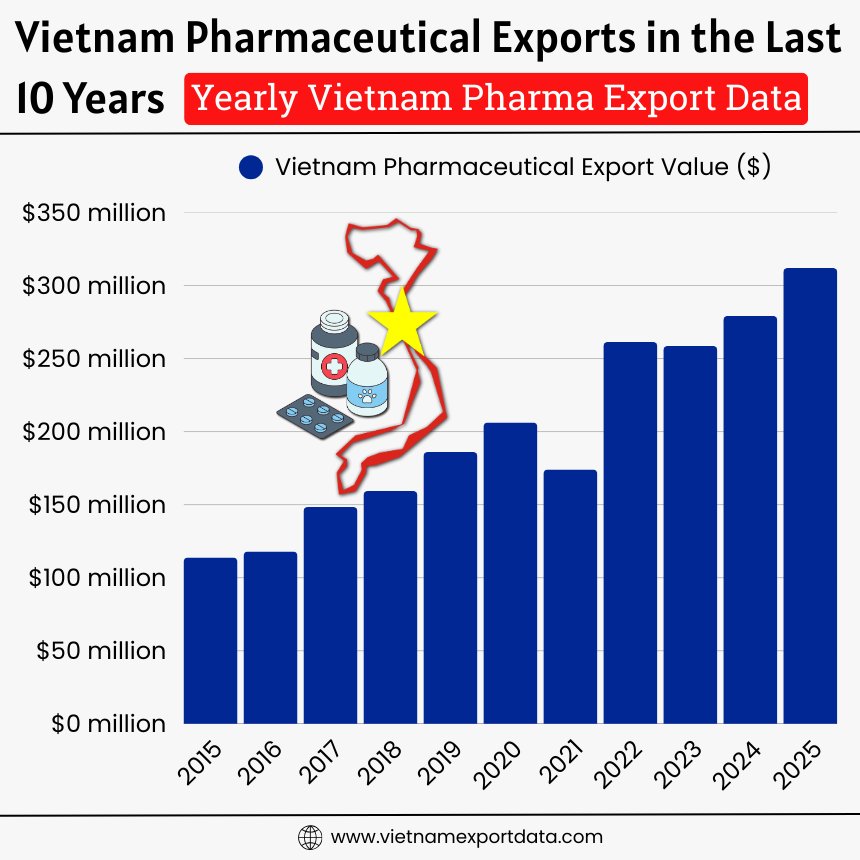

Vietnam Pharmaceutical Exports in the Last 10 Years: Yearly Vietnam Pharma Export Data

|

Year of Exports |

Vietnam Pharmaceutical Export Value ($) |

|

2015 |

$113.84 million |

|

2016 |

$117.87 million |

|

2017 |

$148.37 million |

|

2018 |

$159.33 million |

|

2019 |

$185.99 million |

|

2020 |

$206.19 million |

|

2021 |

$174.04 million |

|

2022 |

$261.29 million |

|

2023 |

$258.64 million |

|

2024 |

$279.20 million |

|

2025 |

$312 million |

Structure of Vietnam’s Pharmaceutical Export Industry

Vietnam’s pharmaceutical export industry is highly fragmented compared to those of India or China. It is dominated by domestic manufacturers producing:

-

Generic finished formulations

-

Traditional and herbal medicines

-

Basic active pharmaceutical ingredients (APIs)

-

Vaccines and biological products (limited scale)

Large multinational pharmaceutical companies operate in Vietnam primarily for domestic distribution, while exports are led mainly by local enterprises.

Product Breakdown of Vietnam’s Pharmaceutical Exports

Vietnam’s pharma exports are diversified across several product categories, though the value contribution varies significantly.

1. Generic Finished Formulations (Largest Segment)

Generic medicines account for around 55–60 percent of the total export value.

These include:

-

Tablets and capsules

-

Antibiotics

-

Analgesics and antipyretics

-

Cardiovascular and diabetes drugs

-

Anti-inflammatory medications

Vietnam’s strength in this segment lies in:

-

Low manufacturing costs

-

Competitive pricing

-

Regional regulatory acceptance

-

Ability to meet WHO-GMP standards for many products

Generic exports are primarily targeted at price-sensitive markets where affordability is critical.

2. Traditional and Herbal Medicines

Herbal and traditional medicines contribute 15–18 percent of export value, making Vietnam one of Southeast Asia’s notable exporters in this category.

Products include:

-

Herbal capsules and syrups

-

Traditional Vietnamese medicinal formulations

-

Plant-based supplements

-

Natural health products

Vietnam benefits from:

-

Rich biodiversity

-

Long-standing traditional medicine practices

-

Growing global demand for natural and alternative medicine

These products are particularly popular in East Asia, ASEAN countries, and select African markets.

3. Vaccines and Biological Products

Vaccines and biologicals represent 10–12 percent of export value, but this segment carries strategic importance.

Exports include:

-

Pediatric vaccines

-

Basic immunization products

-

Limited biological preparations

Vietnam’s vaccine production capabilities are largely led by state-linked manufacturers, with exports focused on regional public health programs and international aid-supported initiatives.

4. Active Pharmaceutical Ingredients (APIs) and Intermediates

APIs and intermediates account for 8–10 percent of exports, reflecting Vietnam’s partial dependence on imported raw materials, especially from China and India, as per the Vietnam customs export data of API by HS code.

While Vietnam does not yet compete with major API exporters, local production is gradually increasing for:

-

Basic antibiotics

-

Simple chemical intermediates

5. Medical Preparations and OTC Products

Over-the-counter medicines and basic medical preparations contribute the remaining export share.

These include:

-

Cough and cold medicines

-

Topical creams and ointments

-

Vitamins and dietary supplements

Key Export Destinations for Vietnamese Pharmaceuticals

Vietnam’s pharmaceutical exports are regionally concentrated, with most shipments going to developing and emerging markets.

ASEAN (Largest Market)

ASEAN countries account for over 40 percent of Vietnam’s pharma exports.

Major destinations include:

-

Cambodia

-

Laos

-

Myanmar

-

Philippines

-

Indonesia

Geographic proximity, similar regulatory frameworks, and established trade ties make ASEAN the backbone of Vietnam’s pharma exports.

Asia-Pacific (Non-ASEAN)

Exports to East and South Asia represent 20–25 percent of the total value.

Key markets:

-

South Korea

-

Japan (limited but growing)

-

Bangladesh

-

Sri Lanka

Vietnamese products in these markets are typically positioned as cost-effective generics.

Africa

Africa accounts for 15–18 percent of exports, making it a crucial growth region.

Key markets include:

-

Nigeria

-

Ghana

-

Kenya

-

Tanzania

African demand is driven by:

-

High need for affordable medicines

-

Public health procurement programs

-

International donor-supported healthcare systems

Middle East and Other Markets

The Middle East and other emerging regions contribute 10–15 percent of exports, primarily through distributors and tender-based procurement.

Leading Pharmaceutical Exporters in Vietnam

Vietnam’s pharma exports are driven by a mix of state-owned, private, and semi-private enterprises.

1. DHG Pharma

-

One of Vietnam’s largest pharmaceutical manufacturers

-

Strong export focus on generic drugs and herbal medicines

-

Major markets include ASEAN and emerging Asian economies

2. Traphaco

-

Specializes in herbal and traditional medicines

-

Strong R&D base for plant-based pharmaceuticals

-

Growing international demand for natural products

3. Pymepharco

-

WHO-GMP-certified facilities

-

Focus on antibiotics and injectables

-

Exports to Southeast Asia and Africa

4. Imexpharm

-

Known for EU-GMP-compliant production

-

Strong export orientation

-

Focus on high-quality generics

5. VABIOTECH

-

Leading vaccine and biological product manufacturer

-

Exports tied to public health initiatives

-

Strategic role in regional disease prevention

Regulatory Environment and Export Readiness

Vietnam’s pharmaceutical export growth is closely linked to regulatory improvements.

Key Regulatory Developments

-

Expansion of WHO-GMP and EU-GMP certified facilities

-

Strengthening of quality control and pharmacovigilance

-

Alignment with ASEAN Common Technical Dossier (ACTD) standards

-

Improved intellectual property protection

These changes have improved international buyer confidence and facilitated market entry.

Trade Agreements Supporting Vietnam Pharma Exports

Vietnam benefits from multiple trade agreements that indirectly support pharmaceutical exports:

-

ASEAN Free Trade Area (AFTA)

-

Regional Comprehensive Economic Partnership (RCEP)

-

Bilateral trade agreements with Asian and Middle Eastern countries

These agreements reduce tariffs, streamline customs procedures, and improve market access.

Challenges Facing Vietnam’s Pharmaceutical Exports

Despite progress, Vietnam’s pharma export industry faces several challenges:

1. API Dependence

Vietnam still imports a large share of APIs, increasing vulnerability to:

-

Supply chain disruptions

-

Price volatility

-

Geopolitical risks

2. Limited Presence in Regulated Markets

Exports to the U.S., EU, and other highly regulated markets remain minimal due to:

-

High compliance costs

-

Lengthy approval processes

-

Limited experience with advanced regulatory filings

3. Brand Recognition

Vietnamese pharmaceutical brands lack global recognition, making exports heavily reliant on:

-

Distributors

-

Tender systems

-

Private-label arrangements

4. R&D Constraints

R&D spending remains relatively low compared to global pharma leaders, limiting innovation-driven exports.

Opportunities and Growth Potential Beyond 2025

Vietnam’s pharmaceutical export sector has several growth opportunities:

Expansion of EU-GMP Capacity

More EU-GMP-certified plants could unlock access to regulated markets.

Herbal and Natural Medicine Leadership

Vietnam is well-positioned to become a regional hub for herbal pharmaceuticals.

Vaccine and Biotech Development

Increased investment could strengthen exports of vaccines and biologicals.

Contract Manufacturing

Vietnam could emerge as a low-cost contract manufacturing base for global pharma companies.

Export Outlook for 2026–2030

Looking ahead, Vietnam’s pharmaceutical exports are expected to:

-

Cross USD 400 million by 2030 under favorable conditions

-

Expand deeper into Africa, ASEAN, and South Asia

-

Gradually enter regulated markets with select products

-

Shift toward higher-value formulations

Export growth will likely remain value-driven rather than volume-driven, focusing on quality upgrades rather than mass production.

Conclusion and Final Thoughts

In conclusion, Vietnam’s pharmaceutical exports reaching USD 312 million in 2025 mark a significant step in the country’s industrial and healthcare evolution. While Vietnam is not yet a global pharmaceutical giant, it has firmly established itself as a reliable regional exporter of affordable, quality medicines. With continued regulatory reforms, investment in manufacturing quality, and strategic market expansion, Vietnam’s pharmaceutical industry has the potential to become a key supplier in emerging markets over the next decade. For investors, buyers, and policymakers, Vietnam’s pharma export story is no longer emerging; it is actively unfolding.

For more insights into the latest Vietnam import-export data, or to search live data on Vietnam pharmaceutical exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top pharmaceutical exporters in Vietnam, tailored to your requirements.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0