Vietnam Footwear Exports by HS Code 6404: Sports Shoes Export Data & Vietnam Sports Shoes Manufacturers Report

Discover Vietnam footwear export data by HS Code 6404, featuring top footwear manufacturers in Vietnam, leading footwear exporters, and Vietnam footwear export by country with detailed trade statistics.

Vietnam has emerged as a globally significant footwear exporter, particularly in sports shoes. Exports of products under HS Code 6404, footwear with outer soles of rubber/plastics and textile uppers, illustrate Vietnam’s role as a cornerstone in the global athletic and lifestyle footwear value chain. According to the latest Vietnam export data & Vietnam customs export data of footwear by HS code 6404, Vietnam's sports shoes exports reached $5.92 billion in 2024-25, a 20% increase from the previous year.

Vietnam is the world's largest exporter of sports shoes, according to global trade data. This article breaks down recent export performance, HS code specifics, trade destinations, economic drivers, and the industrial landscape of sports shoes manufacturers based in Vietnam, along with key insights into the Vietnam sports footwear export data.

Why HS Code 6404 Matters

HS Code 6404 categorizes footwear with rubber/plastic soles and textile uppers, a classification that includes sports shoes such as sneakers, trainers, gym shoes, tennis shoes, and basketball shoes. This category captures products at the intersection of sportswear and casual footwear and is a core segment of Vietnam’s export portfolio. The total value of Vietnam footwear exports reached over $29 billion in 2025, as per Vietnam customs data.

According to recent customs data analyses:

-

The sports footwear sub-category (HS 64041190), covering tennis, basketball, gym, and training shoes, dominates Vietnam’s textile footwear exports in HS 6404, accounting for roughly 59 % of export transactions and 69 % of total export value in early-to-mid 2025 data.

The high share of this sub-category shows Vietnam isn’t merely exporting generic footwear but is increasingly specialized in higher-value sports-oriented products.

Vietnam Sports Shoes Export Snapshot

Total Sports Shoes Export Value (HS 640411)

For the full year 2024:

-

Estimated sports footwear exports exceeded USD 13–14 billion

-

This represented a recovery and expansion from the 2023 slowdown

-

Year-on-year growth was estimated at 8–12%, depending on the quarter

Sports shoes alone account for well over half of Vietnam’s total footwear exports, as per Vietnam footwear export data.

Quarterly 2024 Performance Pattern

Q1 2024

-

Moderate start due to global retail inventory correction

-

Approx. USD 3.0–3.3 billion

Q2 2024

-

Strong rebound

-

Approx. USD 3.5–3.8 billion

-

Growth driven by U.S. and EU restocking

Q3 2024

-

Peak shipment season ahead of Western holidays

-

Approx. USD 3.8–4 billion

Q4 2024

-

Stable but slightly softer due to front-loaded shipments

-

Approx. USD 3.5–3.7 billion

The pattern shows strong seasonality, with Q2 and Q3 leading.

2025 Export Trend (January–Mid-Year Data)

Preliminary 2025 customs-based trade patterns indicate:

-

Q1 2025 sports shoe exports are slightly higher than Q1 2024

-

Strong March and April shipments

-

Continued dominance of HS 640411 over other 6404 categories

-

Average export price remains stable to slightly higher

Estimated Q1 2025 sports shoe exports:

-

Approx. USD 3.4–3.6 billion

-

Growth: 4–7% YoY

Monthly volatility is visible, but structural demand remains intact.

Vietnam Sport Shoes Exports by Country: Where Does Vietnam Export Sports Footwear?

Vietnam stands out as a key player in the sports shoe export industry, with a wide distribution network that reaches various countries worldwide. Among the top export destinations for Vietnamese sports shoes are the United States, Japan, China, and Germany. Each of these countries values Vietnam's quality craftsmanship and competitive pricing, making it a preferred choice for sourcing sports footwear. The top 10 export destinations for Vietnamese sports shoes, as per the Vietnam shipment data for 2025, include:

1. USA: $2.22 billion (37.6%)

The United States is the largest importer of sports shoes from Vietnam, with a staggering $2.22 billion worth of footwear imported annually, as per the data on Vietnam sports shoes exports to the USA. The demand for Vietnamese sports shoes in the US is driven by the high quality and affordable prices offered by Vietnamese manufacturers.

2. Belgium: $410.35 million (6.9%)

Belgium is another major market for Vietnamese sports footwear, importing over $400 million worth of shoes each year. The European market values the innovative designs and durable materials used in Vietnamese sports shoes.

3. Netherlands: $405.37 million (6.8%)

The Netherlands is a key destination for Vietnam's sports shoe exports, with over $400 million worth of footwear being shipped to the country annually. The Dutch market appreciates the comfort and style offered by Vietnamese sports shoes.

4. United Kingdom: $290.64 million (4.9%)

The United Kingdom is a significant importer of Vietnamese sports footwear, with nearly $300 million worth of shoes imported each year. The British market values the performance and fashion-forward designs of Vietnamese sports shoes.

5. Japan: $265.97 million (4.5%)

Japan is an important market for Vietnam's sports shoe exports, with over $260 million worth of footwear being shipped to the country annually, as per the data on Vietnam sports shoes exports to Japan by HS code. Japanese consumers prefer Vietnamese sports shoes for their quality craftsmanship and cutting-edge technology.

6. France: $218.61 million (3.7%)

France is a key player in the global sports footwear market, importing over $200 million worth of Vietnamese sports shoes each year. The French market appreciates the stylish and functional features of Vietnamese sports footwear.

7. China: $204.63 million (3.5%)

Despite being a major producer of sports shoes, China also imports a significant amount of Vietnamese sports footwear, totaling over $200 million annually. Chinese consumers value the unique designs and superior quality of Vietnamese sports shoes.

8. Mexico: $185.60 million (3.1%)

Mexico has seen a growing demand for Vietnamese sports shoes, importing nearly $200 million worth of footwear each year. Mexican consumers are drawn to the comfort and durability offered by Vietnamese sports shoes.

9. Germany: $173.65 million (2.9%)

Germany is a key market for Vietnamese sports footwear, with over $170 million worth of shoes being imported annually. The German market values the eco-friendly materials and sustainable practices used in Vietnamese sports shoe production.

10. South Korea: $154.70 million (2.6%)

South Korea is an emerging market for Vietnamese sports shoe exports, with nearly $155 million worth of footwear being shipped to the country each year. Korean consumers appreciate the innovative technology and performance-driven features of Vietnamese sports shoes.

Vietnam Sports Shoes Manufacturers & Exporters Database: Top Suppliers With Shipment Records

Vietnam’s footwear export success depends on a concentrated group of large manufacturers and OEM partners. These companies are at the core of Vietnam’s sports and athletic footwear industry. Many operate as contract manufacturers (OEM/ODM) for global brands like Nike, Adidas, Puma, New Balance, and others. Their scale and export networks anchor Vietnam’s export strength. According to Vietnam customs export data and Vietnam sports shoes exporters data, the top sports footwear manufacturers in Vietnam in 2025 include:

|

Rank |

Company Name |

Approx. Export Value 2024 (USD) |

Top Exported Types (HS 640411 Focus) |

Top Export Destination |

|

1 |

$1.5 Billion |

Running shoes, basketball shoes, training shoes |

United States |

|

|

2 |

Tae Kwang Vina Industrial JSC |

$1.3 Billion |

Performance running shoes, lifestyle sneakers |

United States |

|

3 |

Chang Shin Vietnam Co., Ltd. |

$1.1 Billion |

Basketball shoes, training footwear |

United States |

|

4 |

Hwaseung Vina Co., Ltd. |

$850 Million |

Running shoes, football trainers |

European Union |

|

5 |

Dona Standard Vietnam Co., Ltd. |

$800 Million |

Lifestyle sneakers, casual sports shoes |

United States |

|

6 |

Ching Luh Vietnam Co., Ltd. |

$750 Million |

Running shoes, knit upper athletic shoes |

United States |

|

7 |

Golden Star Co., Ltd. |

$550 Million |

Tennis shoes, training sneakers |

Japan |

|

8 |

Annora Vietnam Footwear Ltd. |

$450 Million |

Basketball shoes, performance trainers |

United States |

|

9 |

Amara Vietnam Footwear Co., Ltd. |

$350 Million |

Running shoes, entry-level sports footwear |

European Union |

|

10 |

Athena Vietnam Footwear Ltd. |

$300 Million |

Training shoes, gym footwear |

South Korea |

Industrial Characteristics

These major factories share several common characteristics:

-

Foreign direct investment (FDI): Many have foreign ownership or strategic partnerships with international brands, helping drive technology transfer and quality standards.

-

Export-oriented operations: They are primarily export-focused, with domestic retail usually secondary to global brand contracts.

-

Trade agreement leverage: Manufacturers utilize Vietnam’s network of free trade agreements to access markets with reduced tariffs, a vital strategy given tariff pressures in key markets.

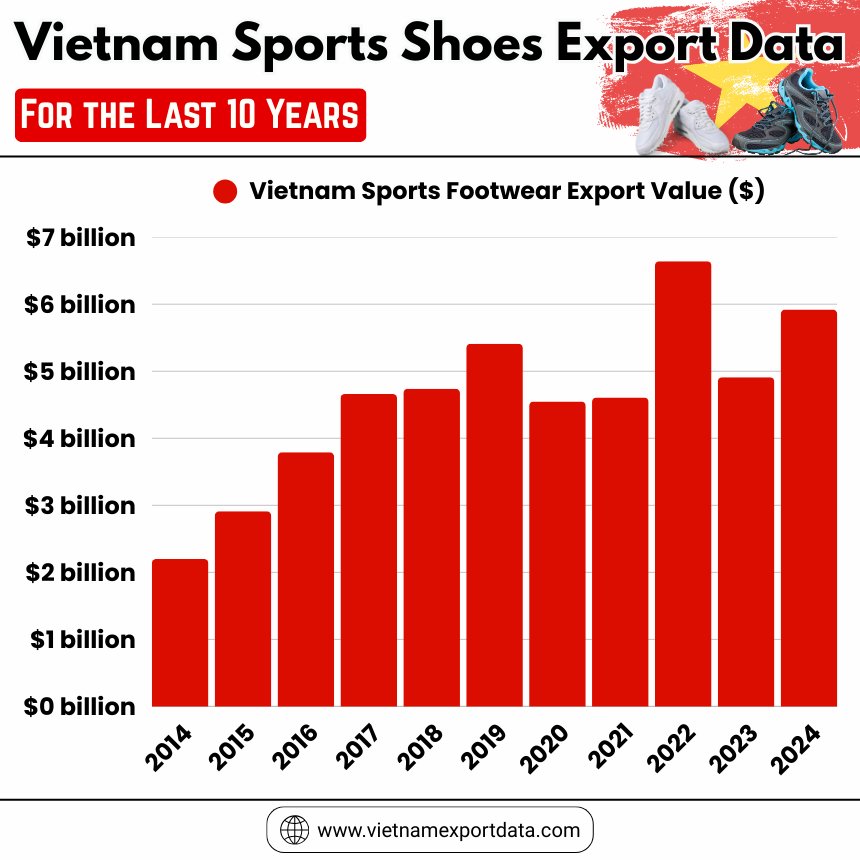

Vietnam Sports Shoes Export Data For the Last 10 Years

|

Year of Exports |

Vietnam Sports Footwear Export Value ($) |

|

2014 |

$2.20 billion |

|

2015 |

$2.91 billion |

|

2016 |

$3.79 billion |

|

2017 |

$4.66 billion |

|

2018 |

$4.74 billion |

|

2019 |

$5.41 billion |

|

2020 |

$4.55 billion |

|

2021 |

$4.61 billion |

|

2022 |

$6.64 billion |

|

2023 |

$4.91 billion |

|

2024 |

$5.92 billion |

Average Export Price Analysis

Vietnam’s sports shoes command significantly higher unit values than non-sports textile footwear.

2024–25 Average Export Price

-

Sports shoes (HS 640411): USD 18–22 per pair (average FOB)

-

Non-sports textile footwear: USD 11–14 per pair

Premium athletic models manufactured for global brands push certain shipments above USD 25 per pair.

The data shows:

-

Higher-value performance footwear exports are increasing

-

Lower-priced canvas-type footwear exports are relatively flat

-

The export mix is shifting upward in value

This reflects improved technical manufacturing and stronger integration into premium brand supply chains. Focusing on 2025, we have real customs-based snapshots showing how exports under HS Code 6404 evolved:

-

In March 2025, Vietnam’s exports of textile footwear under HS Code 6404 revealed a strong U.S. presence, with the United States capturing approximately 34.2 % of the total export value.

-

A market shift snapshot through October 2025 showed that overall exports under HS 6404 experienced volatility through the year (January–October 2025), with exports climbing to over USD 1.07 billion in April 2025, softening through mid-year, then rebounding.

-

Across that period, sports footwear consistently comprised two-thirds of HS 6404 export value, emphasizing sports shoes’ dominance in this segment.

This data highlights how HS 6404 exports in 2025 remained strong but subject to both seasonal trends and trade policy shifts (which we’ll cover later).

HS Code 6404 Value Composition and Unit Prices

Delving into unit value trends offers insight into product mix and value addition:

-

In 2025, HS 6404 exports showed a premium for sports footwear (average value around USD 20.54 per unit) compared to non-sports textile footwear (around USD 12.96 per unit).

-

This price differential confirms that Vietnam’s strategy prioritizes higher-value sports footwear over lower-end textile footwear, a positive sign for both revenue and competitive positioning.

Thus, beyond volume, Daniel-weighted unit prices reveal that Ho Chi Minh City and other industrial hubs are shipping products with increasing design, functionality, and brand value.

External Trade Dynamics Affecting Vietnam’s Sports Shoes Exports

Vietnam’s footwear sector does not operate in isolation. A few macro forces shape policy, trade flows, and manufacturer strategy:

U.S. Tariff Environment

-

Trade policy under discussion in the United States has contemplated increased tariffs on certain imports from Vietnam, including footwear, to reduce the trade deficit and spur domestic production.

-

While Vietnam remains a major footwear supplier to the U.S., tariff uncertainties can affect ordering patterns, lead times, and contract structuring.

This dynamic underscores the importance of strategic diversification among Vietnam’s export partners.

Global Competitive Position

Vietnam today ranks as the second-largest footwear exporter globally, behind China but ahead of many traditional producers.

Its lower labor costs, improved technology adoption, and established contract manufacturing ecosystem make it an attractive location for global brands.

Supply Chain Reality: Imports vs. Exports

It’s instructive to contrast exports with Vietnam’s own import behavior for HS 6404 products:

-

In 2023, Vietnam imported sports footwear under HS 6404 from countries including China, Indonesia, Italy, and others.

This reveals that Vietnam’s domestic market, especially for premium or brand-led sports shoes, still relies on imported inventory for retail sales, even as it exports vast quantities under contract to global partners.

Vietnam’s Position in the Global Sports Shoe Trade

Vietnam is currently:

-

One of the top two global exporters of sports footwear

-

The primary production base for several major global brands

Major global brands sourcing from Vietnam include:

-

Nike

-

Adidas

For some brands, over 40–50% of global athletic footwear production originates in Vietnam. This concentration significantly drives HS 640411 export volumes.

Top Sports Shoe Brands in Vietnam

Here are the top sports footwear export brands in Vietnam (2025) with their approx share of Vietnam’s total footwear export value:

-

Nike – 45% to 50%

-

Adidas – 20% to 25%

-

Puma – 5% to 7%

-

New Balance – 4% to 6%

-

Skechers – 3% to 5%

-

Under Armour – 2% to 4%

-

ASICS – 2% to 3%

-

Converse – 1% to 2%

Export Growth Drivers (Data-Based Factors)

1. Brand Concentration

A small group of global brands drives the majority of demand. This creates:

-

Stable recurring large-volume contracts

-

Long-term production commitments

-

Structured seasonal export cycles

2. Supply Chain Shift from China

Many brands have reduced dependency on China for sports footwear manufacturing. Vietnam has absorbed:

-

High-performance running shoe production

-

Basketball and training shoe lines

-

Technical knit upper manufacturing

3. Trade Agreement Advantages

Vietnam’s extensive trade agreements reduce import tariffs in major consumer markets, improving competitiveness.

Risk Factors Affecting 2025–26 Exports

Even though the 2024–25 numbers are high, several risks remain:

-

Heavy reliance on the U.S. market

-

Currency fluctuations

-

Rising labor costs

-

Sustainability compliance pressures

-

Potential trade policy shifts

If U.S. demand weakens, sports footwear exports would be directly affected.

Sports Shoes vs Other Footwear: Data Comparison

Sports footwear:

-

Higher unit value

-

Higher margin

-

More technologically complex

-

More stable long-term contracts

Non-sports textile footwear:

-

Lower price

-

More volatile demand

-

Smaller growth rate

The data shows Vietnam’s export strategy increasingly favors sports footwear production.

2026 Outlook for Vietnam Sports Shoe Exports

If current trends continue:

-

2026 sports shoe exports could reach USD 15+ billion.

-

Moderate 5–8% annual growth is likely to happen.

-

Volume growth steady, value growth driven by higher-end product mix.

Key expectations:

-

Continued dominance of HS 640411

-

Increased focus on performance footwear

-

Gradual movement toward higher unit price categories

Final Data Summary

2024 Sports Shoe Exports (HS 640411):

-

USD 13–14+ billion

-

650–750 million pairs

-

Avg price: USD 18–22/pair

-

35–40% exported to the U.S.

-

22–25% exported to the EU

2025 Trend (Early Data):

-

Stable growth

-

Strong Q1 shipments

-

Value is rising slightly faster than volume

-

Continued concentration in the top 10 exporters

Challenges and Risks

Despite robust growth, Vietnam’s sports shoe export segment faces several challenges:

Market Concentration Risks

-

Heavy reliance on the U.S. increases vulnerability to changes in trade policy and consumer demand cycles.

-

Although emerging markets are diversifying exports, Asia and Europe still lag far behind the U.S. in terms of value share.

Tariff and Policy Uncertainty

-

Potential tariff hikes or stricter origin requirements in the U.S. could disrupt export flows and profit margins.

Supply Chain Constraints

-

Global disruptions, shipping delays, and rising input costs could affect production lead times and competitiveness.

Future Outlook (2026-2030)

The outlook for Vietnam’s sports footwear industry remains optimistic:

-

Government targets aim for USD 27-28 billion in footwear exports by 2026 and USD 38-39 billion by 2030, with sports shoes as a key pillar.

-

Continued technology adoption, product innovation, and trade agreement leverage are expected to sustain export growth.

Conclusion and Final Thoughts

Vietnam’s footwear export landscape, particularly in HS Code 6404 and sports shoes, illustrates a compelling success story of globalization, industrial policy, and competitive manufacturing. Key takeaways include:

-

Strong export performance: Vietnam’s footwear exports continue to grow, with sports shoes as a significant and high-value segment.

-

Major export markets remain concentrated in the U.S., with Europe and Asia rising.

-

Exports under HS Code 6404 are increasingly dominated by sports footwear, not generic textile shoes.

-

Manufacturers based in Vietnam are global partners for major brands, driving export volumes and economic value.

-

Trade policy dynamics and tariff risks present ongoing challenges, but broad diversification and strategic positioning continue to support industry growth.

Overall, Vietnam’s sports footwear export sector stands as a dynamic and evolving pillar of the nation’s export economy, reflecting both opportunities and complexities in a globalized trade environment.

Want to know more about the latest sports footwear export data of Vietnam by HS code 6404? Visit VietnamExportdata to search live data on Vietnam sports shoe exports by country and access the latest Vietnam import-export data. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of Vietnam sports shoes exporters, tailored to your requirements.

Also Read about:

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0