Vietnam Seafood Export Data 2025: Vietnam Seafood Exports by Country & Top Seafood Exporters in Vietnam

Explore Vietnam's seafood export data for 2025, including top exports, leading destination countries, and the biggest seafood exporters in Vietnam.

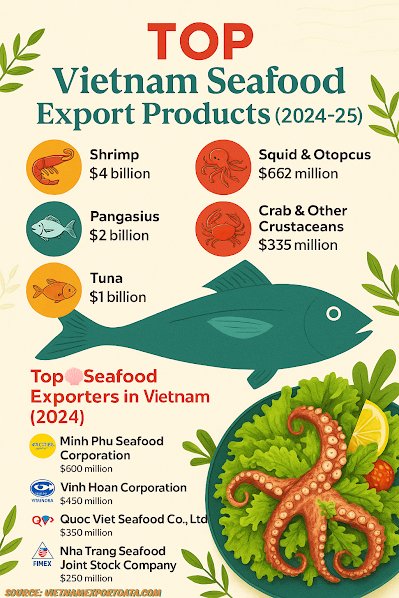

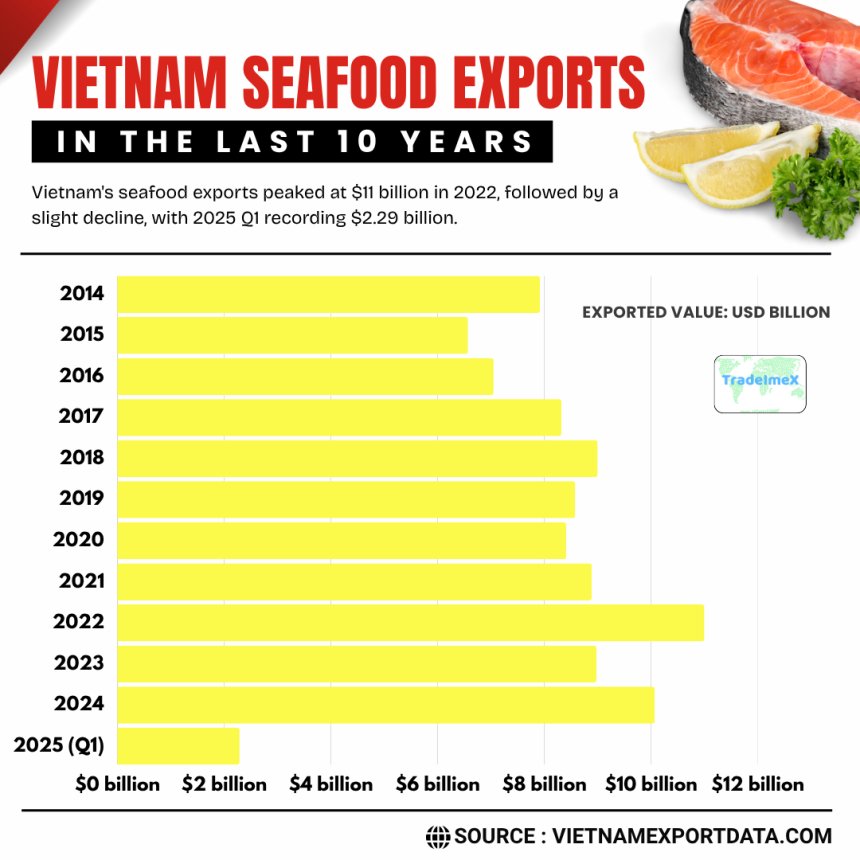

In the bustling world of international trade, Vietnam has established itself as a major player in the seafood export industry. With its long coastline and rich aquatic resources, Vietnam has become one of the top seafood exporters in the world. According to Vietnam export data and seafood export data of Vietnam, the total value of Vietnam seafood exports reached a record $10.07 billion in 2024, an increase of 13% from the previous year. Major Seafood Products like Shrimp ($4 billion, up by 16.7%), pangasius ($2 billion, up by 9.6%), and tuna ($1 billion, up by 17%) were the main drivers of this development. Vietnam is the third-largest exporter of seafood, only behind China and Norway, as per the global trade data.

As per Vietnam export statistics and Vietnam seafood export data, Vietnam exported $2.29 billion worth of seafood in the first quarter of 2025, an 18.1% increase over the same period in 2024. Vietnam’s seafood exports are projected to exceed $11 billion in 2025, as per Vietnam customs data. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), sustainable development initiatives and increased product value were the main drivers of the industry's growth. In this article, we will take a closer look at the Vietnam seafood export data for 2025, including Vietnam seafood exports by country and the top seafood exporters in Vietnam.

Important Points to Remember:

-

$10 billion was the total export value, up 13% from 2023.

-

Shrimp exports increased 16.7% to $4 billion.

-

Exports from Pangasius: $2 billion, 9.6% increase.

-

$1 billion in tuna exports, a 17% increase.

-

Key markets include the US, China, the EU, and nations in the Middle East.

-

Challenges include natural disasters, inflation, political unpredictability, and the European Commission's yellow card warning for IUU fishing.

-

Future Priorities: Investigating halal and Middle Eastern markets, addressing market impediments, and adapting to climate change.

Top 10 Seafood Export Markets of Vietnam: Vietnam Seafood Exports by Country

Vietnam, which is well-known for having a flourishing seafood industry, has been exporting seafood to many different countries all over the world. According to data on Vietnam seafood export by country, the United States, Japan, South Korea, and China are among the top 10 countries to which Vietnam exports seafood. Vietnam's credibility for quality and diversity in the international market is reflected in these countries' continuous strong demand for its seafood goods. According to Vietnam shipment data and data on Vietnam seafood exports by country in 2024–2025, the top 10 nations to which Vietnam exports the most seafood are as follows:

1. China: $1.65 billion (16.5%)

China stands out as the top seafood export market for Vietnam, accounting for a substantial 16.5% of the country's total seafood exports, as per the customs data on Vietnam seafood exports to China. With a strong demand for a variety of seafood products, China continues to be a major destination for Vietnamese seafood exporters.

2. USA: $1.5 billion (15%)

The USA holds the second spot on the list of top seafood export markets for Vietnam, with a significant share of 15% of total seafood exports, as per the data on Vietnam seafood exports to USA. The United States has a robust market for Vietnamese seafood products, ranging from shrimp to fish and beyond.

3. Japan: $1.25 billion (12.5%)

Japan ranks third among Vietnam's key seafood export markets, with a notable share of 12.5%. Japanese consumers have a particular affinity for Vietnamese seafood, making Japan a crucial destination for Vietnam's seafood exports.

4. South Korea: $790 million (7.9%)

South Korea is another important market for Vietnamese seafood exports, capturing a significant share of 7.9%, as per the data on Vietnam seafood exports to South Korea by HS code. With a growing appetite for high-quality seafood, South Korea presents lucrative opportunities for Vietnamese exporters.

5. Thailand: $620 million (6.2%)

Thailand emerges as a key player in Vietnam's seafood export landscape, accounting for 6.2% of total exports. The proximity between the two countries and the demand for a variety of seafood products make Thailand a strategic market for Vietnamese exporters.

6. Netherlands: $520 million (5.2%)

The Netherlands holds a prominent position as a seafood export market for Vietnam, with a share of 5.2%. As a gateway to European markets, the Netherlands serves as an important entry point for Vietnamese seafood products into the European Union.

7. Germany: $400 million (4%)

Germany is a significant market for Vietnamese seafood exports, capturing a share of 4% of total exports. With a discerning consumer base and a strong demand for sustainable seafood, Germany presents opportunities for Vietnamese exporters to showcase their products.

8. Australia: $314 million (3.1%)

Australia features as a notable market for Vietnam's seafood exports, with a share of 3.1%. The demand for premium seafood products in Australia creates avenues for Vietnamese exporters to tap into this lucrative market.

9. Canada: $250 million (2.5%)

Canada emerges as a key destination for Vietnamese seafood exports, accounting for 2.5% of total exports. With a growing interest in sustainable seafood practices, Canada represents a promising market for Vietnamese exporters.

10. United Kingdom: $200 million (2%)

The United Kingdom rounds up the list of Vietnam's top seafood export markets, capturing a share of 2%. With a diverse consumer base and a strong penchant for seafood, the UK presents opportunities for Vietnamese exporters to expand their presence in this market.

Top 10 Seafood Exporters in Vietnam: Vietnam Seafood Exporters Database

Vietnam became a major force in the seafood export sector in 2024–2025, and it has a directory of seafood exporters that have been successful in breaking into foreign markets. Vietnam's top seafood enterprises, also known as the Top 10 Seafood Exporters in Vietnam, provide goods that meet exceptional standards for sustainability, innovation, and quality. The largest seafood exporter from Vietnam is Minh Phu Seafood Corporation. According to the Vietnam seafood exporters data and the Vietnam suppliers list for 2024–2025, the top and most successful seafood exporters in Vietnam are as follows:

|

Rank |

Vietnamese Seafood Export Company |

Approx. Export Value 2024 ($) |

|

1 |

Minh Phu Seafood Corporation |

$600 million |

|

2 |

Vinh Hoan Corporation |

$450 million |

|

3 |

Quoc Viet Seafood Co., Ltd. |

$350 million |

|

4 |

Sao Ta Foods Joint Stock Company (Fimex VN) |

$300 million |

|

5 |

Nha Trang Seafood Joint Stock Company |

$250 million |

|

6 |

Hung Vuong Corporation |

$200 million |

|

7 |

Thuan Phuoc Seafoods and Trading Corporation |

$180 million |

|

8 |

Seaprodex Vietnam |

$150 million |

|

9 |

Cadovimex II Seafood Import-Export Processing |

$120 million |

|

10 |

Bac Lieu Fisheries Joint Stock Company |

$100 million |

Major Vietnam Seafood Export Products (2024-25)

The top seafood exports from Vietnam for 2024–2025 include a few essential items that still rule the world market. According to Vietnam shrimp export data, the country's most popular exports are shrimp, which are known for their high quality and flavor. These include black tiger shrimp and Whiteleg shrimp.

Additionally, because of its affordability and adaptability to other cuisines, catfish, often referred to as Basa fish, continues to be a popular choice for consumers worldwide. Other seafood products that highlight Vietnam's substantial involvement in the international seafood export market are pangasius, squid, and tuna. According to Vietnam customs data and Vietnam seafood export shipment data, the top 10 seafood exports from Vietnam in 2024 are as follows:

|

Rank |

Seafood Product |

Export Value ($) |

Key Export Destinations |

|

1 |

Shrimp (Whiteleg, Black Tiger, Lobster) |

$4 billion |

US, China, Japan, EU, South Korea |

|

2 |

Pangasius |

$2 billion |

China, U.S., Brazil, Mexico, EU |

|

3 |

Tuna |

$1 billion |

U.S., EU, Japan, South Korea, Israel |

|

4 |

Other Marine Fish |

$1 billion |

Japan, EU, U.S., South Korea |

|

5 |

Squid & Octopus |

$662 million |

South Korea, China, Japan |

|

6 |

Crab & Other Crustaceans |

$335 million |

China, Japan, U.S. |

|

7 |

Shellfish (Clams, Mussels, Scallops) |

$215 million |

EU, Japan, South Korea |

|

8 |

Other Mollusks |

$14.5 million |

Japan, EU |

|

9 |

Eel |

$12 million |

Japan, China |

|

10 |

Seaweed & Other Aquatic Products |

$10 million |

South Korea, Japan |

Vietnam Seafood Exports in the Last 10 Years: Yearly Vietnam Seafood Export Data

|

Year of Trade |

Vietnam seafood export data ($) |

|

2014 |

$7.92 billion |

|

2015 |

$6.57 billion |

|

2016 |

$7.05 billion |

|

2017 |

$8.32 billion |

|

2018 |

$9 billion |

|

2019 |

$8.58 billion |

|

2020 |

$8.41 billion |

|

2021 |

$8.89 billion |

|

2022 |

$11 billion |

|

2023 |

$8.98 billion |

|

2024 |

$10.07 billion |

|

2025 Q1 |

$2.29 billion |

Key Challenges Impacting Vietnam’s Seafood Export Industry

Rising Competition from Global Players

Despite the generally optimistic outlook for Vietnam’s seafood export industry, the sector faces mounting competition from other major exporters like Thailand and Indonesia. These countries boast well-developed seafood industries and are actively working to capture greater market share, challenging Vietnam’s position on the global stage.

Environmental and Sustainability Pressures

Vietnam’s seafood sector must also confront growing environmental challenges, particularly concerns over overfishing and marine pollution. With increasing global focus on marine conservation and the sustainable use of ocean resources, Vietnam will need to strengthen its adoption of eco-friendly fishing practices and tackle pollution in coastal waters to ensure the long-term health of its seafood industry.

Price Volatility and Exchange Rate Risks

The industry is no stranger to fluctuating seafood prices, driven by shifting supply-demand dynamics, seasonal patterns, and evolving consumer preferences. Additionally, unpredictable currency exchange rates can influence the global competitiveness of Vietnam’s seafood exports, adding another layer of complexity for exporters.

Vietnam Seafood Export Performance Snapshot (2024-25)

-

Total Export Value 2024: $10.07 billion (up 12.7% year-on-year)

-

Total Exports 2025 q1: $2.29 billion (up by 18%)

-

Projected exports 2025: $11 billion

-

Top Markets:

-

China: $1.65 billion (increase of 37%)

-

United States: $1.5 billion (growth of 31%)

-

Japan: $1.25 billion (increase by 22%)

-

European Union: $1.1 billion (up by 11%)

-

South Korea: $790 million (rise of 13%)

Noteworthy Developments:

-

In 2024, China overtook the U.S. as Vietnam’s largest shrimp importer.

-

Exports to the EU shifted towards more value-added seafood products.

-

Japan’s demand grew modestly, partly due to domestic inflation pressures.

Vietnam Seafood Export Trends & Insights

Monthly Export Highlights:

-

January 2025: $774.3 million (up 3.3% YoY)

-

October 2024: Monthly exports surpassed $1 billion for the first time since June 2022

Product Trends:

-

Shrimp: Continued robust growth, with live lobster exports to China surging.

-

Pangasius: Strong performance in the U.S. market, though facing price pressures in China.

-

Tuna: Exports hit $1 billion, driven by demand for canned and pouched tuna products.

Regulatory & Supply Chain Challenges

U.S. Tariffs & Duties on Shrimp:

The U.S. imposed preliminary countervailing duties in October 2024:

-

Vietnam: 2.84%

-

India: 4.36%

-

Ecuador: 7.55%

Vietnam’s relatively lower duty rate gives it an edge over some competitors in the U.S. market.

EU IUU Fishing Warning:

The EU’s ongoing ‘yellow card’ warning on Illegal, Unreported, and Unregulated (IUU) fishing continues to impact exports, especially for squid and octopus.

Raw Material Constraints:

Vietnam’s shrimp and tuna industries are grappling with domestic supply shortages, increasing reliance on imported raw materials, and affecting production efficiency.

Outlook for Vietnam Seafood Exports in 2025

-

Projected Export Value: $11 billion (expected 10% growth YoY)

Growth Opportunities:

-

Rising seafood demand in the U.S. and EU.

-

Progress in resolving trade barriers, particularly for pangasius.

-

Expansion into new regions like the Middle East and South America.

Persistent Challenges:

-

Continued regulatory pressures, including the EU’s IUU fishing concerns.

-

Heightened competition from countries such as Ecuador and India.

-

Domestic hurdles, like aquaculture disease outbreaks and material shortages.

Final Word & Conclusion

Vietnam’s seafood industry achieved remarkable growth in 2024, crossing the $10 billion mark in exports. Looking ahead, while new markets and product innovation offer promising avenues, the sector must strategically address regulatory, environmental, and competitive challenges to sustain momentum in 2025.

In conclusion, Vietnam's seafood export industry is thriving, with a continuous growth trajectory in 2025. With a focus on quality, sustainability, and market diversification, Vietnam has solidified its position as a top seafood exporter in the world. By leveraging its rich aquatic resources and innovative practices, Vietnam is set to expand its seafood exports to new heights in the coming years.

We hope you found our detailed and engaging blog on Vietnam’s seafood export data for 2025 valuable. For more updates on Vietnam import-export data and to explore the leading seafood exporters in Vietnam, be sure to visit and subscribe to VietnamExportdata. If you’re looking for a tailored & customized report on Vietnam’s trade data or seafood exports for Q1 2025, feel free to reach out to us at info@tradeimex.in!

Share

What's Your Reaction?

Like

2

Like

2

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0