Vietnam Free Trade Agreements: Exploring the Vietnam FTA Network for Trade Diversification

Explore Vietnam Free Trade Agreements covering 17 FTAs & more than 60 economies. Learn about Vietnam’s key FTAs, trade data, & strategic future directions.

Introduction

Over the past three decades, Vietnam has transformed from a relatively closed, agriculture-based economy into one of the world’s most dynamic trade hubs. The country’s growth strategy rests heavily on integration into global markets, and at the heart of this effort is an ambitious network of Free Trade Agreements (FTAs). Vietnam today has one of the most extensive FTA portfolios among developing economies. The Vietnam FTA network directly impacts the Vietnam import data & Vietnam export data.

As of 2024, Vietnam has signed and implemented 17 FTAs covering more than 60 economies, with several more under negotiation. These agreements give Vietnamese goods and services preferential access to nearly 90% of global GDP. For a nation where exports account for well over 90% of GDP, this web of agreements is not just a trade policy; it is an economic lifeline and a diversification tool. This article explores Vietnam’s FTA network in detail, its role in reducing market dependence, the economic outcomes to date, and the future opportunities and challenges.

Vietnam’s Expanding Trade Landscape

Vietnam has steadily positioned itself as one of the world’s most open economies. A major driver of this openness is its extensive participation in free trade agreements (FTAs) and double tax agreements (DTAs). These agreements are not just trade tools; they form the backbone of Vietnam’s economic development strategy, giving it access to new markets, attracting investment, and ensuring stronger integration into global supply chains.

Currently, Vietnam has over a dozen active FTAs, both bilateral and multilateral, and continues to negotiate new ones. On the taxation side, it has signed more than 80 DTAs with countries worldwide. Together, these networks give Vietnam’s businesses preferential access to goods markets while avoiding double taxation on cross-border income.

Exploring the Vietnam Free Trade Agreements

Vietnam became a strong and dedicated trading partner for the world community in 2007 when it joined the World Trade Organization (WTO). The nation has now signed a large number of free trade agreements and agreements to prevent double taxation. An agreement used by two or more nations to agree on the parameters of trade is known as a free trade agreement (FTA). These agreements establish the amount of levies and tariffs that nations apply to imports and exports.

Vietnam FTA Portfolio: Breadth and Depth

Vietnam’s FTA journey began in the 1990s with ASEAN integration and has steadily expanded to include both regional and bilateral deals. Broadly, Vietnam’s agreements fall into three categories:

1. ASEAN-Based Agreements

Vietnam joined the ASEAN Free Trade Area (AFTA) in 1993, which gradually eliminated tariffs among Southeast Asian neighbors. Building on that, ASEAN collectively signed FTAs with key partners:

-

ASEAN–China FTA (2005): Opened doors to the world’s second-largest economy.

-

ASEAN–Korea FTA (2007) and ASEAN–Japan Comprehensive Economic Partnership (2008): Anchored Vietnam’s integration into advanced Asian markets.

-

ASEAN–India FTA (2010) and ASEAN–Australia–New Zealand FTA (2010): Added two large emerging and developed partners to the mix.

These agreements gave Vietnam a central role in regional supply chains, particularly in electronics, textiles, and agricultural exports.

2. Bilateral and Niche Agreements

Vietnam has pursued direct bilateral agreements to secure preferential treatment outside the ASEAN framework. Notable examples include:

-

Vietnam–Chile FTA (2014): Vietnam’s first FTA with a Latin American country.

-

Vietnam–Korea FTA (2015): Deepened market access beyond the ASEAN–Korea deal, crucial given Korea’s role as a top investor in Vietnam.

-

Vietnam–Eurasian Economic Union FTA (2016): Covered Russia and Central Asian economies, giving Vietnamese seafood, textiles, and farm goods a competitive edge.

These deals target diversification by expanding beyond traditional Asian and Western markets.

3. Mega-Regional and Advanced-Economy FTAs

The most transformative agreements for Vietnam have been the mega-regional and advanced-economy deals:

-

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP, 2019): A high-standard pact with 10 other economies, including Japan, Canada, Australia, and Mexico.

-

Regional Comprehensive Economic Partnership (RCEP, 2022): The largest FTA in the world, covering 15 Asia-Pacific economies, including China, Japan, and Korea.

-

EU–Vietnam FTA (EVFTA, 2020): Gave Vietnamese exporters duty-free access to a $17 trillion market. Tariffs on 99% of goods are being phased out.

-

UK–Vietnam FTA (UKVFTA, 2021): A continuity agreement after Brexit, safeguarding access to the UK.

-

Vietnam–Israel FTA (2023): Vietnam’s first FTA with a Middle Eastern country, signaling diversification beyond traditional partners.

-

Vietnam–UAE Comprehensive Economic Partnership Agreement (2024): A strategic deal with one of the Middle East’s largest re-export hubs, opening opportunities in both trade and logistics.

Together, these FTAs balance breadth (many partners across continents) with depth (comprehensive coverage, modern rules, and high standards).

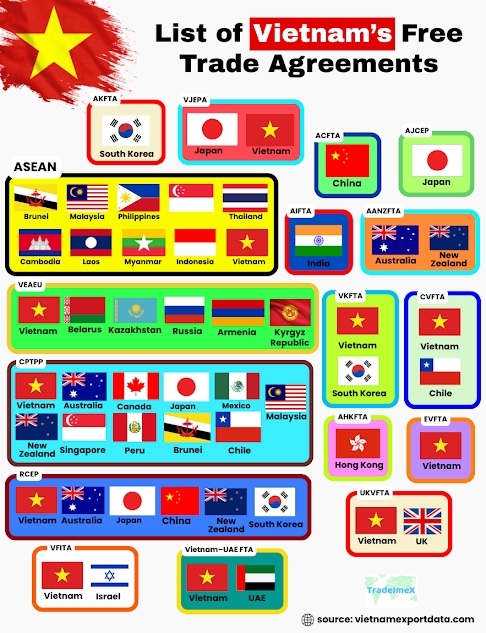

List of Vietnam’s Free Trade Agreements

|

Free Trade Agreement |

Short form |

Signers |

Effective Date |

|

ASEAN Free Trade Area |

ASEAN |

ASEAN Member States: Brunei, Malaysia, Philippines, Singapore, Thailand, Cambodia, Laos, Myanmar, Indonesia, Vietnam |

1993 |

|

ASEAN–China Comprehensive Economic Cooperation Agreement |

ACFTA |

ASEAN Member States, China |

2005 |

|

ASEAN–South Korea Comprehensive Economic Cooperation Agreement |

AKFTA |

ASEAN Member States, South Korea |

2007 |

|

ASEAN–Japan Comprehensive Economic Partnership |

AJCEP |

ASEAN Member States, Japan |

2008 |

|

Japan–Vietnam Economic Partnership Agreement |

VJEPA |

Japan, Vietnam |

2009 |

|

ASEAN–India Comprehensive Economic Cooperation Agreement |

AIFTA |

ASEAN Member States, India |

2010 |

|

ASEAN–Australia–New Zealand Free Trade Agreement |

AANZFTA |

ASEAN Member States, Australia, New Zealand |

2010 |

|

Vietnam–Chile Free Trade Agreement |

CVFTA |

Vietnam, Chile |

2012 |

|

South Korea–Vietnam Free Trade Agreement |

VKFTA |

Vietnam, South Korea |

2015 |

|

Eurasian Economic Union–Vietnam Free Trade Agreement |

VEAEU |

Vietnam, Belarus, Kazakhstan, Russia, Armenia, Kyrgyz Republic |

2016 |

|

Comprehensive and Progressive Agreement for Trans-Pacific Partnership |

CPTPP |

Vietnam, Australia, Canada, Japan, Mexico, New Zealand, Singapore, Peru, Brunei*, Chile*, Malaysia (*signed but pending ratification for some) |

2019 |

|

ASEAN–Hong Kong, China Free Trade Agreement |

AHKFTA |

ASEAN Member States, Hong Kong |

2019 |

|

EU–Vietnam Free Trade Agreement |

EVFTA |

Vietnam, EU Member States (27) |

2020 |

|

United Kingdom–Vietnam Free Trade Agreement |

UKVFTA |

Vietnam, United Kingdom |

2021 |

|

Regional Comprehensive Economic Partnership |

RCEP |

Vietnam, ASEAN Member States, Australia, Japan, China, New Zealand, South Korea |

2022 |

|

Vietnam–Israel Free Trade Agreement |

VFITA |

Vietnam, Israel |

2023 |

|

Vietnam–UAE Comprehensive Economic Partnership Agreement |

Vietnam–UAE FTA |

Vietnam, United Arab Emirates |

2024 |

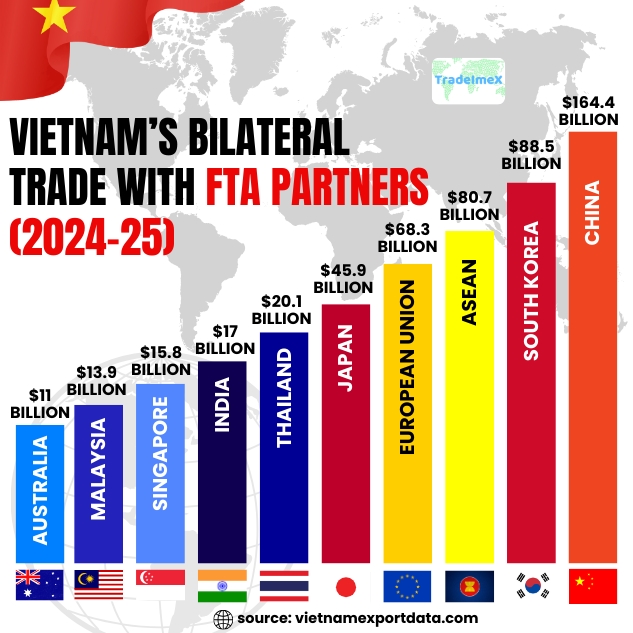

Vietnam’s Bilateral Trade with FTA Partners (2024-25)

|

Rank |

Vietnam FTA Partner / Bloc |

Exports from Vietnam ($) (2024) |

Imports into Vietnam ($) (2024) |

Total Trade (2024) |

|

1 |

China (ACFTA/RCEP) |

$58.1 billion |

$106.3 billion |

$164.4 billion |

|

2 |

South Korea (AKFTA/VKFTA/RCEP) |

$25.6 billion |

$62.9 billion |

$88.5 billion |

|

3 |

ASEAN (AFTA/RCEP/CPTPP) |

$36.2 billion |

$44.5 billion |

$80.7 billion |

|

4 |

European Union (EVFTA) |

$52 billion |

$16.3 billion |

$68.3 billion |

|

5 |

Japan (AJCEP/CPTPP/RCEP) |

$24.8 billion |

$21.1 billion |

$45.9 billion |

|

6 |

Thailand (AFTA/RCEP) |

$7.8 billion |

$12.3 billion |

$20.1 billion |

|

7 |

India (AIFTA) |

$9.2 billion |

$7.8 billion |

$17 billion |

|

8 |

Singapore (AFTA/CPTPP/RCEP) |

$6 billion |

$9.8 billion |

$15.8 billion |

|

9 |

Malaysia (AFTA/CPTPP/RCEP) |

$5.4 billion |

$8.5 billion |

$13.9 billion |

|

10 |

Australia (AANZFTA/CPTPP/RCEP) |

$6.9 billion |

$4.1 billion |

$11 billion |

Totals (FTA Partners, 2024):

-

Exports: $268.6 billion

-

Imports: $312 billion

-

Total Trade: $580.6 billion

This table demonstrates the breadth and balance of Vietnam’s FTA-driven trade. Some markets (China, Korea) are heavily tilted toward imports, while others (EU, US, UK, Canada) are export-heavy, underlining the role of FTAs in market access and supply chain integration. China dominates the Vietnam FTA network, as per the data on Vietnam-China trade.

Key Takeaways

-

China, South Korea, and ASEAN together account for over 55% of Vietnam’s FTA trade, highlighting Asia’s dominance in supply chains.

-

The EU is Vietnam’s top Western trade partner, driven by the EVFTA, with a strong export surplus.

-

Japan remains balanced, with near parity between exports and imports, as per the customs data on Vietnam imports from Japan.

-

Regional partners like Thailand, Singapore, and Malaysia show the depth of intra-ASEAN and RCEP trade flows.

-

Australia rounds out the top 10, boosted by agricultural trade and CPTPP ties, as per the data on Vietnam exports to Australia.

Why FTAs Matter for Vietnam: Diversification and Resilience

1. Reducing Over-Dependence on Major Markets

Vietnam’s rapid export growth has come with risks. By 2024, exports to the United States alone made up nearly 30% of Vietnam’s GDP. While this dependence fueled growth, it also exposed the country to policy shocks. The imposition of 20% tariffs on Vietnamese goods by the U.S. in 2025 underscored the danger of putting too many eggs in one basket.

FTAs provide alternative markets. The EVFTA and CPTPP, for instance, allow Vietnamese firms to redirect goods to Europe, Canada, or Australia if U.S. demand falters. The UAE and Israel deal further widen the safety net.

2. Expanding Export Opportunities

FTAs remove tariffs, ease quotas, and streamline customs procedures, making Vietnamese products more competitive abroad. For example, under the EVFTA, Vietnamese footwear and textiles enjoy near duty-free access, allowing them to compete strongly with Chinese and Bangladeshi goods in Europe.

By 2023, preferential exports using FTA provisions reached $86.1 billion, up from $69 billion in 2021. The utilization rate of tariff preferences rose from 32.6% in 2021 to 37.3% in 2023. This shows that Vietnamese businesses are increasingly aware of and able to exploit FTA benefits.

3. Cheaper Inputs and Stronger Supply Chains

Vietnam’s manufacturing boom relies on imported machinery, electronics components, and raw materials. FTAs lower costs by reducing tariffs on imports. In the first seven months of 2024, Vietnam’s imports of machinery and inputs grew nearly 20% year-on-year, with strong growth in imports from Canada and Mexico, both CPTPP members. These inputs fuel exports of higher-value products such as electronics and machinery.

4. Attracting Foreign Investment

Vietnam’s FTA network also serves as a magnet for foreign direct investment (FDI). Investors set up factories in Vietnam not only to tap its labor force but also to access markets under its FTA umbrella. For instance, a Korean electronics firm producing in Vietnam can export duty-free to the EU via the EVFTA, while also benefiting from Korea–Vietnam and ASEAN–Korea FTAs.

As a result, FDI inflows reached record levels in recent years, making Vietnam one of Asia’s top destinations.

5. Institutional and Productivity Gains

Modern FTAs require reforms in areas such as intellectual property, labor rights, environmental standards, and dispute settlement. Compliance improves Vietnam’s institutional framework, reduces trade frictions, and raises productivity. EVFTA, for example, requires Vietnam to ratify core International Labour Organization (ILO) conventions, strengthening its labor governance.

Data Snapshot: Vietnam Trade Under FTAs

-

Vietnam Exports to FTA markets (2024): $268 billion.

-

Preferential exports using FTA benefits (2024): $86.1 billion.

-

Top Vietnam FTA markets by export value: China ($19.4 billion), ASEAN ($15.2 billion), South Korea ($11.9 billion), India ($8.7 billion).

-

Highest utilization rates: India (68–70%), Chile (over 60%), South Korea (over 50%).

-

Share of FTA-based exports in total exports: Up from 32.6% in 2022 to 37.3% in 2024.

These figures reveal both progress and untapped potential. With over 60% of exports not yet using preferential tariffs, there is ample room to raise FTA utilization.

Challenges Ahead

1. Low Utilization Rates

Despite improvements, many Vietnamese exporters, especially small and medium-sized enterprises (SMEs), struggle with complex rules of origin. Without proper documentation, they cannot claim tariff preferences, losing competitiveness.

2. Overlap and Complexity

With 17 FTAs in force, overlapping rules create administrative burdens. Navigating whether to use EVFTA or CPTPP for exports to Europe, for instance, can be complicated.

3. Global Trade Tensions

Vietnam’s reliance on global value chains exposes it to geopolitical risks. U.S.–China trade tensions, tariffs, and shifting supply chains can disrupt inputs.

4. Sustainability Pressures

FTAs increasingly include commitments on environmental protection and labor rights. Vietnam must balance its industrial growth with compliance, which can be costly in the short run.

Vietnam’s Double Tax Avoidance Agreements (DTAAs)

Double Tax Avoidance Agreements are treaties designed to prevent individuals and businesses from being taxed twice on the same income in two different countries. These agreements either exempt certain types of income from taxation or reduce the amount of tax payable in Vietnam for eligible residents of partner countries.

Without such agreements, international investors often face the burden of double taxation, where income is taxed both in their home country and in the country where the income is earned, such as Vietnam. For instance, a foreign company providing goods or services in Vietnam could be liable for taxes both in Vietnam and its home jurisdiction.

As of 2024, Vietnam has signed DTAAs with 80 countries and territories, including key partners such as France, China, and Canada. These agreements help foster international trade and investment by offering clear tax benefits and reducing financial barriers.

Future Directions

Vietnam is not resting on its existing network. Several negotiations and exploratory talks are underway:

-

Vietnam–EFTA FTA: With Switzerland, Norway, Iceland, and Liechtenstein.

-

New agreements under consideration: With India (upgrading ASEAN–India ties), Brazil, Egypt, Saudi Arabia, and Qatar.

-

Negotiations with the U.S.: Ongoing discussions focus on reducing reliance on Chinese inputs and strengthening supply chain transparency.

These future deals will push Vietnam’s diversification further into Latin America, the Middle East, and beyond.

Strategic Implications

Vietnam’s FTA strategy delivers multi-layered benefits:

|

Objective |

Strategic Value |

|

Market diversification |

Reduces dependence on the U.S. and China |

|

Export growth |

Boosts access to large consumer markets |

|

Supply chain resilience |

Lowers input costs and widens sourcing options |

|

Investment attraction |

Positions Vietnam as an FDI hub |

|

Institutional reforms |

Strengthens labor, environment, and governance standards |

|

Economic growth |

Adds up to 15% to GDP from EVFTA and 1.3% from CPTPP by 2035 |

Conclusion and Final Verdict

In conclusion, Vietnam has built one of the most comprehensive FTA networks in the developing world. This network is more than a collection of trade deals; it is a strategic insurance policy against external shocks, a growth engine for exports, and a magnet for foreign investment. The data shows clear progress: rising utilization rates, expanding exports, and deeper integration into global supply chains. At the same time, challenges remain in implementation, rules of origin compliance, and balancing sustainability with growth.

Yet the trajectory is clear. Vietnam is positioning itself as a trade gateway not only for Southeast Asia but also for global supply chains. Its FTA network is the cornerstone of this vision, ensuring that no single market or policy shock can derail its momentum. For policymakers, businesses, and investors alike, Vietnam’s trade strategy is a case study in how a small economy can punch above its weight on the global stage by leveraging FTAs not just for liberalization, but for true diversification.

We hope that you liked our data-driven and detailed blog report on the Vietnam Free Trade Agreements & FTA networks. For more information on the latest Vietnam trade data, or to search live Vietnam import-export data by country, product, or HS code, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and an exclusive Vietnam customs database.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0