What Does Vietnam Import From the US? - US Unveils Vietnam Trade Framework After 20% Tariff Deal

Discover what Vietnam imports from the US and how the 2025 US–Vietnam Trade Framework reshapes trade after the new 20% tariff deal.

The year 2024-25 marked a major inflection point in the economic relationship between Vietnam and the United States. Vietnam solidified its position as America’s seventh-largest trading partner, while the U.S. became Vietnam’s single largest export destination. According to the Vietnam import data and the US export data, the total value of Vietnam imports from the US reached $14.98 billion in 2024, a 33% increase from the previous year. The total value of the US-Vietnam trade of goods reached $149.5 billion in 2024, as per the Vietnam export data.

Vietnam is the 7th largest trading partner of the US, as per the latest global trade data. The trade relationship has exploded in scale over the past decade. In 2024, the total value of two-way goods trade surpassed $149 billion, up from just $1.5 billion in the mid-1990s, when the two countries normalized relations. But the balance remains sharply tilted:

-

U.S. exports to Vietnam (Vietnam’s imports from the U.S.) reached roughly $13 billion in 2024, a 33 percent jump from the previous year.

U.S. imports from Vietnam were far larger, at about $136.6 billion, up nearly 19 percent year-on-year. -

The result was a U.S. goods-trade deficit of over $123 billion, one of the widest bilateral deficits Washington runs with any country.

This imbalance has become politically and strategically sensitive for the United States. For Vietnam, the U.S. market accounts for close to one-third of the country’s total exports, meaning Vietnam’s growth engine is tightly linked to U.S. consumer demand.

In late 2025, Washington unveiled a new U.S.–Vietnam Trade Framework Agreement designed to reset this relationship. The framework followed months of negotiations after the United States introduced a 20 percent tariff on most Vietnamese goods entering the U.S. market. The deal lays out reciprocal commitments: Vietnam will open its market wider to U.S. goods and services, while the U.S. will maintain its tariff structure but carve out exemptions for key Vietnamese exports.

Understanding what does Vietnam import from the US, and how this new trade deal could reshape those flows, is critical to interpreting where the relationship is headed next.

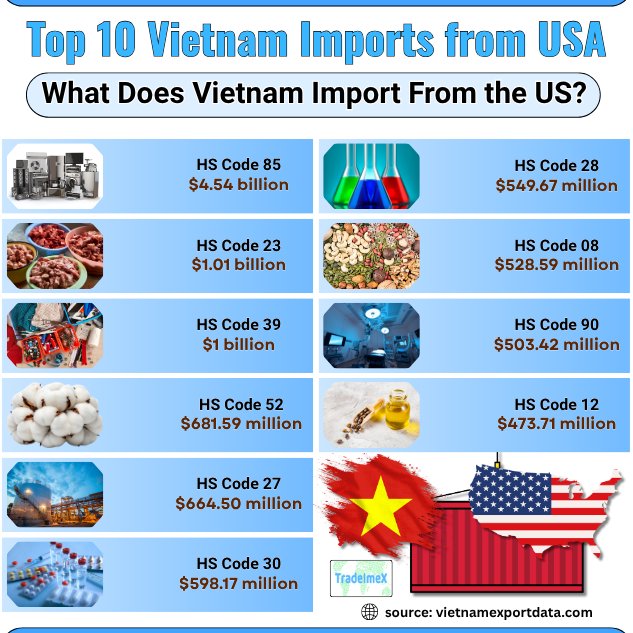

Top 10 Vietnam Imports from USA: What Does Vietnam Import From the US?

Vietnam imports a diverse range of products from the United States, encompassing a variety of sectors. Among the top 10 Vietnam imports from the USA are aircraft and aircraft parts, agricultural products such as soybeans and corn, machinery and equipment, electrical machinery, and medical instruments. These imports contribute significantly to Vietnam's economy and play a crucial role in enhancing trade relations between the two nations. The major goods that Vietnam imports from the US, as per the Vietnam shipment data and Vietnam-US import trade data for 2024-25, include:

1. Electrical Machinery & Equipment (HS Code 85): $4.54 billion

One of the top imports from the USA to Vietnam is electrical machinery and equipment, with a total value of $4.54 billion, as per the customs data on Vietnam electronics imports from the US by HS code. This category includes a wide range of products such as electrical transformers, electrical parts, and machinery for distributing electricity. The demand for electrical machinery in Vietnam is driven by the country's rapid industrialization and modernization efforts.

2. Prepared Animal Food (HS Code 23): $1.01 billion

Prepared animal food is another key import from the USA to Vietnam, with a total value of $1.01 billion. This category includes a variety of products such as pet food, animal feed supplements, and other prepared food for animals. The increasing demand for high-quality animal food products in Vietnam has led to a rise in imports from the US.

3. Plastics and Articles Thereof (HS Code 39): $1 billion

Plastics and articles thereof are also among the top imports from the USA to Vietnam, with a total value of $1 billion. This category includes plastic products such as plastic bags, plastic containers, and plastic packaging materials. The growing packaging industry in Vietnam has fueled the demand for plastic products, leading to a significant increase in imports from the US.

4. Cotton (HS Code 52): $681.59 million

Vietnam imports a substantial amount of cotton from the USA, with a total value of $681.59 million, as per the data on Vietnam cotton imports from the US by HS code. Cotton is a key raw material for Vietnam's textile and garment industry, which is one of the country's major export sectors. The high-quality cotton from the US is preferred by Vietnamese manufacturers, driving the demand for imports.

5. Mineral Fuels and Oils (HS Code 27): $664.50 million

Mineral fuels and oils are essential imports for Vietnam, with a total value of $664.50 million. This category includes products such as petroleum oils, natural gas, and other mineral fuels. Vietnam relies on imports of mineral fuels and oils to meet its energy needs, driving the demand for these products from the US.

6. Pharmaceutical Products (HS Code 30): $598.17 million

Pharmaceutical products are another key import from the USA to Vietnam, with a total value of $598.17 million. This category includes a wide range of products such as medicines, medical drugs, and healthcare products. The growing healthcare sector in Vietnam has led to an increase in the demand for pharmaceutical products, driving imports from the US.

7. Inorganic Chemicals (HS Code 28): $549.67 million

Vietnam imports a significant amount of inorganic chemicals from the USA, with a total value of $549.67 million. This category includes products such as chemical fertilizers, sulfuric acid, and other inorganic chemicals. The agricultural sector in Vietnam relies on imports of inorganic chemicals for crop production, leading to a steady demand for these products from the US.

8. Edible Fruit and Nuts (HS Code 08): $528.59 million

Edible fruit and nuts are popular imports from the USA to Vietnam, with a total value of $528.59 million. This category includes products such as fresh fruits, dried fruits, and nuts. The increasing demand for healthy and natural food products in Vietnam has driven the import of edible fruit and nuts from the US.

9. Optical, Medical, & Surgical Devices (HS Code 90): $503.42 million

Vietnam imports a significant amount of optical, medical, and surgical instruments from the USA, with a total value of $503.42 million. This category includes products such as medical devices, surgical tools, and optical equipment. The healthcare sector in Vietnam relies on imports of high-quality medical instruments, driving the demand for these products from the US.

10. Oil Seeds & Oleaginous Fruits (HS Code 12): $473.71 million

Last but not least, Vietnam imports a substantial amount of oil seeds and oleaginous fruits from the USA, with a total value of $473.71 million. This category includes products such as soybeans, sunflower seeds, and other oil-producing crops. The food processing industry in Vietnam relies on imports of oilseeds and oleaginous fruits for cooking oil production, leading to a steady demand for these products from the US.

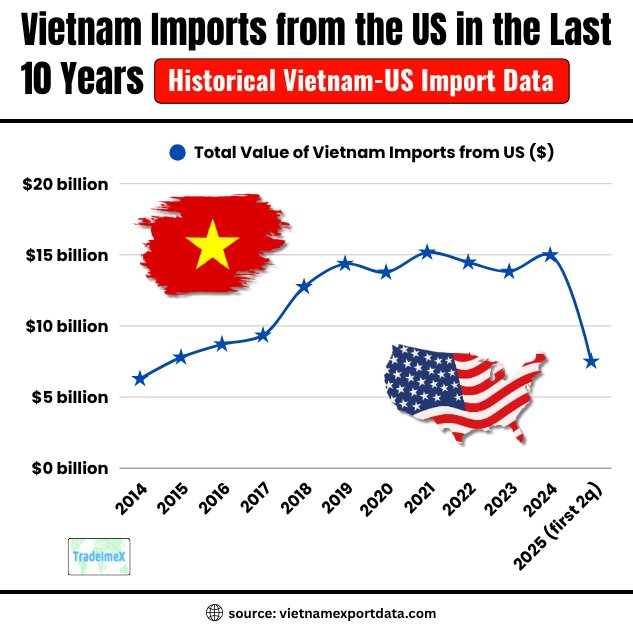

Vietnam Imports from the US in the Last 10 Years: Historical Vietnam-US Import Data

|

Year of Imports |

Total Value of Vietnam Imports from US ($) |

|

2014 |

$6.28 billion |

|

2015 |

$7.79 billion |

|

2016 |

$8.71 billion |

|

2017 |

$9.34 billion |

|

2018 |

$12.75 billion |

|

2019 |

$14.37 billion |

|

2020 |

$13.76 billion |

|

2021 |

$15.17 billion |

|

2022 |

$14.47 billion |

|

2023 |

$13.82 billion |

|

2024 |

$14.98 billion |

|

2025 (first 2 quarters) |

$7.5 billion |

Vietnamese Imports from the US Saw Growth in Early 2025

Vietnam has recorded a remarkable surge in imports from the United States during the first five months of 2025, reaching a total of $7.3 billion, which represents a 21% increase compared to the same period last year, as per the Vietnam customs data.

A closer look at the data reveals several standout trends:

-

Cotton imports from the US soared by 116% in volume and 79% in value. Vietnam purchased 455,000 tonnes ($800 million) of cotton, with the US supplying 48% of Vietnam’s total cotton imports, making Vietnam the third largest importer of US cotton after China.

-

Wood materials from the US jumped by 52%, positioning the US as Vietnam’s second-largest wood supplier. The spike was helped by a tariff reduction to 0% in April 2025, as per Vietnam customs wood import data for imports from the USA.

-

Soybeans from the US rose 10% in imports, and wheat by 26%, with the US capturing around 48% of Vietnam’s soybean market and leading the wheat supply ahead of Australia and Brazil.

-

US fruit and food-product imports grew 43% year-on-year, totaling nearly US $297 million in five months. US fruit’s share in Vietnam’s import market increased from 20% to 25%, second only to China.

-

Beyond agriculture, Vietnamese firms significantly heightened imports of computers, electronic components, auto parts, and vehicles from the US, reflecting a growing demand for high-tech inputs to upgrade domestic manufacturing and industrial output.

Industry experts view these developments as more than a short-term uptick: they highlight how deeper trade ties between Vietnam and the US are facilitating technology transfer, improved production quality, and increased competitiveness for Vietnamese manufacturers. In sum, Vietnam’s strong growth in US imports in early 2025 is a sign that both the domestic economy and export-oriented sectors are shifting toward higher-value inputs, while US firms are gaining ground in key Vietnamese supply chains.

What Vietnam Imports from the U.S.: The Big Picture

Although the United States imports more than ten times as much from Vietnam as it exports, Vietnam’s purchases of U.S. goods are steadily growing and shifting toward higher-value items. In 2024, Vietnam imported over $14 billion worth of goods from the United States, dominated by five main product groups:

-

Electrical machinery and equipment

-

Agricultural products and animal feed

-

Plastics and chemicals

-

Industrial machinery and mechanical appliances

-

Medical devices, vehicles, and aerospace components

Together, these sectors account for nearly 80 percent of Vietnam’s total imports from the U.S.

Let’s break those down in detail.

1. Electrical Machinery and Equipment

This is the single largest category of U.S. exports to Vietnam. In 2024, electrical machinery, semiconductors, and related components made up roughly $4 billion of the total export value.

Vietnam’s booming electronics and semiconductor assembly industries rely heavily on imported inputs, including chips, wafers, and specialized manufacturing equipment. Much of that high-end capital equipment originates in the United States.

Key items in this group include:

-

Integrated circuits and semiconductor components

-

Power generation and distribution systems

-

Telecommunication switches and transceivers

-

Industrial sensors, instruments, and automation components

The U.S. dominates the high-tech end of this segment, and Vietnam’s push to develop its own semiconductor ecosystem (partly as a diversification away from China) suggests this import category will continue to expand through 2025 and beyond.

2. Agricultural Products and Animal Feed

Agriculture is another major U.S. export pillar. Vietnam imports large quantities of oil seeds, soybeans, animal feed ingredients, and agricultural residues from the U.S. Midwest.

In 2024, this category accounted for roughly $700 million to $1 billion in value. The imports serve Vietnam’s fast-growing livestock and aquaculture sectors, both of which require high-protein feed ingredients sourced globally.

Other key U.S. farm products entering Vietnam include:

-

Wheat, corn, and sorghum for food and feed use

-

Dairy products (especially specialty cheeses and whey)

-

Frozen meats (particularly beef and poultry)

-

Cotton and raw hides for Vietnam’s textile and leather industries

The new trade framework specifically mentions agriculture and food products as areas for tariff elimination on the Vietnamese side, meaning these imports are poised for further growth once Vietnam enacts the promised market-access reforms.

3. Plastics, Chemicals, and Industrial Inputs

Plastics and chemical derivatives represent another strong area for U.S. exporters. In 2024, Vietnam imported approximately $800 million in plastics and articles thereof from the United States.

The imports are mainly used in packaging, manufacturing, and industrial production. Vietnamese factories use U.S.-made polymers, resins, and chemical compounds as raw materials for consumer goods, furniture, and electronics destined for re-export.

Industrial chemicals, fertilizers, and coatings also feature prominently. Vietnam’s domestic chemical industry remains limited, so high-purity and specialty inputs are often sourced from American producers.

4. Industrial Machinery and Mechanical Appliances

Vietnam’s industrialization depends on heavy machinery and mechanical equipment, and U.S. exporters play a growing role here. In 2024, exports of industrial machinery, boilers, and mechanical appliances to Vietnam totaled roughly $600 million.

This includes:

-

Construction and mining equipment

-

Factory automation and robotics systems

-

Machine tools for metalworking and fabrication

-

Pumps, turbines, and compressors for energy and utilities

-

Food-processing and packaging machinery

Vietnam’s infrastructure build-out, from highways to power plants, and its ambition to move up the value chain in manufacturing both create opportunities for U.S. suppliers.

The 2025 framework highlights technical standards recognition: Vietnam has agreed to accept U.S. certifications for certain industrial machinery and vehicles. That step alone could significantly reduce non-tariff barriers that have hampered American exporters in the past.

5. Medical Devices, Pharmaceuticals, and Aerospace

Another rapidly growing import segment involves medical equipment, diagnostic tools, pharmaceuticals, and aerospace components.

U.S. firms like GE Healthcare, Abbott, and Medtronic have expanded their footprint in Vietnam, supplying hospitals and private clinics with imaging systems, diagnostic kits, and medical instruments.

Although this category still represents less than $500 million in value, it is growing at double-digit rates. Under the new framework, Vietnam has committed to streamlined approvals for U.S. medical devices and pharmaceuticals, aligning its standards with those of international agencies.

Aerospace components and maintenance equipment, particularly for Vietnam Airlines and VietJet’s Boeing fleets, also form part of this import basket. Aircraft parts, engines, and aviation electronics contribute several hundred million dollars annually to the total.

Why Vietnam’s Imports from the U.S. Are Still Relatively Small

Despite clear growth, Vietnam’s imports from the United States remain limited compared to the country’s purchases from Asia. Several structural factors explain this:

-

Geographic proximity: Most of Vietnam’s imports come from nearby countries, China, South Korea, Japan, and Singapore, where trade flow is faster and cheaper.

-

Supply-chain integration: Many Vietnamese factories are part of production networks that source intermediate goods from China and other regional hubs. The U.S. mostly sells finished products or capital equipment rather than intermediate inputs.

-

Price sensitivity: American goods are often more expensive than Asian alternatives. For consumer or commodity segments, cost competitiveness is a challenge.

-

Regulatory friction: Technical standards, certification delays, and licensing requirements have historically limited the penetration of U.S. goods.

-

Currency and financing: Dollar-denominated transactions and high logistics costs make imports from the U.S. less attractive for small and mid-sized Vietnamese buyers.

The new trade framework aims directly at these bottlenecks by cutting tariffs, harmonizing regulations, and simplifying approvals for U.S. products.

The 2025 U.S.–Vietnam Trade Framework Explained

1. Core Provisions

The 2025 framework, formally titled the Framework Agreement on Reciprocal, Fair, and Balanced Trade, lays out the rules for a new era in bilateral commerce. Its key elements include:

-

Tariff structure: The United States will maintain a 20 percent tariff on most Vietnamese exports, but will exempt certain categories, such as apparel inputs, electronics components, and furniture, under a zero-tariff list (Annex III).

-

Vietnamese commitments: Vietnam pledges to remove or reduce tariffs on nearly all U.S. goods, particularly agricultural and industrial products, and to accelerate licensing and customs procedures.

-

Regulatory alignment: Vietnam will adopt U.S. or international standards for vehicles, medical devices, and pharmaceuticals.

-

Digital trade guarantees: Vietnam will not impose customs duties on electronic transmissions and will allow cross-border data transfers, creating a freer environment for U.S. tech firms.

-

SOE reform and transparency: State-owned enterprises must operate on commercial terms when competing with U.S. firms, and Vietnam will increase data sharing on subsidies and procurement.

-

Enforcement mechanisms: Both sides agreed to create a joint monitoring committee and a dispute-resolution channel for tariff or non-tariff issues.

2. Why the 20 Percent Tariff Still Matters

The 20 percent U.S. tariff remains significant, but it is lower than some earlier proposals that floated rates as high as 40–50 percent. For Washington, it signals seriousness about addressing trade imbalances and discouraging the transshipment of Chinese goods through Vietnam.

For Hanoi, the reciprocal opening, eliminating many import tariffs on U.S. goods, is a calculated concession to maintain market access for Vietnamese exports. The hope is that easier access for U.S. exporters will soften the political pressure around the trade deficit.

3. Implications for Imports from the U.S.

For U.S. exporters, the framework could be transformative:

-

Agriculture: Zero-tariff access for farm goods means American soybeans, dairy, and meat products can compete directly with cheaper suppliers from South America and Australia.

-

Industrial goods: Recognition of U.S. standards for machinery and vehicles cuts certification delays, making it easier to sell complex equipment into Vietnam.

-

Healthcare: Simplified approval processes will make it faster to register and distribute medical devices and pharmaceuticals.

-

Digital economy: The commitment to free data flows opens a large new market for American cloud, fintech, and cybersecurity services.

If Vietnam fully implements these provisions, U.S. exports to the country could easily double within five years.

Vietnam’s Strategic Motivation

Vietnam’s willingness to offer preferential access to U.S. goods reflects both economic and geopolitical calculations.

First, the country wants to diversify its import sources and reduce overreliance on China for industrial inputs. Bringing in more American equipment, technologies, and raw materials fits that goal.

Second, Vietnam is positioning itself as a trusted manufacturing partner in global supply chains. Compliance with U.S. standards and stronger transparency measures help secure its reputation as a reliable alternative to China.

Third, access to advanced U.S. technology supports Vietnam’s long-term development strategy, particularly in high-tech manufacturing, energy transition, and digital infrastructure.

Finally, closer economic alignment with the U.S. serves Vietnam’s broader foreign-policy balancing act, ensuring strategic autonomy while maintaining constructive ties with both Washington and Beijing.

Key Growth Areas for U.S. Exporters Supplying to Vietnam

Given the framework and Vietnam’s domestic priorities, the following segments hold the highest potential for growth between 2024 and 2026:

-

Semiconductors and Electronics Equipment: Demand for chipmaking and assembly tools is accelerating as Vietnam attracts foreign investment in semiconductor packaging and testing.

-

Agricultural and Food Products: Vietnam’s rising middle class and expanding livestock industry will drive demand for American grains, dairy, meat, and feed ingredients.

-

Medical and Pharmaceutical Supplies: Rapid hospital expansion and private healthcare investment create demand for advanced diagnostic and therapeutic equipment.

-

Energy and Environmental Technologies: U.S. exporters of renewable-energy components, emission-control systems, and power-grid hardware can benefit from Vietnam’s green-growth agenda.

-

Digital and Cloud Services: The new rules on cross-border data flows make Vietnam one of the most open digital markets in Southeast Asia for U.S. technology firms.

Risks and Implementation Challenges

While the framework is ambitious, its success depends on execution. Several challenges could limit the expected benefits:

-

Regulatory inertia: Vietnamese ministries may take time to translate commitments into enforceable rules, especially for sensitive sectors.

-

Domestic protectionism: Local manufacturers may resist opening to foreign competition, slowing tariff cuts or approvals.

-

Enforcement gaps: The dispute-resolution mechanism is untested; ensuring compliance could prove difficult.

-

Currency and cost pressures: A strong U.S. dollar raises import prices for Vietnamese buyers, reducing competitiveness.

-

Geopolitical volatility: Changes in U.S. trade policy or tensions in the South China Sea could influence bilateral trade conditions.

Nonetheless, both governments appear motivated to make the framework work, for economic and strategic reasons.

Quantitative Snapshot of Vietnam-US Trade: 2024–25

|

Indicator |

2024 |

Change from 2023 |

Comment |

|

Vietnam’s imports from the US |

$14.98 billion |

+33 % |

Driven by machinery and agriculture |

|

U.S. imports from Vietnam |

$136.6 billion |

+19 % |

Strong growth in textiles, electronics |

|

U.S. trade deficit with Vietnam |

$123.5 billion |

+18 % |

Politically sensitive in Washington |

|

Share of U.S. goods in Vietnam’s total imports |

3 % |

Rising slowly |

Reflects a limited but growing presence |

|

Vietnam’s GDP share from exports to the U.S. |

30 % |

Slightly higher |

Highlights Vietnam’s dependency |

|

Tariff rate on Vietnamese goods entering the U.S. |

20 % |

New in 2025 |

The framework allows selective exemptions |

|

Expected tariff on U.S. goods entering Vietnam |

0–5 % |

Down sharply |

Under framework commitments |

Strategic Takeaways for Businesses

For U.S. exporters, the path forward is clear but challenging:

-

Focus on high-value sectors — where the U.S. has a competitive edge, advanced manufacturing, healthcare, agritech, and digital services.

-

Localize intelligently — partner with Vietnamese distributors who understand the regulatory environment and customer base.

-

Leverage tariff reforms — time market entry around tariff phase-outs and use the framework to negotiate better import conditions.

-

Invest in after-sales service — quality and reliability often matter more than price in Vietnam’s fast-developing industrial sector.

-

Monitor compliance — stay alert to evolving rules of origin and data-flow regulations to avoid penalties or shipment delays.

For Vietnamese importers, the framework offers a window to source high-tech, high-quality goods from the US at a lower cost. The key is to build long-term relationships with suppliers who can offer training, warranties, and technology transfer, not just low prices.

Conclusion and Final Verdict

The unveiling of the 2025 US–Vietnam Trade Framework marks the most significant reset in bilateral trade relations in over a decade. While the 20% U.S. tariff on Vietnamese goods grabs headlines, the deeper story lies on the other side of the ledger: the chance for U.S. exports to finally gain serious traction in the Vietnamese market. Vietnam already imports a growing range of U.S. goods, from semiconductors and industrial machinery to farm products and medical devices. The new framework’s tariff cuts, regulatory reforms, and digital-trade provisions could double those imports within a few years if both sides follow through.

For the United States, this is a strategic opportunity to rebalance a lopsided trade relationship while embedding American technology and standards deeper into Southeast Asia. For Vietnam, it is a path to upgrade its industrial base, diversify import sources, and strengthen its geopolitical autonomy.

In short, Vietnam imports from the U.S. what it cannot easily get elsewhere: advanced technology, high-quality agricultural goods, and strategic industrial inputs. Under the new trade framework, that list is set to grow longer and more valuable, turning the Vietnam-US trade deal & partnership into one of the defining trade relationships of the Indo-Pacific in the years ahead.

We hope you liked our insightful blog report on the top Vietnam imports from the US & the US-Vietnam trade framework deal 2025. For more information on the latest Vietnam trade data or to search live Vietnam import-export data by country, product, or HS code, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified Vietnam customs import-export database.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0