Vietnam-China Trade Relations: Top Vietnam Imports from China in 2024-25

Explore Vietnam-China trade relations in 2024-25. Discover top Vietnam imports from China, key trade stats, trends, and import data insights.

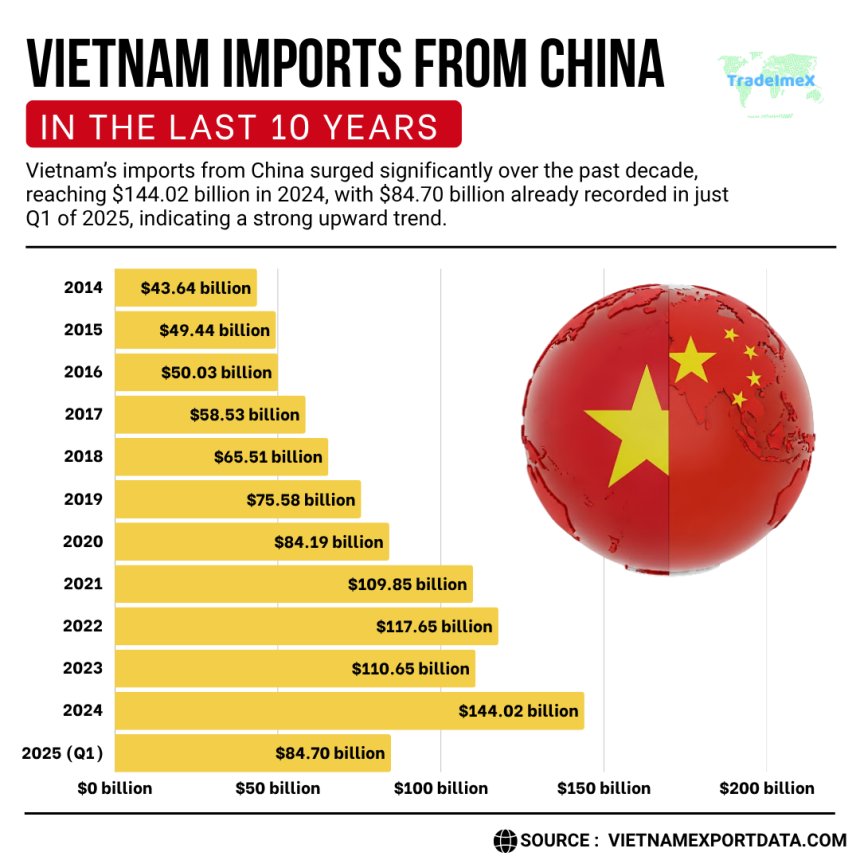

With a long history of trade relations, Vietnam and China continue to be key trading partners in the global market. In recent years, Vietnam has seen significant growth in imports from China, with various products making their way into the Vietnamese market. According to Vietnam import data and Vietnam customs data, the total value of Vietnam imports from China reached $144.02 billion in 2024, a 12% increase from the previous year. China had a 22% share in Vietnam's total imports in 2024. Vietnam imports a wide array of goods from China, ranging from electronics to industrial products.

Vietnam has a trade deficit with China, which means that it imports more from China than it exports. Along with investment and infrastructural connections, Vietnam and China's economic and trade cooperation has grown significantly. Based on data from Vietnam and China, this collaboration is expected to surpass previous records in 2024, reaching over $205 billion and $260 billion, respectively.

Vietnam continues to rank fourth internationally and as China's biggest ASEAN trading partner. According to the global trade data, China is the largest import partner of Vietnam. The volume of bilateral trade between China and Vietnam increased 17.46% to $51.25 billion in the first three months of 2025. Many Vietnamese farmers are directly benefiting from China's rise as the country's biggest export market for forestry, fisheries, and agricultural goods, as per China export data. With US$31.26 billion in FDI, China is now Vietnam's sixth-largest foreign investor. In this article, we will take a look at the top imports from China to Vietnam in the years 2024-25.

Vietnam-China Trade Relations: Key Insights

Vietnam–China trade surged to an all-time high in 2024. According to the General Department of Vietnam Customs and the WTO Center report, it reached $205.2 billion, with Vietnam importing $144 billion from China, up 30.1% vs. 2023, and deepening its trade deficit from roughly $49 billion to about $82.8 billion. China’s data suggests a broader figure: $260.65 billion of bilateral trade, with China exporting $161.9 billion to Vietnam and importing $98.8 billion. By H1 2024, imports from China had already reached $66.7 billion (a 34% YoY rise), while exports to China were only $27.8 billion, leading to a cumulative trade deficit of nearly $39 billion.

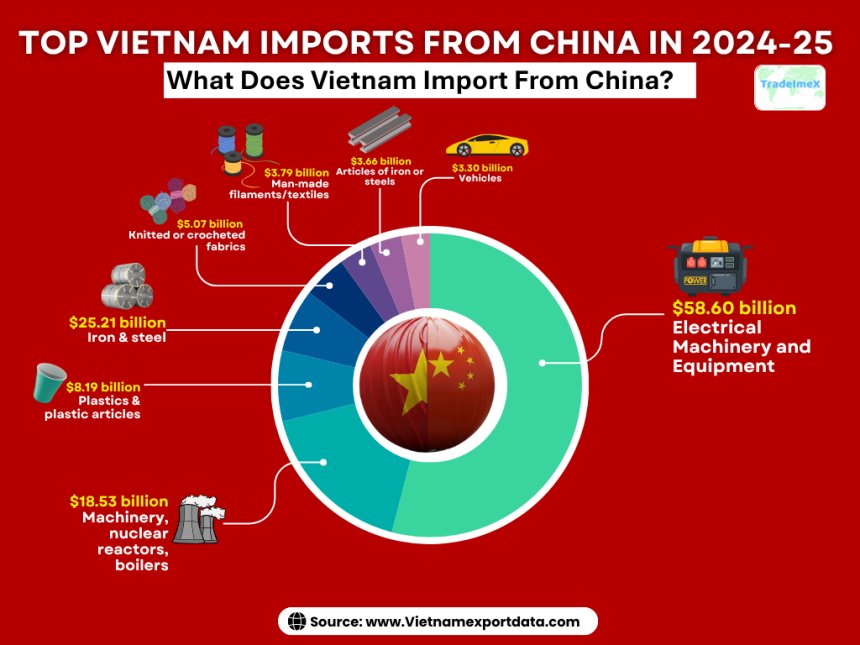

Top 10 Vietnam Imports from China in 2024-25: What Does Vietnam Import from China?

As of 2024-25, Vietnam's top 10 imports from China encompass a diverse range of products, showcasing the robust trade relations between the two nations. In this period, Vietnam primarily imports electronic equipment, machinery, textiles, and plastics from China, as per Vietnam customs data. This comprehensive list highlights the significant role China plays in supplying essential goods to support Vietnam's industrial and consumer needs. The major Vietnam imports from China, or the top 10 goods that are imported by Vietnam from China, as per the Vietnam-China trade data and Vietnam shipment data for 2024-25, include:

1. Electrical machinery & equipment (HS code 85): $58.60 billion (36.2%)

Electrical machinery and equipment are among the top imports from China to Vietnam. These products are essential for various industries and sectors in Vietnam, including manufacturing, construction, and telecommunications.

2. Machinery and nuclear reactors (HS code 84): $18.53 billion (11.5%)

Machinery, nuclear reactors, and boilers are also significant imports from China to Vietnam, as per the customs data on Vietnam machinery imports from China. These products are crucial for the development of infrastructure and industrial sectors in Vietnam.

3. Plastics & plastic articles (HS code 39): $8.19 billion (5.1%)

Plastics and plastic articles are in high demand in Vietnam, and China is a major supplier of these products, as per the data on Vietnam plastics imports from China by HS code. From packaging materials to consumer goods, plastics play a vital role in various industries in Vietnam.

4. Iron & steel (HS code 72): $7.27 billion (4.5%)

Iron and steel products are essential for the construction and manufacturing industries in Vietnam. With China being a leading producer of iron and steel, Vietnam imports a significant amount of these products from its neighbor.

5. Knitted or crocheted fabrics (HS code 60): $5.07 billion (3.1%)

Textile products, including knitted or crocheted fabrics, are popular imports from China to Vietnam. The textile industry is a booming sector in Vietnam, and the country relies on imports to meet the growing demand for fabrics.

6. Man‑made filaments/textiles (HS code 54): $3.79 billion (2.3%)

Man-made filaments and textiles are also essential imports from China to Vietnam. These products are used in various industries, including textile manufacturing, apparel production, and home furnishing.

7. Articles of iron or steel (HS code 73): $3.66 billion (2.3%)

Articles of iron or steel, such as iron rods, bars, and wire, are crucial imports for Vietnam's construction and infrastructure development. China's high-quality iron and steel products are in demand in the Vietnamese market.

8. Vehicles (HS code 87): $3.30 billion (2.0%)

Vehicles, excluding railway vehicles, are popular imports from China to Vietnam. The automotive industry in Vietnam is growing rapidly, and the country relies on imports to meet the demand for cars, trucks, and other vehicles.

9. Commodities not specified by kind (HS code 99): $3.08 billion (1.9%)

Commodities not specified by kind include various products that Vietnam imports from China. These products cover a wide range of items, including raw materials, intermediate goods, and consumer products.

10. Optical, medical, or surgical instruments (HS code 90): $2.19 billion (1.4%)

Optical, medical, and surgical instruments are essential imports for Vietnam's healthcare industry. China provides a wide range of high-quality medical equipment and instruments to support the healthcare sector in Vietnam.

Notably, the electronics‑machinery axis accounts for nearly 45% of imports, fueling Vietnam’s export-oriented manufacturing sectors.

Vietnam Imports from China in the Last 10 Years: Historical Vietnam-China Trade Data

|

Year of Imports |

Vietnam Imports from China Value ($) |

|

2014 |

$43.64 billion |

|

2015 |

$49.44 billion |

|

2016 |

$50.03 billion |

|

2017 |

$58.53 billion |

|

2018 |

$65.51 billion |

|

2019 |

$75.58 billion |

|

2020 |

$84.19 billion |

|

2021 |

$109.85 billion |

|

2022 |

$117.65 billion |

|

2023 |

$110.65 billion |

|

2024 |

$144.02 billion |

|

2025 quarter 1 |

$84.70 billion |

Vietnam–China Trade Relations & Agreements: What’s Powering the Pipeline?

Vietnam and China share one of Asia’s most complex trade relationships—strategically intertwined, economically critical, yet geopolitically cautious. Beyond raw numbers, several formal and informal frameworks guide and influence their trade dynamics.

1. ASEAN-China Free Trade Area (ACFTA)

Vietnam and China are both parties to the ASEAN–China Free Trade Area (ACFTA), operational since 2010. Under this pact:

-

Over 90% of tariff lines have been eliminated or reduced on goods traded between China and ASEAN members, including Vietnam.

-

It’s been a catalyst for China’s dominance in supplying raw materials and components to Vietnam’s factories, boosting vertical integration.

-

The agreement also covers rules of origin, customs facilitation, and investment protections.

2. Regional Comprehensive Economic Partnership (RCEP)

As of 2022, Vietnam and China are members of RCEP, the world’s largest trade pact, encompassing 15 countries, including Japan, Korea, and Australia. RCEP:

-

Builds on ACFTA and aims to harmonize standards, open up services, and reduce non-tariff barriers.

-

Benefits for Chinese exporters supplying Vietnam’s manufacturing sectors, especially in electronics, chemicals, and plastics.

-

Helps Vietnamese firms access Chinese markets on equal footing with Korean or Japanese firms, especially in textiles and processed food.

3. Bilateral Infrastructure Cooperation

Beyond multilateral trade deals, Vietnam and China have signed a series of memoranda of understanding (MoUs) focused on:

-

Cross-border transport connectivity, especially rail (e.g., Lao Cai–Ha Khau and the proposed North–South high-speed line).

-

Smart customs clearance at border gates like Huu Nghi–Youyi Guan.

-

Energy and logistics cooperation in special economic zones.

During President Xi Jinping’s December 2023 visit, the two countries signed 37 cooperation documents, covering:

-

E-commerce and digital economy

-

Agricultural trade

-

Industrial park development

-

Green development and carbon reduction

4. Strategic Partnership Framework

Since 2008, Vietnam and China have maintained a “comprehensive strategic cooperative partnership.” This vague but wide-ranging arrangement includes regular:

-

Party-to-party meetings between the Communist Party of Vietnam (CPV) and the Chinese Communist Party (CCP).

-

Joint border trade committees and working groups.

-

Mechanisms to prevent and manage maritime disputes in the South China Sea.

While tensions persist, especially around sovereignty and fishing rights, trade has proven resilient, even expanding under pressure.

China-Vietnam Trade Relations: Strategic, Not Just Commercial

Vietnam–China trade is more than commerce; it’s a structural feature of Vietnam’s export-led development model. Vietnam relies on China for:

-

Low-cost, high-volume inputs (components, raw materials).

-

Capital equipment for scaling the domestic industry.

-

Consumer goods for its growing middle class.

At the same time, Vietnam tries to avoid overreliance, hedge with U.S. and EU partners, and localize more supply chains. Future trade will hinge on how well Vietnam can:

-

Leverage trade deals without losing autonomy.

-

Deepen infrastructure links without becoming dependent.

-

Navigate China’s economic gravity while defending its manufacturing rise.

Vietnam-China Trade Facilitation

In the joint statement, both sides committed to enhancing bilateral commerce through the ASEAN-China Free Trade Area (ACFTA) and the Regional Comprehensive Economic Partnership (RCEP). The Trade Facilitation and E-commerce Cooperation Working Groups will be activated between China and Vietnam in order to investigate trade prospects and improve business cooperation. They have sought to address trade concerns and broaden opportunities for collaboration through communication. In addition to implementing the mutually recognized plan for "Authorized Economic Operator" (AEO) and "single window" cooperation, both parties intend to strengthen customs cooperation and promote each other's major exports.

The establishment of Vietnamese trade promotion offices in Haikou, Hainan, and other locations is something that the Chinese government is willing to promote. In order to reduce clearance pressure, both countries must cooperate to increase customs effectiveness at border crossings. Rice bran, chili, passion fruit, and bird nests are among the Vietnamese exports that are subject to Chinese regulations. China is attempting to approve the importation of a number of Vietnamese agricultural goods, such as plant-based and citrus products.

Vietnam also wants to import more Chinese sturgeon. With an emphasis on high-tech agriculture, food security, and disease control, both countries have fortified the Vietnam-China Joint Committee on Agricultural Cooperation and the Joint Committee on Fishery in the Gulf of Tonkin.

Vietnam Imports From China: H1 2025 Import Trends

Vietnam’s imports from China continued rising into early 2025. In the first half of the year, imports reached $84.7 billion, up 26.4% YoY, making China Vietnam’s top supplier by value share (40% of total imports).

Top imports of Vietnam from China (Jan–Jun 2025):

-

Computers & electronic components: $23.5 billion (+47%)

-

Machinery, tools & spares: $17.7 billion (+35.6%)

-

Plastic products: $3 billion (+31%)

-

Auto parts & vehicles: Auto components $969.7 m (+78%); full vehicles $746 m (+64%)

-

Wires & cables: $1.48 billion (+54%)

-

Base‑metal products: $1.75–1.8 billion (+37–54%)

Declines included iron & steel (−23%) and glass, animal feed, and transport parts.

Why These Imports Matter

1. Fueling Vietnam’s Export‑Driven Manufacturing

High‑value electronics and machinery imported from China serve as critical inputs for Vietnam’s export industries, itself a major supplier of smartphones, PCs, garments, furniture, and footwear to global markets. These raw materials and components enable assembly packages that feed both U.S. and EU supply chains.

2. Accelerating Industrial Modernization

Imports of capital equipment and tools support the scaling of Vietnam’s industrial base, especially in textiles, plastics, and electronics, helping shift from low‑value assembly to higher‑value manufacturing.

3. Rising Vehicle & Auto Part Demand

Vietnam has seen rapid growth in imported auto parts (+78%) and assembled vehicles (+64%) in early 2025. This reflects increasing domestic demand and a nascent auto sector still reliant on imported components.

Strategic Context: Trade, Diplomacy & Risk

Infrastructure & Connectivity Projects

The bilateral strategic partnership deepened during Xi Jinping’s December 2023 state visit to Vietnam, which produced 37 cooperation agreements covering infrastructure, digital economy, and transport—including plans for standard‑gauge railways linking China and Vietnam. Vietnam’s 2024–25 infrastructure push includes collaboration with Chinese firms on its North–South high‑speed railway (targeting construction around 2026–30).

Foreign Policy & Trade Strategy

Vietnam applies its signature “bamboo diplomacy”, balancing relations with China and the U.S. amid rising regional tensions. While building ties with Beijing, Hanoi also courts Washington to diversify markets and reduce exposure to Chinese dominance in imports.

U.S. Pressure & Origin Rules

Vietnam is facing U.S. scrutiny over the alleged transshipment of Chinese goods labeled “Made in Vietnam” to dodge U.S. tariffs. In response, the government has cracked down on supply‑chain loopholes and reinforced rules of origin certifications.

The coming months are critical as Vietnam must negotiate US–Vietnam trade terms, manage rising U.S. tariffs, and at the same time balance continued reliance on Chinese supply inputs.

Looking Ahead: Implications & Opportunities

-

Vietnam must decide if and how to reduce dependence on China for critical industrial inputs, especially amid U.S. trade pressure.

-

Diversification efforts may include increased sourcing from ASEAN, India, or domestic production.

-

China‑Vietnam infrastructure projects like high-speed rail may further deepen connectivity and dependence on Chinese financing and equipment.

-

Vietnam’s policymakers may seek to renegotiate ASEAN/ACFTA and RCEP rules to boost trade resilience.

-

On the export side, Vietnamese firms could aim to add more value locally, reducing U.S. concerns about nominal “Made in Vietnam” labels without sufficient processing.

-

Continued growth in electronic and auto manufacturing could benefit Vietnam, but only if balanced with stronger domestic capacity building.

Summary of Vietnam Imports from China in 2024-25

Vietnam’s top import categories from China in 2024 were:

-

Computers, electronics & components ($34.6 billion; 24%)

-

Machinery & equipment ($29 billion; 20%)

-

Fabrics, phones, iron/steel & plastic products (each from $5–10 billion)

Imports surged further in early 2025, notably in electronics, tools, plastics, auto parts, and cables. These inflows are vital for Vietnam’s export-oriented economy, but also raise strategic concerns under U.S. trade scrutiny. As Vietnam walks its foreign policy bamboo path, the next phase of China–Vietnam trade will demand skillful balancing between growth and economic sovereignty.

Conclusion and Final Verdict

In conclusion, Vietnam-China trade relations remain strong, with China being a top supplier of imports to Vietnam. From electronics and textiles to machinery and chemicals, Chinese products are essential for Vietnam's economic growth and development. As Vietnam continues to expand its industrial and consumer sectors, the demand for Chinese imports is expected to remain high in the years 2024-25 and beyond.

We hope that you liked our interactive data-driven blog report on Vietnam-China Trade Relations & Top Vietnam imports from China in 2025. For more such insights on the latest Vietnam Export-Import Data or to search live data on Vietnam imports by country, visit VietnamExportdata. Contact us at info@tradeimex.in to get a customized database report or bilateral trade data report, along with a verified list of the top importers in Vietnam.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0