Vietnam's Trade Turnover Reaches a Record $930.05 Billion in 2025: Latest Vietnam Trade Data

Vietnam’s trade turnover hit a record $930.05 billion in 2025, with strong export growth & a $20.03 billion surplus. Explore the latest Vietnam trade data.

Vietnam’s external trade crossed a historic threshold in 2025. For the first time, the country’s total import–export turnover reached a new all-time high, marking a decisive leap in Vietnam’s integration into global supply chains. This achievement places Vietnam among the world’s leading trading nations and confirms its role as a central manufacturing and export hub in Asia. According to the latest Vietnam import data & Vietnam export data, Vietnam’s total import–export turnover reached $930.05 billion, representing an 18.2 % increase over 2024’s figures. Exports accounted for $475.04 billion of that total, while imports totaled $455.01 billion, resulting in a trade surplus of $20.03 billion for the year.

The 2025 results are not a one-off spike. They are the outcome of long-term structural changes in Vietnam’s economy, including export-oriented industrialization, rising foreign direct investment, deep participation in global value chains, and expanding free trade networks, as per the global trade data. This article provides a detailed, data-driven examination of Vietnam’s trade performance in 2025, breaking down exports, imports, trade balances, sectoral trends, partner markets, and the broader economic implications.

Overview of Vietnam’s Record Trade Performance in 2025

In 2025, Vietnam’s total trade turnover reached $930.05 billion, representing an increase of approximately 18.2 percent year-on-year, as per the National Statistics Office of Vietnam (NSO). This growth rate significantly exceeded global trade growth, which remained subdued due to lingering geopolitical tensions and uneven global demand.

The trade structure was as follows:

-

Exports: $475.04 billion (up around 17 percent)

-

Imports: $455.01 billion (up about 19.4 percent)

-

Trade surplus: $20.03 billion

This marked the ninth consecutive year Vietnam recorded a trade surplus, an uncommon achievement for a fast-growing, manufacturing-driven economy that depends heavily on imported inputs.

To put the scale into perspective, Vietnam’s total trade turnover was just over $100 billion in 2007, the year it joined the World Trade Organization. In less than two decades, Vietnam’s trade volume has expanded more than ninefold.

Export Growth: Structure, Composition, and Key Drivers

Overall Export Performance

Vietnam’s exports reached $475.04 billion in 2025, reflecting a strong recovery in global demand for electronics, machinery, textiles, and consumer goods. Export growth was broad-based across industries, though manufacturing continued to dominate. Electronics led Vietnam’s export growth in 2025, as per the Vietnam customs export data of electronics by HS code.

Exports accounted for slightly over 51 percent of total trade turnover, reinforcing Vietnam’s export-oriented growth model.

Export Composition by Sector

Vietnam’s export structure in 2025 highlights the country’s transition from a resource-based exporter to a manufacturing-driven economy.

Export breakdown by sector:

-

Processed industrial goods: $421.47 billion (88.7%)

-

Agriculture and forestry products: $39.46 billion (8.3%)

-

Seafood: $11.29 billion (2.4%)

-

Fuels and minerals: $2.83 billion (0.6%)

The overwhelming dominance of processed industrial goods shows that Vietnam is no longer primarily exporting raw or semi-processed materials. Instead, it exports finished and semi-finished products embedded in global value chains.

Major Export Product Groups

In 2025:

-

36 export product groups exceeded $1 billion in value.

-

8 groups surpassed $10 billion, together accounting for more than 70 percent of the total export value.

Key export categories included:

-

Electronics, computers, and components

-

Machinery and mechanical equipment

-

Mobile phones and parts

-

Textiles and garments

-

Footwear

-

Furniture and wood products

Electronics and high-tech manufacturing remained the largest contributors, reflecting Vietnam’s growing importance in global electronics assembly and production.

Import Growth: Inputs for an Expanding Manufacturing Base

Import Overview

Vietnam’s imports reached $455.01 billion in 2025, rising nearly 19.4 percent year-on-year. This faster growth relative to exports reflects expanding industrial capacity and strong investment activity. Vietnam’s imports were dominated by machinery in 2025, as per the Vietnam customs import data of machinery by HS code.

Rather than signaling weakness, rising imports highlight the scale of Vietnam’s manufacturing ecosystem, which relies on imported machinery, components, and raw materials to support export production.

Import Composition by Category

Imports were dominated by production inputs:

-

Machinery, equipment, tools, and spare parts: 52.7%

-

Raw materials and fuels: 40.9%

-

Consumer goods: 6.4%

This structure confirms that Vietnam’s imports are largely investment- and production-oriented rather than consumption-driven.

Import Product Concentration

In 2025:

-

47 imported product groups exceeded $1 billion in value.

-

9 groups surpassed $10 billion, accounting for nearly 94 percent of total imports.

Major imported items included electronic components, industrial machinery, plastics, steel, chemicals, and petroleum products.

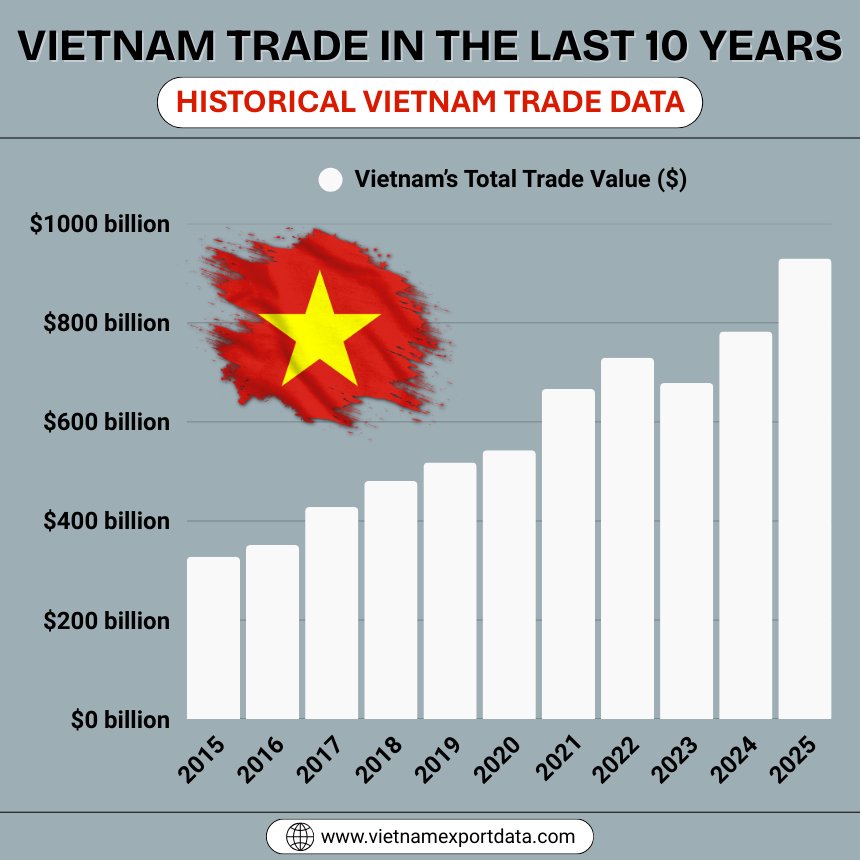

Vietnam Trade in the Last 10 Years: Historical Vietnam Trade Data

|

Year of Trade |

Vietnam’s Total Trade Value ($) |

|

2015 |

$327.78 billion |

|

2016 |

$351.55 billion |

|

2017 |

$428.32 billion |

|

2018 |

$480.55 billion |

|

2019 |

$518.05 billion |

|

2020 |

$542.74 billion |

|

2021 |

$666.54 billion |

|

2022 |

$729.68 billion |

|

2023 |

$678.51 billion |

|

2024 |

$782.36 billion |

|

2025 |

$930.05 billion |

Trade Balance: Surplus Amid Structural Dependence

Vietnam recorded a trade surplus of $20.03 billion in 2025. This surplus, however, masks important structural dynamics between domestic enterprises and foreign-invested firms.

Domestic vs. Foreign-Invested Sector

-

Domestic enterprises: Trade deficit of approximately $29.4 billion

-

Foreign-invested enterprises (including crude oil): Trade surplus of about $49.46 billion

Foreign-invested firms continue to dominate Vietnam’s export sector, particularly in electronics and high-tech manufacturing. Their strong export performance offsets the import-heavy structure of domestic firms.

Sustainability of the Trade Surplus

Vietnam’s persistent trade surplus strengthens foreign exchange reserves and stabilizes the balance of payments. However, its dependence on foreign-invested enterprises raises long-term questions about domestic value addition and technological upgrading.

Major Trading Partners and Bilateral Trade Patterns

Export Markets

Vietnam’s exports in 2025 were heavily concentrated in major developed markets:

-

United States: $153.2 billion in exports

-

European Union: Strong growth, particularly in electronics, footwear, & furniture

-

Japan and South Korea: Stable demand for machinery, textiles, and electronics

The U.S. remained Vietnam’s largest single export destination, accounting for nearly one-third of total exports.

Import Sources

Vietnam’s imports were concentrated in Asia:

-

China: $186 billion in imports

-

South Korea: Major supplier of electronics components

-

ASEAN countries: Key sources of raw materials and intermediate goods

China remained Vietnam’s largest trading partner by volume and its largest source of imported inputs.

Bilateral Trade Balances

Vietnam’s trade balances with major partners in 2025 reveal clear structural patterns:

-

Trade surplus with the United States: Nearly $134 billion

-

Trade surplus with the European Union: $38.6 billion

-

Trade deficit with China: $115.6 billion

-

Trade deficits with ASEAN and South Korea: Continued expansion

These imbalances reflect Vietnam’s role as an assembly hub that imports components from Asia and exports finished goods to Western markets.

Key Drivers Behind Vietnam’s Trade Expansion

Foreign Direct Investment (FDI)

Disbursed foreign direct investment in 2025 reached approximately $27.62 billion, the highest level in five years. FDI has been central to:

-

Expanding export manufacturing capacity

-

Introducing advanced production technologies

-

Strengthening Vietnam’s integration into global supply chains

Most FDI flowed into manufacturing, electronics, renewable energy, and industrial infrastructure.

Free Trade Agreements

Vietnam benefits from one of the most extensive networks of free trade agreements in Asia. These agreements have:

-

Reduced tariff barriers for Vietnamese exports

-

Improved market access in high-income economies

-

Encouraged multinational firms to locate production in Vietnam

Preferential trade terms have been especially important for textiles, footwear, and agricultural products.

Manufacturing and Supply Chain Shifts

Global supply chain diversification has accelerated Vietnam’s rise as a manufacturing hub. Companies seeking to reduce over-concentration in single markets have expanded operations in Vietnam, boosting both exports and imports of industrial inputs.

Challenges and Risks Going Forward

Despite its impressive performance, Vietnam’s trade model faces several challenges:

1. Heavy Reliance on Imported Inputs

High import dependence limits domestic value addition and exposes Vietnam to external supply shocks and price volatility.

2. Dominance of Foreign-Invested Enterprises

While FDI drives exports, domestic firms capture a smaller share of export value. Upgrading local capabilities remains a policy priority.

3. Exposure to Global Economic Shocks

Vietnam’s high trade-to-GDP ratio makes it sensitive to global downturns, protectionist measures, and geopolitical disruptions.

Economic Implications of the $930 Billion Milestone

Vietnam’s record trade turnover has wide-ranging economic implications:

-

Strengthens GDP growth and industrial output

-

Supports employment in manufacturing and trade

-

Enhances foreign exchange stability

-

Elevates Vietnam’s position in global trade rankings

In 2025, Vietnam ranked among the top 15 trading nations globally, an extraordinary achievement for a middle-income economy.

Outlook: Can Vietnam Sustain Trade Growth?

Looking ahead, Vietnam’s ability to sustain trade growth will depend on:

-

Moving up the value chain in manufacturing

-

Increasing domestic content in exports

-

Developing supporting industries

-

Expanding green and digital trade capabilities

If structural reforms continue and global demand remains stable, Vietnam’s trade turnover could approach or exceed $1 trillion within the next few years.

Conclusion and Final Verdict

In conclusion, Vietnam’s $930.05 billion trade turnover in 2025 is more than a record-breaking statistic. It is evidence of a profound economic transformation driven by manufacturing, foreign investment, & deep global integration. While challenges remain, the data clearly show that Vietnam has emerged as one of the most dynamic trading economies in the world. This milestone signals not only Vietnam’s success in global trade but also the scale of opportunity and responsibility that comes with being a central node in international supply chains.

We hope that you liked our data-driven and insightful blog report on the Vietnam trade turnover 2025. For more information on the latest Vietnam trade data, or to search live Vietnam import-export data by country or product, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports and market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0