Latest Vietnam Wood Export Data: Vietnam Wood Exports Hit a Record $17 Billion in 2025

Vietnam wood exports reached a record $17 billion in 2025. Access updated export data, key markets, product trends, and trade analysis.

Vietnam’s wood and wood products industry reached a historic turning point in 2025. For the first time, export revenue crossed the record $17 billion mark, cementing Vietnam’s position as one of the world’s most important wood-exporting nations, as per the Vietnam customs export data of wood. This milestone was achieved despite a difficult global environment marked by slowing consumer demand, higher interest rates, tightening environmental regulations, and rising geopolitical uncertainty.

Vietnam is the 7th largest wood exporter in the world, as per the global trade data. What makes this achievement particularly notable is not just the number itself, but how Vietnam reached it. Growth came from a mix of expanding market share in key destinations, deeper penetration into high-value segments like furniture, improved production efficiency, and a gradual shift toward more sustainable and traceable supply chains.

This article provides a deep, data-driven analysis of Vietnam’s 2025 wood export performance, including market breakdowns, product structures, growth drivers, risks, and what lies ahead for the industry.

Vietnam Wood Exports in 2025: The Big Picture

In 2025, Vietnam’s total wood and wood product exports accounted for $17.2 billion, representing a year-on-year increase of nearly 6 percent compared with 2024, as per the latest Vietnam export data and Vietnam customs data. This growth came after a challenging period in 2023–2024, when global inflation and inventory corrections in major markets temporarily slowed orders.

Several indicators underline the strength of the 2025 performance:

-

Monthly export values remained consistently above $1.3 billion for most of the year

-

December alone contributed close to $1.7 billion, indicating strong year-end demand

-

Wood exports remained one of Vietnam’s top five agro-forestry export categories by value

The industry’s ability to rebound and surpass previous records reflects both structural strengths and effective short-term adaptation to market conditions.

Vietnam Wood Exports by Country: Where Does Vietnam Export Wood?

Vietnam is a significant player in the wood export industry, with a wide range of countries benefiting from its exports. Some of the top destinations for Vietnam's wood exports include the United States, Japan, China, South Korea, and the European Union. These countries rely on Vietnam for high-quality wood products like furniture, timber, and wood-based materials. The top 10 export destinations for Vietnamese wood, as per the data on Vietnam wood exports by country and Vietnam shipment data for 2025, include:

1. USA: $9.45 billion (55%)

The United States is the largest importer of wood products from Vietnam, accounting for a whopping 55% of the total export value, as per the data on Vietnam wood exports to the USA by HS code. With a strong demand for furniture, flooring, and other wood-based products, the US market offers a lucrative opportunity for Vietnamese exporters.

2. Japan: $2.15 billion (12.5%)

Japan is another key market for Vietnam's wood exports, with a substantial annual import value of $2.15 billion, as per the data on Vietnam wood exports to Japan. The demand for high-quality wood products in Japan has created a significant export opportunity for Vietnamese companies looking to expand their reach in the Asian market.

3. China: $2.05 billion (12%)

China is a major player in the global wood industry, and Vietnam has capitalized on this by exporting $2.05 billion worth of wood products to its neighbor. With a rapidly growing economy and a strong demand for wood products, China offers a lucrative market for Vietnamese exporters.

4. South Korea: $700 million (4%)

South Korea is a significant importer of wood products from Vietnam, with an annual import value of $700 million. The Korean market offers a diverse range of opportunities for wood exporters, including furniture, construction materials, and decorative items.

5. Canada: $290 million (1.7%)

Canada is a key market for Vietnamese wood exporters, with an annual export value of $290 million. The demand for sustainable and eco-friendly wood products in Canada has created opportunities for Vietnamese companies to showcase their products in the North American market.

6. United Kingdom: $240 million (1.4%)

The United Kingdom is a prominent destination for Vietnam's wood exports, with a yearly import value of $240 million. The demand for high-quality wood products in the UK has created opportunities for Vietnamese exporters to establish a strong presence in the European market.

7. Germany: $220 million (1.3%)

Germany is a significant importer of wood products from Vietnam, with an annual import value of $220 million. The German market offers opportunities for Vietnamese exporters to cater to the demand for sustainable and innovative wood products in Europe.

8. India: $196 million (1.1%)

India is a growing market for Vietnam's wood exports, with an annual export value of $196 million. The Indian market offers opportunities for Vietnamese exporters to tap into the demand for unique and exotic wood products in South Asia.

9. Netherlands: $0.180 million (1%)

The Netherlands is a small but significant market for Vietnam's wood exports, with an annual import value of $0.180 million. The Dutch market offers opportunities for Vietnamese exporters to showcase their high-quality wood products in Europe.

10. Malaysia: $145 million (0.8%)

Malaysia is an emerging market for Vietnam's wood exports, with an annual export value of $145 million. The Malaysian market offers opportunities for Vietnamese exporters to tap into the demand for sustainable and innovative wood products in Southeast Asia.

Detailed Insights Into Major Vietnam Wood Export Markets

United States: The Anchor Market

The United States remained Vietnam’s most important export destination for wood and wood products in 2025, accounting for around 55 percent of total export value.

Key figures for the U.S. market include:

-

Export value of approximately $9.4–9.5 billion

-

Strong growth in wooden furniture imports, particularly bedroom, living room, and outdoor furniture

-

Rising market share as imports from competing suppliers declined

Vietnam’s competitive advantage in the U.S. market is driven by several factors. First, Vietnamese manufacturers have built large-scale production capacity capable of handling high-volume orders with consistent quality. Second, many buyers have diversified sourcing away from China due to tariff exposure and supply chain risk, benefiting Vietnam directly.

By 2025, Vietnam accounted for nearly half of total U.S. wooden furniture imports, a dramatic shift compared with just a decade earlier. This dominance positions Vietnam not merely as a substitute supplier, but as the core pillar of U.S. furniture imports.

Japan: A High-Value Growth Market

Japan emerged as Vietnam’s second-largest wood export destination in 2025, with export value reaching around $2.15 billion, marking growth of over 20 percent year-on-year.

Japan’s importance lies not just in volume, but in value and stability:

-

Japanese buyers emphasize precision, quality, and long-term supplier relationships

-

Demand is strong for interior furniture, housing components, and finished wooden products

-

Orders tend to be less volatile than those from Western markets

Vietnam’s success in Japan reflects improvements in manufacturing standards, product design, and compliance with strict technical requirements. For many Vietnamese exporters, Japan represents a strategic market that supports stable margins rather than rapid volume expansion.

China: A Strategic but Slower-Growing Market

China ranked third among Vietnam’s wood export destinations, with exports valued at just over $2 billion in 2025. Compared with the U.S. and Japan, growth in the Chinese market was more moderate. This is partly due to:

-

Slower recovery in China’s real estate and construction sectors

-

Increased domestic supply competition

-

Shifts in China’s import demand toward raw and semi-processed wood rather than finished furniture

Nevertheless, China remains strategically important. It absorbs large volumes of wood chips, sawn wood, and intermediate products, helping Vietnam balance its export portfolio and maintain throughput during demand fluctuations elsewhere.

Other Markets: Expanding the Global Footprint

Beyond the top three markets, Vietnam exported wood products to more than 160 countries in 2025. Notable secondary markets included:

-

South Korea, with exports approaching $700 million

-

Canada, exceeding $280 million

-

The United Kingdom, around $240 million

While individually smaller, these markets collectively contribute to risk diversification and provide opportunities for niche and premium products.

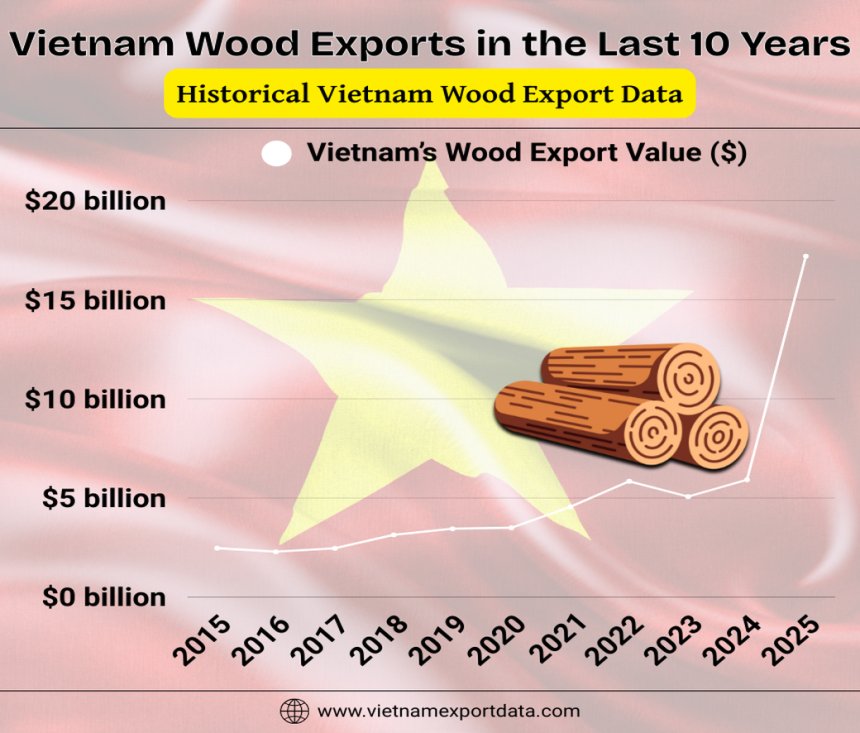

Vietnam Wood Exports in the Last 10 Years: Historical Vietnam Wood Export Data

|

Year of Exports |

Vietnam’s Wood Export Value ($) |

|

2015 |

$2.47 billion |

|

2016 |

$2.29 billion |

|

2017 |

$2.46 billion |

|

2018 |

$3.14 billion |

|

2019 |

$3.45 billion |

|

2020 |

$3.50 billion |

|

2021 |

$4.55 billion |

|

2022 |

$5.84 billion |

|

2023 |

$5.07 billion |

|

2024 |

$5.92 billion |

|

2025 |

$17.20 billion |

Product Structure: What Vietnam Is Exporting

Vietnam’s $17 billion export figure is supported by a diversified product mix, ranging from finished furniture to industrial wood materials.

Wooden Furniture: The Core Driver

Wooden furniture continued to dominate exports, accounting for approximately 60–62 percent of total export value.

In absolute terms:

-

Vietnam Furniture exports exceeded $9.5 billion in 2025

-

Growth was strongest in indoor furniture, followed by outdoor and garden furniture

-

Demand was driven by home renovation, hospitality projects, and e-commerce retail

Vietnam’s furniture industry benefits from vertically integrated clusters, particularly in provinces such as Binh Duong, Dong Nai, and Binh Dinh. These clusters allow manufacturers to control quality, manage costs, and respond quickly to buyer requirements.

Wood Chips and Raw Materials

Wood chips remained a significant export category, generating over $2.2 billion in revenue.

Although less value-added than furniture, wood chips play an important role:

-

They provide stable demand for plantation timber

-

They support rural incomes and forestry development

-

They help balance utilization of forest resources

Japan and China are the primary destinations for wood chips, mainly for pulp and paper production.

Sawn Wood, Panels, and Flooring

Processed wood products such as sawn timber, plywood, MDF, and wooden flooring contributed around $2.1 billion in export revenue.

Growth in this segment reflects:

-

Rising global demand for prefabricated and modular construction materials

-

Increased use of engineered wood products

-

Vietnam’s improving processing technology and consistency

Wood Pellets: A Growing Energy Segment

Wood pellet exports reached approximately $1.08 billion in 2025, driven by bioenergy demand in Asia and parts of Europe.

This segment is expected to grow further as countries seek renewable energy alternatives, though it faces scrutiny over sustainability and resource efficiency.

Key Growth Drivers Behind the 2025 Record

1. Market Share Gains Rather Than Market Expansion

One of the most important factors behind Vietnam’s growth is market share capture, especially in the U.S. Vietnam did not rely solely on rising global demand; instead, it replaced other suppliers in key markets.

This shift was enabled by:

-

Competitive pricing

-

Reliable delivery schedules

-

Large-scale production capacity

-

Improved compliance with buyer standards

2. Upgrading Along the Value Chain

Over the past decade, Vietnam’s wood industry has moved steadily from simple processing to higher value-added manufacturing.

Key improvements include:

-

In-house design capabilities

-

Use of automated and semi-automated machinery

-

Better finishing, packaging, and branding

These upgrades helped exporters command higher unit prices and reduce reliance on low-margin products.

3. Trade Agreement Advantages

Preferential tariffs under multiple free trade agreements enhanced Vietnam’s competitiveness in markets such as Canada, Japan, and parts of Asia-Pacific. While tariffs alone do not guarantee success, they improve price positioning and reduce barriers to entry for Vietnamese suppliers.

4. Supply Chain Adaptation

Despite limited domestic timber resources, Vietnam has optimized its supply chains by:

-

Combining domestic plantation wood with imported logs

-

Improving trade efficiency

-

Building stronger links between forest owners, processors, and exporters

This flexibility allowed the industry to maintain output even when raw material prices fluctuated.

Challenges and Structural Risks

Sustainability and Traceability Pressure

Global buyers are demanding stronger proof of legal and sustainable sourcing. Compliance now requires:

-

Full traceability from forest to finished product

-

Certification systems

-

Digital record-keeping and audits

For large exporters, this is manageable. For smaller firms, it represents a major cost and operational challenge.

Raw Material Constraints

Vietnam still lacks sufficient large-diameter timber for high-end furniture production. Dependence on imported logs exposes the industry to:

-

Price volatility

-

Currency risks

-

Supply disruptions

Financial Pressure on SMEs

Many small and medium enterprises operate on thin margins. Rising costs for labor, energy, and compliance threaten profitability, particularly for firms unable to scale or differentiate.

Global Economic Uncertainty

Weak consumer confidence, geopolitical tensions, and shipping disruptions remain ongoing risks that could affect demand in key markets.

Outlook for 2026 and Beyond

Looking ahead, Vietnam’s wood industry is expected to pursue growth that is slower but more sustainable.

Key priorities include:

-

Expanding value-added production

-

Investing in sustainable forestry

-

Strengthening SME capabilities

-

Diversifying export markets

While surpassing $17 billion again will depend on external conditions, the industry has clearly moved into a new phase of maturity and global relevance.

Conclusion and Final Thoughts

In conclusion, Vietnam’s achievement of $17 billion in wood and wood product exports in 2025 marks a defining moment for the industry. It demonstrates not only resilience in the face of global headwinds, but also the success of long-term structural improvements in production, market positioning, and value creation.

The challenges ahead are real, particularly around sustainability and resource constraints. However, if Vietnam continues to invest in higher value, stronger compliance, and smarter market diversification, its wood industry is well positioned to remain a global leader for years to come.

For more insights into the latest Vietnam import-export data, or to search live data on Vietnam wood exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customised trade reports, market insights, and a verified database of the top wood exporters & suppliers in Vietnam, as per your requirements.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0