What the Vietnam-Mercosur Trade Talks Mean for Global Trade: From $11 Billion Trade to a Preferential Agreement

Vietnam & Mercosur launch PTA talks to expand an $11B trade relationship, signaling deeper South–South cooperation & reshaping global trade dynamics.

When Vietnam and Mercosur announced the launch of negotiations toward a Preferential Trade Agreement (PTA), it did not make global headlines the way mega-deals like the CPTPP or the EU-Mercosur agreement once did. Yet beneath the surface, this move carries quiet but meaningful implications for global trade, emerging-market cooperation, and supply-chain restructuring. According to the latest Vietnam import data, the total value of Vietnam imports from Mercosur bloc reached $9.13 billion in 2024, a 3% increase from the previous year. According to the Vietnam export data, the total value of Vietnam exports to Mercosur bloc reached $3.38 billion in 2024, a 1% decline from the previous year. The total value of Vietnam-Mercosur trade accounted for a record high of $12.51 billion in 2024 and $11.46 billion in the first 11 months of 2025, as per the Vietnam customs data & Mercosur trade data.

At first glance, Vietnam and Mercosur may appear like distant partners with limited overlap. One sits at the heart of Southeast Asia’s manufacturing boom; the other anchors South America’s agricultural and commodity exports. But that distance is precisely what makes these talks significant. The negotiations reflect a broader shift in global trade data. Emerging economies are increasingly building direct links with one another rather than relying solely on traditional North-South trade routes.

This blog explores what the Vietnam–Mercosur trade talks really mean. It looks beyond the headlines to examine the data, the economic logic, and the strategic motivations behind a deal that aims to transform an $11-billion trade relationship into a structured preferential framework.

Vietnam & MERCOSUR Launch Talks for Preferential Trade Agreement

At the 67th MERCOSUR Summit held in Brazil on December 20 (Vietnam time), the Southern Common Market, which includes Argentina, Brazil, Paraguay, and Uruguay, issued a joint statement formally announcing the launch of negotiations for a Vietnam–MERCOSUR Preferential Trade Agreement. The announcement was made shortly after the opening remarks by Brazilian President Luiz Inácio Lula da Silva, when Brazilian Foreign Minister Mauro Vieira confirmed that the two sides would begin PTA negotiations in the near future and described Vietnam as an important economic partner for the bloc. The summit brought together the presidents of all four MERCOSUR member states, underscoring the political weight behind the decision and signaling a shared commitment to deepening trade and economic ties between Vietnam and South America.

Preparatory work has been underway since September 2025, when Vietnam and MERCOSUR negotiating teams held multiple meetings to agree on the scope, approach, and roadmap for the talks. Both sides are now finalizing the Terms of Reference, which will form the basis for the first negotiation round planned for early 2026. Brazilian officials noted that announcing the negotiations during Brazil’s rotating presidency highlights the value placed on long-standing bilateral relations and leadership-level cooperation. As of the end of November 2025, total trade between Vietnam and MERCOSUR stood at $11.46 billion, roughly unchanged from the same period a year earlier, indicating both a solid foundation and significant room for expansion under a future agreement.

Understanding the Players: Vietnam and Mercosur in the Global Economy

Vietnam’s Trade Profile

Vietnam has become one of the most trade-dependent economies in the world. Total trade value regularly exceeds 180 percent of its GDP, driven by export-oriented manufacturing and deep integration into global supply chains.

Key features of Vietnam’s trade model include:

-

Strong export specialization in electronics, machinery, textiles, footwear, and furniture

-

Heavy participation in regional and global value chains

-

A deliberate strategy of signing multiple trade agreements to secure market access and hedge geopolitical risk

Vietnam already has free trade agreements or preferential arrangements with most major economic blocs, including ASEAN, the European Union, several Asia-Pacific partners, and large individual economies. What it lacks, until now, is meaningful preferential access to South America.

Mercosur’s Economic Structure

Mercosur is composed of Argentina, Brazil, Paraguay, and Uruguay. Collectively, the bloc represents:

-

Over 270 million people

-

A combined GDP exceeding $2 trillion

-

A dominant position in global agricultural and commodity markets

Mercosur economies are heavily export-oriented in:

-

Soybeans, corn, beef, poultry, sugar, and coffee

-

Iron ore, steel, energy, and related industrial inputs

However, Mercosur’s integration into Asian markets remains uneven. While China is a major destination, trade with Southeast Asia beyond China is still underdeveloped. Vietnam stands out as a fast-growing, complementary market.

The Numbers: From Modest Trade to Strategic Scale

Current Trade Volume

Bilateral trade between Vietnam and Mercosur has reached approximately $11–12 billion annually, depending on commodity cycles and exchange rates.

The structure of this trade is asymmetrical:

-

Vietnam imports significantly more from Mercosur than it exports

-

Imports are dominated by agricultural commodities and raw materials

-

Exports from Vietnam are mainly manufactured goods

Vietnam’s imports from Mercosur include:

-

Animal feed and soybeans

-

Corn and wheat

-

Beef and other agricultural products

-

Iron and steel inputs

Vietnam’s exports to Mercosur typically include:

-

Electronics and consumer devices

-

Machinery and mechanical parts

-

Textiles, garments, and footwear

-

Processed food products

Despite growth in recent years, this trade remains well below potential, especially given the size of both economies.

Why a Preferential Trade Agreement Instead of a Full FTA?

The decision to pursue a Preferential Trade Agreement, rather than a comprehensive Free Trade Agreement, is strategic.

A PTA typically includes:

-

Partial tariff reductions rather than full elimination

-

Focus on priority goods rather than all sectors

-

More flexible timelines and narrower regulatory commitments

For Vietnam and Mercosur, this approach makes sense for several reasons.

1. Managing Sensitivity in Agriculture and Industry

Agriculture is politically sensitive in both regions. Mercosur’s farmers are globally competitive, whereas Vietnam has a large rural population that is dependent on domestic production. A PTA allows selective liberalization rather than an all-or-nothing approach.

2. Lower Negotiation Costs and Faster Implementation

Full FTAs can take a decade or more to negotiate and ratify. A PTA enables both parties to deliver tangible benefits more quickly, which is crucial in a volatile global environment.

3. Testing Economic Complementarity

A PTA serves as a “proof of concept.” If trade expands smoothly and political resistance remains manageable, the agreement can later be upgraded.

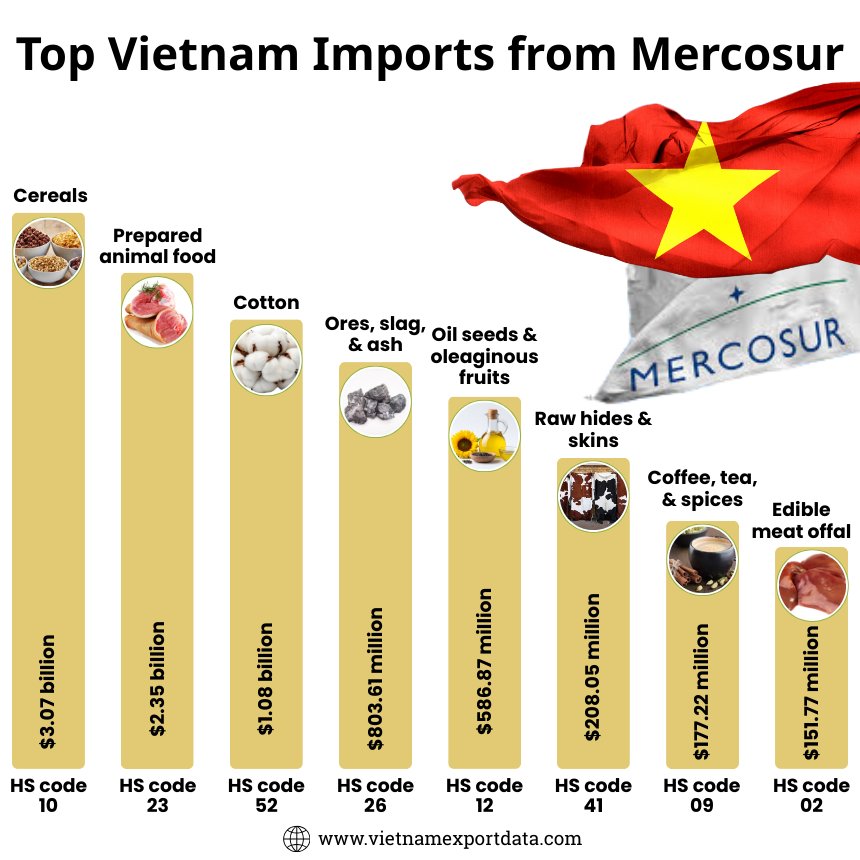

Top Vietnam Imports from Mercosur: What Does Vietnam Import from the Mercosur Bloc?

Vietnam holds a significant trade relationship with the Mercosur bloc, importing various goods and services. Some of the top imports from Mercosur into Vietnam include agricultural products like soybeans and corn, machinery, chemicals, and iron and steel products. The exchange between Vietnam and the Mercosur bloc showcases the mutually beneficial trade partnership that exists between the two regions. The top 10 goods that Vietnam imports from Mercosur, as per the Vietnam import statistics & Mercosur-Vietnam trade data for 2024-25, include:

1. Cereals (HS code 10): $3.07 billion

One of the top imports from Mercosur to Vietnam is cereals, with a total value of $3.07 billion. Cereals are an essential commodity for Vietnam, and the country relies heavily on imports to meet its domestic demand. Argentina and Brazil are the main suppliers of cereals to Vietnam, with products such as wheat, corn, and rice being the most commonly imported, as per the customs data on Vietnam corn imports from Argentina by HS code.

2. Prepared animal food (HS code 23): $2.35 billion

Prepared animal food is another significant import category for Vietnam, with a total value of $2.35 billion. These products are essential for the livestock industry in Vietnam, as they help in providing the necessary nutrition for animals. Mercosur countries are known for their high-quality animal feed, which is why Vietnam imports a large quantity from this region.

3. Cotton (HS code 52): $1.08 billion

Vietnam is one of the largest producers of textiles and garments in the world, making cotton a crucial import for the country. With a total import value of $1.08 billion, cotton is sourced mainly from Mercosur countries like Brazil and Argentina. The high-quality cotton produced in these countries is preferred by Vietnamese manufacturers for its durability and versatility.

4. Ores, slag, & ash (HS code 26): $803.61 million

Vietnam's growing industrial sector requires a steady supply of raw materials like ores, slag, and ash. With an import value of $803.61 million, these products are vital for the production of steel, cement, and other construction materials. Mercosur countries have extensive reserves of these raw materials, making them a natural choice for Vietnam's imports.

5. Oil seeds & oleaginous fruits (HS code 12): $586.87 million

Oil seeds and oleaginous fruits are essential for Vietnam's food and beverage industry, with a total import value of $586.87 million. These products are used in cooking oils, margarine, and other food products consumed in Vietnam. Mercosur countries like Argentina and Brazil are major exporters of oil seeds, providing a reliable source for Vietnam's imports.

6. Raw hides & skins (HS code 41): $208.05 million

Vietnam's leather industry relies on imports of raw hides and skins, with a total import value of $208.05 million. These products are essential for producing leather goods, footwear, and other fashion accessories. Mercosur countries supply high-quality hides and skins, making them a preferred source for Vietnam's imports.

7. Coffee, tea, & spices (HS code 09): $177.22 million

Vietnam is known for its coffee production, but the country also imports coffee, tea, and spices from Mercosur countries. With a total import value of $177.22 million, these products are in high demand in Vietnam's vibrant food and beverage industry. The rich flavors and aromas of Mercosur coffee and spices make them popular imports in Vietnam.

8. Meat & edible meat offal (HS code 02): $151.77 million

As Vietnam's middle class grows, so does the demand for high-quality meat products. With an import value of $151.77 million, meat and edible meat offal are important imports from Mercosur countries. Argentina and Brazil are known for their high-quality beef and poultry products, which are favored by Vietnamese consumers.

9. Tobacco (HS code 24): $145.22 million

Tobacco products are another significant import for Vietnam, with a total value of $145.22 million. Mercosur countries like Brazil are major exporters of tobacco, providing a variety of products for Vietnam's tobacco industry. Despite health concerns, tobacco remains a popular product in Vietnam, driving demand for imports from Mercosur.

10. Wood & articles of wood (HS code 44): $111.97 million

Lastly, Vietnam imports wood and articles of wood from Mercosur countries, with a total value of $111.97 million. These products are essential for Vietnam's furniture and construction industries, as well as for producing paper and packaging materials. Mercosur countries offer a wide variety of high-quality wood products, making them a prominent source for Vietnam's imports.

Top Vietnam Exports to Mercosur: What Does Vietnam Export to the Mercosur Bloc?

Top Vietnam exports to Mercosur primarily consist of electronic products, textiles, footwear, and machinery. Vietnam has established itself as a leading exporter of these goods to the Mercosur bloc due to its competitive pricing, quality, and reliability. The electronics sector, including items like smartphones and computers, remains a significant contributor to Vietnam's exports to Mercosur countries. The top products that Vietnam exports to the Mercosur trade bloc, as per the Vietnam shipment data for 2024-25, include:

1. Electrical Machinery & Equipment (HS code 85): $1.45 billion

Electrical machinery and equipment are among the top exports from Vietnam to the Mercosur bloc, with a total value of $1.45 billion. These products include items such as electrical transformers, electrical capacitors, and electrical resistors, which are essential for various industries in Mercosur countries. Vietnam exports the most electronics to Brazil among Mercosur members, as per the data on Vietnam electronics exports to Brazil by HS code.

2. Footwear (HS code 64): $353.74 million

Vietnam is well-known for its footwear industry, and it is no surprise that this product category features prominently in exports to Mercosur. With a value of $353.74 million, Vietnamese footwear, including shoes, sandals, and slippers, is in high demand in Mercosur markets.

3. Rubber & Articles Thereof (HS code 40): $341.40 million

Rubber and articles made from rubber are another significant export category for Vietnam to Mercosur, with a total value of $341.40 million. These products include items such as tires, tubes, and rubber sheets, which are crucial for various industries in Mercosur countries.

4. Nuclear Reactors & Machinery (HS code 84): $251.14 million

Vietnam also exports nuclear reactors and machinery to Mercosur, with a total value of $251.14 million. These products, which include parts for nuclear reactors, steam turbines, and engines, play a vital role in the energy sector of Mercosur countries.

5. Iron & Steel (HS code 72): $211.22 million

Iron and steel products from Vietnam are in demand in Mercosur markets, with a total export value of $211.22 million. These products, including iron bars, rods, and steel structures, are essential for construction and manufacturing industries in Mercosur countries.

6. Fish & Seafood (HS code 03): $137.85 million

Vietnam's fish and seafood exports to Mercosur amount to $137.85 million, making it a significant player in this category. With a wide variety of products, including fish fillets, shrimp, and squid, Vietnam meets the seafood demands of Mercosur consumers.

7. Plastics & Articles Thereof (HS code 39): $81.95 million

Plastics and articles made from plastics are also key exports from Vietnam to Mercosur, with a total value of $81.95 million. These products, such as plastic bags, containers, and packaging materials, serve various industries in Mercosur countries.

8. Articles of Apparel, Not Knitted (HS code 62): $64.25 million

Vietnam's apparel exports, which include non-knitted clothing items, are valued at $64.25 million in Mercosur markets. These products, such as dresses, suits, and jackets, cater to the fashion needs of Mercosur consumers.

9. Vehicles (HS code 87): $63.55 million

Vehicles and automotive parts from Vietnam have a total export value of $63.55 million in the Mercosur bloc. This category includes motor vehicles, bicycles, and parts thereof, meeting the transportation needs of Mercosur countries.

10. Articles of Apparel, Knitted (HS code 61): $35.71 million

Lastly, knitted apparel items from Vietnam have a total export value of $35.71 million in Mercosur markets. These products, such as sweaters, T-shirts, and socks, are popular among consumers in Mercosur countries.

Top Trade Partners of Vietnam in the Mercosur Trading Bloc

|

Top Import Partners |

Value ($) |

Top Export Partners |

Value ($) |

|

1. Brazil |

$5.36 billion |

1. Brazil |

$2.59 billion |

|

2. Argentina |

$3.58 billion |

2. Argentina |

$515.67 million |

|

3. Paraguay |

$117.77 million |

3. Paraguay |

$115.44 million |

|

4. Uruguay |

$60.26 million |

4. Uruguay |

$109.02 million |

|

5. Venezuela |

$5.76 million |

5. Venezuela |

$49.78 million |

Vietnam-Mercosur Trade Data in the Last 10 Years

|

Year of Trade |

Vietnam-Mercosur Trade Value ($) |

|

2015 |

$6.60 billion |

|

2016 |

$6.27 billion |

|

2017 |

$7.10 billion |

|

2018 |

$7.48 billion |

|

2019 |

$8.90 billion |

|

2020 |

$8.88 billion |

|

2021 |

$11.08 billion |

|

2022 |

$12.08 billion |

|

2023 |

$10.90 billion |

|

2024 |

$12.51 billion |

|

2025 (first 11 months) |

$11.46 billion |

Economic Logic: Why the Two Sides Fit

Complementary Trade Structures

Vietnam and Mercosur are not direct competitors in most sectors. Instead, their economies fit together in a classic complementary pattern.

-

Mercosur supplies land-intensive agricultural products and raw materials

-

Vietnam specializes in labor-intensive and technology-assisted manufacturing

This reduces the risk of disruptive competition while maximizing gains from specialization.

Vietnam’s Demand for Agricultural Inputs

Vietnam’s industrial and agricultural expansion has sharply increased demand for:

-

Animal feed for livestock and aquaculture

-

Grains for food processing

-

Industrial inputs for manufacturing

Mercosur is among the world’s most efficient producers of these goods. Preferential tariffs could lower costs for Vietnamese producers, improving competitiveness downstream.

Mercosur’s Access to Asian Manufacturing

Mercosur countries face relatively high tariffs on manufactured imports. Cheaper Vietnamese goods can help:

-

Reduce consumer prices

-

Support industrial upgrading

-

Provide alternatives to imports from a small number of dominant suppliers

Strategic Motivations Beyond Economics

Trade agreements are rarely just about tariffs. The Vietnam–Mercosur talks are deeply shaped by global strategic trends.

Diversification Away from Over-Concentration

Both Vietnam and Mercosur are highly exposed to a limited number of major trading partners.

-

Vietnam relies heavily on the United States, China, and the EU

-

Mercosur is deeply dependent on China and a few Western markets

A PTA strengthens resilience by spreading trade risk across regions.

South–South Trade as a Structural Shift

This agreement reflects a growing trend toward South–South cooperation. Emerging economies are no longer content to act only as suppliers to advanced markets. They are actively building networks among themselves.

This matters because:

-

South–South trade tends to grow faster than global trade averages

-

It often involves higher value-added over time

-

It reshapes global trade governance away from traditional centers

Strategic Autonomy in a Fragmenting World

Global trade is becoming more fragmented due to geopolitical rivalry, sanctions, and industrial policy. Countries like Vietnam and Mercosur members are seeking strategic autonomy without isolation.

A PTA gives both sides:

-

More bargaining power in other negotiations

-

Reduced vulnerability to unilateral trade measures

-

Greater flexibility in navigating geopolitical tensions

Potential Economic Gains: What the Data Suggests

Trade Expansion Effects

Even modest tariff reductions can produce meaningful trade gains when applied to large commodity volumes. Simulation models for similar PTAs suggest:

-

Trade growth of 10–20 percent in covered sectors within five years

-

Faster growth in exports from the smaller or more diversified economy, in this case, Vietnam

If bilateral trade grows at even 8 percent annually, total trade could approach $17–18 billion within a decade.

Price and Cost Effects

Lower tariffs on agricultural imports could reduce input costs for Vietnamese processors and exporters. That effect ripples through:

-

Food processing

-

Aquaculture

-

Livestock and poultry production

On the Mercosur side, cheaper manufactured imports can reduce inflationary pressure and improve consumer welfare.

Investment Spillovers

Trade agreements often lead to investment flows that exceed trade gains. Firms invest in:

-

Secure supply chains

-

Establish local distribution

-

Take advantage of preferential rules of origin

Vietnam could emerge as a processing hub for Mercosur inputs, while South American firms may invest in trade and storage infrastructure linked to Asian trade.

Global Implications: Why the World Should Pay Attention

The Vietnam–Mercosur talks may be bilateral, but their implications are global.

A Signal to Other Emerging Economies

If successful, this PTA sends a signal that emerging economies can negotiate pragmatic, mutually beneficial trade deals without waiting for large multilateral breakthroughs.

Pressure on Traditional Trade Architecture

As more countries pursue targeted PTAs, the role of mega-agreements and traditional trade powers may gradually decline in relative importance.

Reinforcing Multipolar Trade

This agreement contributes to a more multipolar trade system where influence is dispersed across regions rather than concentrated in a few hubs.

What Comes Next

Negotiations are expected to unfold in phases, starting with:

-

Identification of priority sectors

-

Agreement on tariff reduction schedules

-

Trade facilitation measures

Early success will depend on keeping expectations realistic and focusing on areas of clear mutual gain.

Over time, the PTA could expand to include:

-

Deeper tariff cuts

-

Investment cooperation

-

Possibly services and digital trade

Conclusion: A Quiet Deal with Loud Implications

In conclusion, the Vietnam–Mercosur trade talks may not dominate headlines, but they represent an important shift in how global trade is evolving. Moving from an $11-billion transactional relationship to a structured preferential agreement reflects growing confidence among emerging economies to shape their own trade futures. This is not a revolutionary agreement. It is incremental, pragmatic, and selective. And that is precisely why it matters. In a world of uncertainty, fragmentation, and stalled mega-deals, such agreements may define the next phase of global trade more than grand, sweeping accords.

For businesses, policymakers, and analysts, Vietnam–Mercosur is worth watching not because of its size today, but because of what it signals about where global trade is heading tomorrow.

We hope that you liked our data-driven and insightful blog report on the Vietnam-Mercosur preferential trade agreement 2025. For more information on the latest Vietnam trade data, or to search live Vietnam import-export data by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports and market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0