Vietnam-Canada Trade Relations: Top Vietnam Exports to Canada & Free Trade Agreement Insights

Vietnam–Canada trade relations in 2025 explained with data insights, top Vietnam exports to Canada, CPTPP impact, trends, & future opportunities.

Vietnam–Canada trade relations have moved from a peripheral partnership to a strategically important economic corridor. In recent years, Vietnam has become Canada’s largest trading partner in ASEAN and one of Canada’s top global sources of imported manufactured goods. At the same time, Canada has emerged as a stable, high-income export destination for Vietnamese producers seeking diversification beyond traditional Asian, U.S., and EU markets. According to the latest Vietnam export data and Canada import data, the total value of Vietnam exports to Canada reached $6.36 billion in 2024, a 3% increase from the previous year. The total Vietnam-Canada trade value reached $7.21 billion in 2024-25, as per the Vietnam customs data. In the first three quarters of 2025, the total trade value between Vietnam and Canada reached $6.35 billion, fueled by electronics & textiles.

This growth has not been accidental. It is the result of structural changes in global supply chains, Vietnam’s rapid industrial upgrading, and, most importantly, the implementation of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Together, these forces have reshaped bilateral trade flows, export composition, and long-term commercial prospects. Vietnam is one of Canada's top trading partners in both the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Association of Southeast Asian Nations (ASEAN).

This article provides a deep, data-driven analysis of Vietnam–Canada trade relations in 2025, focusing on export performance, sectoral trends, trade agreement impacts, and future opportunities.

Overview of Vietnam–Canada Trade Relations in 2025

Rapid Growth Over the Last Decade

Vietnam–Canada trade has grown at one of the fastest rates among Canada’s Asian trading partners. In the mid-2010s, bilateral merchandise trade was valued at less than USD 5 billion annually. By 2025, total two-way trade is estimated to exceed USD 14–15 billion, with Vietnam accounting for the overwhelming majority of exports. Vietnam and Canada look to double trade in the next decade as well.

Vietnam consistently records a large trade surplus with Canada. Vietnamese exports to Canada now exceed USD 6 billion annually, according to Vietnam customs export data, while Canada’s exports to Vietnam remain below USD 5 billion. This imbalance reflects Vietnam’s role as a manufacturing and export hub and Canada’s role as a high-consumption market.

Vietnam’s Strategic Position in Canada’s Trade Policy

By 2025:

-

Vietnam is Canada’s largest import partner in ASEAN

-

Vietnam ranks among Canada’s top 10 global sources of merchandise imports

-

Nearly half of Canada’s imports from Southeast Asia originate in Vietnam

Canada’s Indo-Pacific Strategy explicitly identifies Vietnam as a priority partner due to its large population, robust manufacturing base, political stability, and integration into global trade frameworks.

Top Goods Vietnam Exports to Canada: What Does Vietnam Export to Canada?

Vietnam's exports to Canada cover a diverse range of goods, showcasing the strong economic ties between the two nations. Some of the top goods that Vietnam exports to Canada include electronics, footwear, textiles, seafood, and furniture. These products not only reflect Vietnam's skilled workforce and manufacturing capabilities but also cater to the Canadian market's demand for quality and affordable goods. Vietnam’s exports to Canada are diversified but remain heavily concentrated in manufactured consumer and industrial goods. The top 10 products that Vietnam exports to Canada, as per the Vietnam shipment data for 2025, include:

1. Electrical Machinery & Equipment (HS Code 85): $1.61 Billion

One of the top goods that Vietnam exports to Canada is electrical machinery and equipment, as per the data on Vietnam electronics exports to Canada by HS code. This category includes a wide range of products such as electrical appliances, telecommunication equipment, and electronic components. The total export value of this category amounts to a whopping $1.61 billion, making it one of the most significant contributors to Vietnam's trade with Canada.

2. Nuclear Reactors & Machinery (HS Code 84): $820.12 Million

Nuclear reactors and machinery are another key export category for Vietnam when it comes to trade with Canada. With an export value of $820.12 million, this category plays a crucial role in strengthening the economic ties between the two countries. These exports include various nuclear parts, reactors, and machinery components.

3. Articles of Apparel, Not Knitted (HS Code 62): $601.72 Million

Vietnam is also a significant exporter of articles of apparel that are not knitted to Canada. With a total export value of $601.72 million, this category includes products like clothing, suits, and dresses made from woven fabrics. The demand for Vietnamese apparel in Canada has been steadily increasing, leading to the growth of this export category.

4. Articles of Apparel, Knitted (HS Code 61): $600.61 Million

In addition to non-knitted apparel, Vietnam also exports a substantial amount of knitted apparel to Canada. This category includes items like sweaters, t-shirts, and knitwear made from various fabrics. With an export value of $600.61 million, knitted apparel is a significant contributor to Vietnam's exports to Canada.

5. Footwear (HS Code 64): $544.58 Million

Vietnam is renowned for its footwear industry, and Canadian consumers have shown a strong preference for Vietnamese shoes and footwear products. With an export value of $544.58 million, footwear is one of the top goods that Vietnam exports to Canada. This category includes various types of shoes, sandals, and footwear accessories.

6. Furniture, Bedding, & Mattresses (HS Code 94): $353.87 Million

Vietnam's exports of furniture, bedding, and mattresses to Canada have also been on the rise in recent years. With an export value of $353.87 million, these products include furniture items like tables, chairs, beds, and mattresses, as per the data on Vietnam furniture exports to Canada. Vietnamese furniture is known for its quality craftsmanship and unique designs, making it a popular choice among Canadian consumers.

7. Fish & Seafood (HS Code 03): $166.77 Million

Vietnam is a significant exporter of fish and seafood products to Canada, with an export value of $166.77 million. This category includes a variety of seafood items like shrimp, fish fillets, and shellfish. Vietnamese fish and seafood are known for their freshness and quality, making them highly sought after in the Canadian market.

8. Articles of Leather (HS Code 42): $156.13 Million

Articles of leather, including bags, belts, and wallets, are also among the top goods that Vietnam exports to Canada. With an export value of $156.13 million, leather products from Vietnam are known for their fine craftsmanship and durability. Canadian consumers appreciate the quality and design of Vietnamese leather goods, which have contributed to the growth of this export category.

9. Vehicles (HS Code 87): $124.80 Million

Vietnam also exports vehicles to Canada, with an export value of $124.80 million. This category includes various types of vehicles like cars, motorcycles, and bicycles. Vietnam's automotive industry has been expanding rapidly, and Canadian consumers have shown interest in Vietnamese vehicles for their affordability and quality.

10. Edible fruit & nuts (HS code 08): $113.95 million

Lastly, Vietnam exports edible fruit and nuts to Canada, with a total value of $113.95 million. This category includes a variety of fruits, such as bananas, mangoes, and coconuts, as well as nuts like cashews and almonds. Vietnamese fruits and nuts are known for their freshness and flavor, making them a favorite among Canadian consumers.

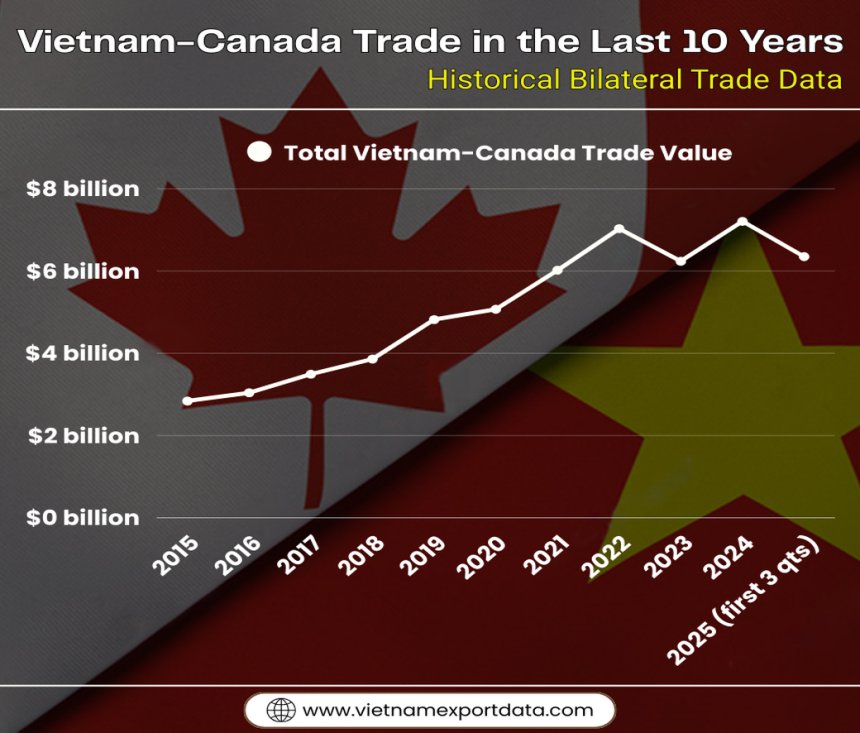

Vietnam-Canada Trade in the Last 10 Years: Historical Bilateral Trade Data

|

Year of Trade |

Total Vietnam-Canada Trade Value |

|

2015 |

$2.84 billion |

|

2016 |

$3.04 billion |

|

2017 |

$3.49 billion |

|

2018 |

$3.86 billion |

|

2019 |

$4.82 billion |

|

2020 |

$5.07 billion |

|

2021 |

$6.02 billion |

|

2022 |

$7.03 billion |

|

2023 |

$6.24 billion |

|

2024 |

$7.21 billion |

|

2025 (first 3 quarters) |

$6.35 billion |

The Role of the CPTPP in Vietnam–Canada Trade

Tariff Elimination and Market Access

The CPTPP is the single most important driver of export growth between Vietnam and Canada.

Key impacts include:

-

Elimination of tariffs on most industrial goods

-

Gradual reduction of tariffs on sensitive agricultural items

-

Simplified customs procedures

-

Improved transparency and dispute resolution mechanisms

For many Vietnamese products, tariffs that once ranged between 7 and 18 percent have been reduced to zero.

Rules of Origin: An Ongoing Challenge

Despite its benefits, CPTPP utilization remains below potential.

By 2025:

-

Only around 18–20 percent of Vietnamese exports to Canada formally use the CPTPP preferential origin certification

-

Many exporters still rely on standard MFN tariffs due to compliance complexity

Improving CPTPP utilization could significantly enhance Vietnam’s competitiveness and export margins.

Challenges in Vietnam–Canada Trade Relations

Trade Defense Measures

Canada has applied trade defense instruments such as anti-dumping duties in selected sectors. These measures require Vietnamese exporters to maintain accurate documentation and cost transparency.

Market Standards and Compliance

Canadian regulations impose strict requirements related to:

-

Product safety

-

Environmental standards

-

Labor and sustainability compliance

Failure to meet these standards can result in shipment delays or market exclusion.

Trade Hubs and Distribution Inefficiencies

A significant share of Vietnamese exports to Canada still transits through third-country distribution hubs, particularly in the United States. This increases costs and reduces the direct capture of trade benefits.

Canada’s Exports to Vietnam: A Smaller but Strategic Flow

Canada exports a narrower range of goods to Vietnam, including:

-

Agricultural commodities

-

Wood and pulp

-

Machinery and equipment

-

Food products

While smaller in value, Canadian exports to Vietnam support complementary supply chains and long-term investment ties.

Foreign Direct Investment (FDI) Linkages and Their Impact on Trade

Canada’s Investment Presence in Vietnam

Trade growth between Vietnam and Canada is increasingly supported by two-way investment flows, particularly Canadian investment into Vietnam’s manufacturing, agri-food, and clean technology sectors.

By 2025:

-

Canada ranks among the top 15 foreign investors in Vietnam

-

Canadian FDI projects are concentrated in:

-

Manufacturing and processing

-

Renewable energy

-

Agri-food processing

-

Infrastructure

While Canadian investment volume is smaller than that of countries such as South Korea or Japan, it is typically high-value, technology-oriented, and export-linked. Many Canadian firms invest in Vietnam specifically to integrate into global supply chains that serve North American markets, including Canada itself.

How FDI Reinforces Export Capacity

Canadian investment contributes to Vietnam’s export performance in several ways:

-

Technology transfer improves product quality and consistency

-

Management standards align production with Canadian regulatory requirements

-

Vertical integration shortens supply chains and reduces compliance risks

This investment-trade feedback loop strengthens Vietnam’s position as a reliable supplier and reduces friction in bilateral trade.

Sustainability, ESG, and the Future of Market Access

Rising Importance of ESG Compliance

Environmental, Social, and Governance (ESG) standards are becoming a decisive factor in Canada’s import decisions. By 2025, Canadian retailers and distributors increasingly require suppliers to demonstrate compliance with sustainability benchmarks.

Key areas of scrutiny include:

-

Carbon footprint and energy usage

-

Waste management and recycling

-

Labor standards and workplace safety

-

Supply chain transparency and traceability

Vietnamese exporters that fail to adapt risk losing access to premium segments of the Canadian market, even if they remain price-competitive.

Opportunities for Vietnamese Exporters

At the same time, ESG requirements create new opportunities:

-

Certified sustainable products can command higher prices

-

Green manufacturing can unlock long-term contracts with major Canadian buyers

-

Alignment with ESG standards improves access to CPTPP-related procurement opportunities

Sectors most affected include textiles, footwear, seafood, wood products, and electronics manufacturing. Firms that invest early in sustainability reporting and certification will be better positioned to maintain and expand market share.

Vietnam–Canada Trade as Part of a Broader Indo-Pacific Strategy

Strategic Context Beyond Bilateral Trade

Vietnam–Canada trade relations do not exist in isolation. They are embedded within broader geopolitical and economic strategies pursued by both countries.

For Canada:

-

Vietnam is a gateway to ASEAN and Indo-Pacific supply chains

-

Trade with Vietnam reduces over-reliance on single-country sourcing

-

Vietnam supports Canada’s long-term Indo-Pacific engagement goals

For Vietnam:

-

Canada offers a stable demand from a high-income market

-

Canada provides diversification beyond the U.S., China, and the EU

-

Canada serves as an entry point into North American value chains

Regional Integration Effects

Vietnam’s participation in multiple trade frameworks, including CPTPP and ASEAN-linked agreements, enhances its attractiveness as a manufacturing base for Canadian firms seeking regional scale.

As a result:

-

Vietnam is increasingly viewed not just as an exporter, but as a strategic production platform

-

Canada’s trade relationship with Vietnam is becoming more resilient to global shocks

-

Bilateral trade is shifting from transactional to structural and long-term

Outlook for Vietnam–Canada Trade in 2026

Growth Drivers

Looking ahead, key growth drivers include:

-

Expanded use of CPTPP preferences

-

Deeper supply chain integration

-

Rising Canadian demand for diversified imports

-

Increased Vietnamese capacity in high-value manufacturing

Strategic Opportunities

Vietnam can strengthen its position by:

-

Investing in compliance and certification systems

-

Moving further up the value chain

-

Developing direct distribution networks in Canada

-

Expanding into services and digital trade

Risks to Monitor

Potential risks include:

-

Global economic slowdowns

-

Protectionist trade measures

-

Increased competition from other ASEAN exporters

-

Supply chain disruptions

Conclusion and Final Words

In conclusion, the Vietnam–Canada trade relations stand as a model of how regional trade agreements, supply chain realignment, and industrial upgrading can transform bilateral commerce. Vietnam has firmly established itself as a key supplier to the Canadian market, particularly in textiles, footwear, electronics, seafood, and furniture. While challenges remain, especially in trade compliance and agreement utilization, the long-term outlook is positive. With continued reforms, deeper cooperation, and strategic use of the CPTPP, Vietnam and Canada are well-positioned to expand trade volumes, diversify exports, and strengthen their economic partnership well beyond 2025.

We hope that you liked our data-driven & interactive blog report on Vietnam-Canada trade relations & FTA insights. For more insights into the latest Vietnam import-export data, or to search live data on Vietnam exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports & market insights.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0