Vietnam-CPTPP Trade Turnover Nears $103 Billion in First 10 Months: Vietnam & CPTPP Trade Milestone 2025

Vietnam-CPTPP trade hits a record $102.8B in the first 10 months of 2025. Explore export growth, top markets, & Vietnam’s rising global trade role.

Vietnam’s trade with CPTPP partners reached a decisive moment in 2025. During the first ten months of the year, total turnover hit 102.8 billion USD, a sharp 20.6 percent rise compared with the same period the year before, as per the Vietnam import data and Vietnam export data. What makes this figure even more striking is that the ten-month total has already surpassed the full-year value of 2024, which was recorded at roughly 102.1 billion USD, itself a growth year for Vietnam, as per the Vietnam customs data.

This milestone tells a broader story. It reflects how fully Vietnam is now integrated into the Asia–Pacific and Americas trade network, how well firms are adapting to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) rules, and how the country is positioning itself as a competitive manufacturing and export hub at a time when global supply chains are shifting.

This blog goes deep into the numbers behind the Vietnam-CPTPP trade, the engines driving growth, the markets that matter most, the challenges emerging beneath the surface, and what Vietnam needs to do to turn this milestone into sustained momentum.

Vietnam-CPTPP Trade Performance at a Glance

A Look at the Ten-Month Surge

During January to October 2025:

-

Total Vietnam-CPTPP trade: 102.8 billion USD

-

Growth rate: 20.6 percent year-on-year

-

Vietnam Exports to CPTPP partners: 58.3 billion USD (up 26 percent)

-

Vietnam Imports from CPTPP partners: 44.5 billion USD (up 14.5 percent)

Exports are growing faster than imports, pushing the trade surplus with CPTPP members higher. This is consistent with the trend of 2024, when Vietnam recorded a surplus of about 9.4 billion USD, roughly double that of the previous year.

CPTPP’s Share in Vietnam’s Overall Trade

In 2024, CPTPP trade made up 13.1 percent of Vietnam’s total import-export turnover. With 2025 on track to exceed 125 billion USD in CPTPP trade by year-end, this share is expected to expand even further. That makes CPTPP one of Vietnam’s most important trading frameworks, second only to the country’s major relationships with China, the US, and the European Union.

Why CPTPP Trade Is Growing So Fast

1. Better Use of Preferential Tariffs and Origin Rules

Vietnamese exporters have learned how to work within CPTPP rules, especially the rules of origin. During the first years of implementation, only a small portion of exports qualified under CPTPP certificates of origin. In 2019, it was roughly 700 million USD, about 2 percent of the CPTPP export value.

By 2024, this figure rose to around 5 billion USD, about 8.8 percent of exports to CPTPP markets. In several sectors, particularly seafood, footwear, wood products, agricultural specialties, handbags, and bamboo/rattan goods, certification rates often surpass 40 percent and in some cases exceed 80 percent. These gains show that manufacturers have adjusted supply chains, upgraded documentation processes, and created compliance-focused production lines to satisfy origin criteria. Rules of origin were once a barrier. Now they are becoming a competitive advantage.

2. Growth of Value-Added Manufacturing

Vietnam’s export profile to CPTPP nations is now dominated by high-value processing and manufacturing. In both 2024 and 2025, the leading export categories included:

-

Machinery, equipment, and spare parts

-

Electronics and electronic components

-

Phones and phone parts

-

Computers and computer products

-

Textiles and garments

-

Footwear

-

Transport equipment

Machinery and equipment exports to CPTPP countries alone hit more than 7.1 billion USD in 2024, growing over 22 percent, as per the Vietnam machinery export data by HS code. Electronics follow a similar trajectory. This reflects Vietnam’s deeper integration into multinational production networks, especially as companies diversify supply chains away from single-country dependence.

3. Rising Consumer Demand in Key CPTPP Markets

Demand for Vietnamese goods has grown strongly in Australia, Canada, and Japan, and is rising quickly in Mexico and Peru. These markets offer something Vietnam has been working toward: stable, high-income consumers who buy manufactured products and processed goods, not just raw or semi-raw materials.

Australia has become a standout market. Bilateral trade reached 11.5 billion USD in the first ten months of 2025, as per the reports on Vietnam-Australia trade relations. Canada and Mexico have emerged as “growth” markets for Vietnamese seafood, wooden products, electronics, footwear, processed foods, and certain agricultural goods.

For example, in Canada:

-

Vietnamese shrimp and pangasius have taken a strong market share, as per the data on Vietnam shrimp exports to Canada by HS code.

-

Suitcases and handbags have a high tariff-free penetration

-

Bamboo and rattan products use CPTPP certificates of origin at rates above 40 percent

Vietnam is not just selling more. It is selling smarter, with a portfolio tailored to each market.

Top CPTPP Export Partners of Vietnam

Vietnam, as a prominent member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), has shown remarkable trade growth with its top export partners within the framework. The top CPTPP export partners of Vietnam include countries such as Japan, Canada, and Australia, with significant trading volumes that boost Vietnam's economy. The top 10 export partners of Vietnam among the CPTPP members, as per the Vietnam exports by country and Vietnam shipment data for 2024-25, include:

|

Rank |

Country |

Vietnam’s Exports ($) |

|

1 |

Japan |

$24.5 billion |

|

2 |

Australia |

$6.4 billion |

|

3 |

Canada |

$6.3 billion |

|

4 |

Mexico |

$5.4 billion |

|

5 |

Singapore |

$5.1 billion |

|

6 |

Malaysia |

$5 billion |

|

7 |

Chile |

$1.3 billion |

|

8 |

New Zealand |

$684.2 million |

|

9 |

Peru |

$442.9 million |

|

10 |

Brunei |

$142.5 million |

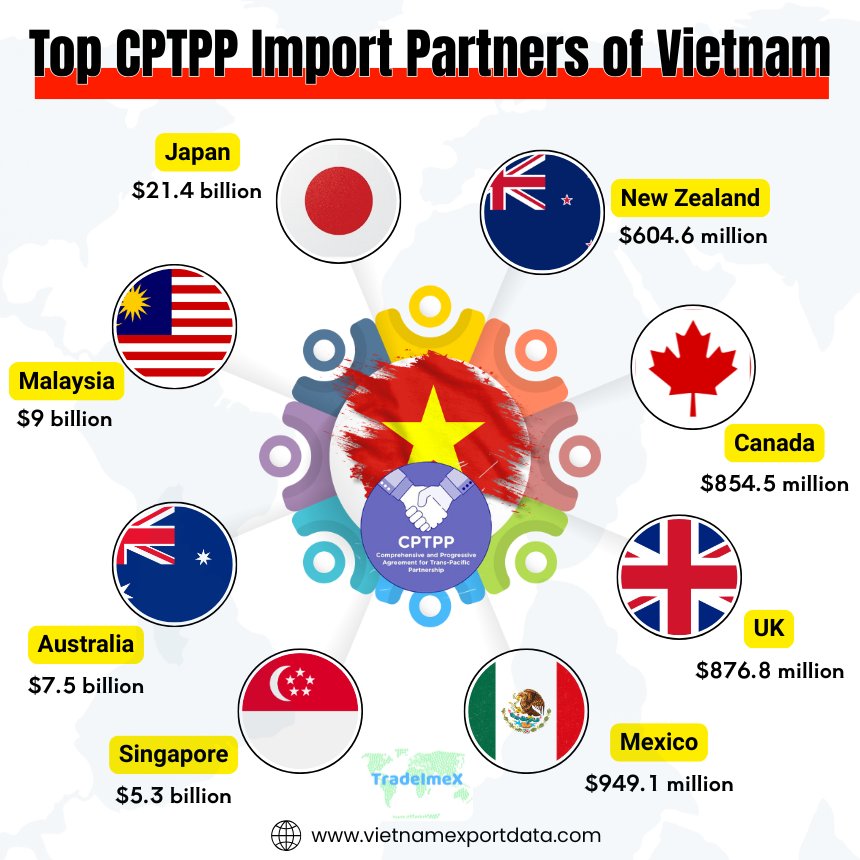

Top CPTPP Import Partners of Vietnam

Vietnam's Top CPTPP import partners play a crucial role in the country's economy. These partners stand out as key players in facilitating trade relations and boosting economic growth. Japan is the leading import partner of Vietnam in the CPTPP, as per the customs data on Vietnam imports from Japan by HS code. The top 10 import partners of Vietnam among the CPTPP member countries, as per the data on Vietnam imports by country & CPTPP-Vietnam trade data for 2024-25, include:

|

Rank |

Country |

Vietnam’s Imports ($) |

|

1 |

Japan |

$21.4 billion |

|

2 |

Malaysia |

$9 billion |

|

3 |

Australia |

$7.5 billion |

|

4 |

Singapore |

$5.3 billion |

|

5 |

Mexico |

$949.1 million |

|

6 |

United Kingdom |

$876.8 million |

|

7 |

Canada |

$854.5 million |

|

8 |

New Zealand |

$604.6 million |

|

9 |

Brunei |

$526.5 billion |

|

10 |

Chile |

$326 million |

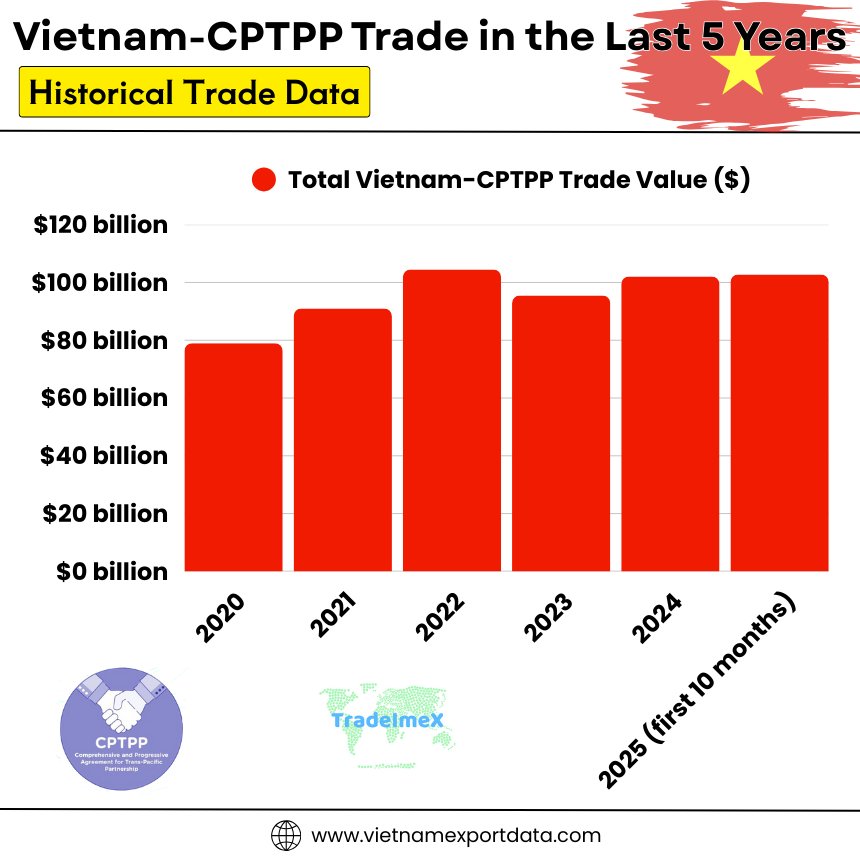

Vietnam-CPTPP Trade in the Last 5 Years: Historical Trade Data

|

Year of Trade |

Total Vietnam-CPTPP Trade Value ($) |

|

2020 |

$79 billion |

|

2021 |

$91 billion |

|

2022 |

$104.5 billion |

|

2023 |

$95.5 billion |

|

2024 |

$102.1 billion |

|

2025 (first 10 months) |

$102.8 billion |

Sector-by-Sector Breakdown

Manufacturing at the Core

Manufacturing remains the backbone of Vietnam’s CPTPP exports. Electronics, machinery, and processed goods benefit from:

-

High levels of investment from multinational firms

-

Access to raw materials through regional supply networks

-

Improving domestic production capabilities

-

Government support for industrial zones and technological upgrading

These factors are pulling Vietnam deeper into global value chains where CPTPP members play critical roles.

Agricultural and Food Products Gain Ground

Though still a smaller share of total export value, agriculture and food-related exports are growing quickly. In 2024:

-

Rice exports to CPTPP states surged nearly 75 percent

-

Coffee exports rose about 26 percent

-

Fruit and vegetable exports grew roughly 21 percent

-

Rubber exports more than doubled, jumping over 118 percent

Rice still only accounts for about 1 percent of Vietnam’s CPTPP export turnover, and coffee about 1.3 percent, but the growth rates suggest both sectors are finding better market access. The limitation is that agricultural exports face tough sanitary standards, packaging demands, and shelf-life expectations. These require investment that smaller producers often struggle to make. Still, the growth is a clear sign that agriculture can claim a larger share of CPTPP trade in the years ahead.

Rising Exports to the Americas

The combinations of Canada, Mexico, Chile, and Peru, the Americas group within CPTPP, create one of Vietnam’s most promising growth frontiers. These markets benefit from tariff reductions that boost Vietnamese competitiveness versus exporters from outside the trade bloc.

In these countries, Vietnamese exports include:

-

Seafood

-

Wood products and furniture

-

Electronics

-

Machinery

-

Handbags and suitcases

-

Clothing and footwear

-

Bamboo, rattan, and craft goods

These markets allow Vietnam to diversify beyond its traditional reliance on the US, the EU, and China. Diversification is no longer a luxury. It is a strategic imperative for economic resilience.

Why The CPTPP-Vietnam Trade Record Matters for Vietnam

Vietnam’s Rise in Global Value Chains

The CPTPP milestone confirms that Vietnam is moving into higher tiers of global value chains. The export mix shows a shift:

-

Less concentration on basic garments

-

More presence in high-value electronics and machinery

-

Growing ability to meet Western and Asia-Pacific quality standards

-

Stronger compliance with labor, environmental, and origin requirements

Vietnam has become more than a low-cost assembly point. It is a value-adding node in global production networks.

More Stability in External Trade

Diversification across CPTPP markets reduces Vietnam’s vulnerability to demand shocks in China, the US, and Europe. With strong demand from Australia, Canada, Japan, and Mexico, Vietnam is less exposed to geopolitical tensions or sudden shifts in large markets.

Support for Macroeconomic Health

A larger trade surplus with CPTPP members stabilizes the national economy. It supports currency strength, bolsters foreign exchange reserves, and strengthens the current account. Since exports are growing faster than imports, Vietnam benefits from greater net inflows into the domestic production system.

Challenges Hidden Beneath the Growth

Even with strong momentum, several challenges could slow Vietnam’s CPTPP gains if not addressed.

Fierce Competition Inside the Bloc

CPTPP is not a guaranteed advantage agreement. Every member competes under the same zero-tariff or reduced-tariff conditions. Markets like Canada, Australia, and Mexico attract exporters from all CPTPP countries, Japan, Singapore, Malaysia, Chile, and others, many of which have stronger supply networks, advanced certifications, and deeper capital bases. Vietnamese producers must continually upgrade quality, branding, supply-chain transparency, and environmental compliance to keep pace.

Under-utilization in Traditional Sectors

Despite the strong growth of rice, coffee, fruits, and vegetables, Vietnam is not leveraging these sectors to their full potential in CPTPP markets. Barriers include:

-

Quality standards

-

Cold-chain limitations

-

Inconsistent packaging

-

Limited farm-to-market traceability

-

Smallholder-dominated production

The result is that high-potential agricultural products still account for only a tiny fraction of CPTPP export value.

Higher Standards and Rising Compliance Costs

As CPTPP evolves, so do its expectations. Rules around labor practices, environmental impact, emissions footprints, and supply-chain transparency are tightening. Larger firms adapt faster, but small and medium enterprises often struggle with compliance costs that cut into margins.

External Demand and Global Volatility

CPTPP trade growth is partly driven by strong demand in member markets. If global consumption slows or a recession hits key economies, Vietnamese exports may feel the impact. High concentration in electronics and textiles also leaves Vietnam vulnerable to demand swings in those sectors.

What Vietnam Must Do Next

To sustain and deepen CPTPP gains, Vietnam needs a coordinated strategy.

1. Strengthen Domestic Value Chains

Vietnam should expand domestic suppliers that can meet the CPTPP origin rules. This means increasing production of CPTPP-compliant inputs, reducing dependence on non-CPTPP suppliers, and improving supply-chain traceability.

2. Invest in Agricultural Modernization

To grow agricultural exports, Vietnam needs:

-

Modern packaging technology

-

Better cold-chain facilities

-

Quality certification systems

-

Improved farming practices

-

Larger production cooperatives

This will allow farmers and processors to meet CPTPP quality and safety standards.

3. Help SMEs Navigate Compliance

Small and medium enterprises need guidance to meet labor, environmental, and origin requirements. Clearer government support programs, training, and digital compliance tools can reduce cost burdens.

4. Boost Market Promotion in New Regions

Vietnam’s trade agencies and business associations should expand promotion efforts in:

-

Canada

-

Mexico

-

Peru

-

Australia

-

New Zealand

These markets offer high growth potential but remain under-penetrated by Vietnamese exports.

5. Attract and Leverage Foreign Investment

Foreign investors bring advanced technology, supply-chain expertise, and capital. Encouraging investments in electronics, renewable energy components, machinery, and supporting industries strengthens Vietnam’s export base and improves long-term competitiveness.

The Bigger Picture: What This Milestone Signals

The 103-billion-USD milestone is not just a statistical achievement. It demonstrates that Vietnam can grow within a high-standard trade environment. It proves that Vietnamese firms can adapt to strict rules of origin, meet rising quality demands, and compete in demanding markets.

It also shows that CPTPP is working as intended: not simply reducing tariffs, but encouraging members to upgrade production, diversify markets, and integrate more deeply into global supply networks.

The world is paying attention. Investors see Vietnam as a stable, competitive, reliable manufacturing hub that can access a wide range of markets tariff-free. Importers in CPTPP countries see Vietnam as a growing source of affordable, high-quality products. Policymakers in other countries see Vietnam as a model of how to leverage modern trade agreements for rapid, sustained growth.

Looking Toward 2026 and Beyond

In the next two to three years, several developments will shape Vietnam’s CPTPP trajectory:

-

CPTPP expansion: New applicants may join, bringing competition and opportunity.

-

Rising environmental standards: Firms will be expected to improve sustainability.

-

Greater demand for traceability: Buyers want clean, transparent supply chains.

-

Technological upgrading: Electronics and machinery will continue to dominate growth.

-

Market diversification: Latin American and Oceania markets will become more important.

If Vietnam continues at its current pace, total CPTPP trade could reach 130–140 billion USD in 2026, setting the stage for even greater integration, as per the global trade data.

Conclusion and Final Thoughts

In conclusion, Vietnam’s nearly 103-billion-USD trade turnover with CPTPP members in the first ten months of 2025 marks a milestone that speaks to far more than short-term growth. It reflects strategy, adaptability, and a commitment to modernize and compete on the global stage. The numbers are impressive. The momentum is strong. The foundation is solid. But sustaining this success demands continued investment, reform, and innovation. Vietnam has passed a milestone. Now it needs to turn it into a springboard.

We hope that you liked our insightful blog report on the Vietnam-CPTPP trade turnover 2025. For more information on the latest Vietnam trade data, or to search live Vietnam import-export data by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and verified databases.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0