Vietnam Tea Export & Tea Exporters Data 2025: Vietnam Tea Exports Reach Nearly 12,000 Tons in October

Explore detailed insights into Vietnam tea exports in 2025, including export values & top destinations. Discover how Vietnam’s tea export sector showed strong resilience in 2025, with nearly 12,000 tons of tea exported in October alone.

Introduction

Tea has been part of Vietnam’s agricultural backbone for more than a century. While it doesn’t draw the same attention as the country’s coffee or rice exports, the tea industry quietly contributes a steady share of foreign exchange, jobs, and rural development. In 2025, that contribution remained visible, especially in October, when Vietnam exported nearly 12,000 tons of tea worth about USD 20.9 million, according to official trade figures. According to the Vietnam export data and Vietnam customs export data of tea, the total value of Vietnam tea exports reached $225.47 million in 2024, a 24% increase from the previous year. According to the Vietnam tea export data, Vietnam exported tea worth a total value of $188.2 million, at a total export quantity of 109,000 tons in the first 10 months of 2025.

As per the latest Vietnam customs data and global trade data, Vietnam is the 9th largest tea exporter in the world. This monthly performance came despite global headwinds and a year-to-date slowdown in export volume. By the end of October 2025, the country had shipped over 109,000 tons of tea valued at roughly $188 million, representing a 10.2% drop in quantity and an 11.2% decline in value compared to the same period in 2024. Still, the October figure signals that Vietnam’s tea export engine remains resilient, and that the sector’s long-term transformation toward higher value, quality, and market diversification is underway.

Overview of Vietnam’s Tea Sector

Production and Scale

Vietnam is one of the world’s top 10 tea producers and exporters. As of 2025, the country maintained an estimated 128,000 hectares of tea plantations, of which about 118,000 hectares were under active harvest. The rest consisted of newly planted or rejuvenated areas expected to enter production within a few years.

Annual tea output averaged between 180,000 and 200,000 tons in recent seasons. Yields typically range around 8–9 tons of fresh leaves per hectare, though some high-quality regions such as Thai Nguyen and Lam Dong reach higher productivity and finer grades.

Vietnam’s tea-growing belt spans 34 provinces, with concentrations in the northern midlands (Thai Nguyen, Phu Tho, Yen Bai), the northwest highlands (Son La, Lai Chau), and the central highlands (Lam Dong). These diverse microclimates support the production of green, black, oolong, and specialty teas.

Product Mix

About 60–65% of Vietnam’s tea exports consist of black tea, primarily produced for Pakistan, Russia, and Middle Eastern markets. Green tea accounts for roughly 30%, and oolong or specialty teas about 5-10%, mainly shipped to Taiwan, Japan, and China. Although the country exports tea to over 70 countries and territories, most exports are still bulk, unbranded shipments, which means low unit prices and thin profit margins.

Vietnam Tea Export Performance 2024–25

Year-to-Date (Jan–Oct 2025)

-

Export Volume: 109,000 tons

-

Export Value: USD 188 million

-

Average Export Price: USD 1,723 per ton

-

Change vs. Jan–Oct 2024: −10.2% in volume, −11.2% in value, −1.1% in price

These figures show that while export activity remained solid, price pressure and lower demand in key markets reduced revenue.

Monthly Highlight: Tea Exports from Vietnam Reach 12,000 tons in October 2025

In October alone, exports reached nearly 12,000 tons, worth about USD 20.9 million. This monthly figure represents roughly 11% of total exports for the first 10 months, a strong showing considering seasonal patterns.

The October performance can be attributed to:

-

Completion of late-season harvests in northern regions.

-

Increased shipping activity ahead of year-end demand from Middle Eastern and South Asian buyers.

-

Slight improvement in orders from China and Taiwan after mid-year decline.

Vietnam Tea Exports by Country: Where Does Vietnam Export Tea?

Vietnam is a significant player in the global tea market, exporting its tea products to various countries worldwide. The country's unique climate and fertile soil have made it an ideal location for tea cultivation, leading to a booming industry that has seen impressive growth in recent years. Key destinations for Vietnam's tea exports include the United States, China, Taiwan, and Russia. These countries have shown a consistent demand for Vietnam's tea due to its quality and unique flavor profiles. The top 10 tea export destinations for Vietnam tea exports by country, and Vietnam shipment data for 2024-25, include:

1. Pakistan: $106.70 million (47.3%)

This country is the largest importer of Vietnamese tea, accounting for nearly half of all exports. The demand for tea in this South-Asian nation is high, with the beverage being an essential part of daily life for many consumers. Vietnamese tea, known for its high quality and unique flavors, has become increasingly popular in this country in recent years.

2. Taiwan: $25.94 million (11.5%)

Taiwan is another significant market for Vietnamese tea, with imports accounting for over 11% of total exports, as per the data on Vietnam tea exports to Taiwan. Taiwanese consumers have a strong appreciation for tea, and Vietnamese varieties are highly sought after for their distinct taste and aroma. The proximity between the two countries also makes trade between them easy and efficient.

3. China: $18.81 million (8.3%)

Despite being a major tea producer itself, China still imports a significant amount of tea from Vietnam. Chinese consumers have a diverse palate and are always on the lookout for new and unique tea flavors. Vietnamese tea, with its rich history and tradition, has found a niche in the Chinese market and continues to be in demand.

4. Russia: $12.08 million (5.4%)

Russia is a growing market for Vietnamese tea, with imports steadily increasing over the years, as per the customs data on Vietnam tea exports to Russia by HS code. Russian consumers have developed a taste for Vietnamese tea, appreciating its quality and affordability. The diverse range of tea varieties that Vietnam offers caters to the diverse preferences of Russian tea drinkers.

5. USA: $11.42 million (5.1%)

The United States is a key market for Vietnamese tea, with exports to the country steadily growing. American consumers are increasingly turning to tea as a healthier alternative to traditional beverages, and Vietnamese tea has quickly gained popularity for its unique flavors and health benefits. The growing trend of tea consumption in the US bodes well for Vietnam's tea exports.

6. Indonesia: $10.20 million (4.5%)

Indonesia is another important market for Vietnamese tea, with a growing demand for quality tea among Indonesian consumers. Vietnamese tea is well-received in Indonesia for its aroma and taste, and imports from Vietnam continue to rise. The cultural ties between the two countries also play a role in fostering trade relations in the tea industry.

7. Saudi Arabia: $5.87 million (2.6%)

Despite being a predominantly coffee-drinking nation, Saudi Arabia has shown a growing interest in tea in recent years. Vietnamese tea, with its unique flavors and high quality, has found a niche in the Saudi market. The health benefits of tea have also contributed to its rising popularity among Saudi consumers.

8. Iraq: $5.03 million (2.2%)

Iraq is a relatively new market for Vietnamese tea, but one that shows great growth potential. Vietnamese tea has been well-received by Iraqi consumers for its refreshing taste and aroma. As the tea culture in Iraq continues to develop, demand for Vietnamese tea is expected to increase.

9. Thailand: $5.02 million (2.2%)

Thailand is a neighboring country to Vietnam and has a long history of tea consumption. Vietnamese tea, with its diverse varieties and unique flavors, has gained traction in the Thai market. The close geographical proximity between the two countries has made trade between them convenient and efficient.

10. Malaysia: $4.11 million (1.8%)

Malaysia rounds out the top 10 countries that import tea from Vietnam. Malaysian consumers have a growing appreciation for quality tea, and Vietnamese tea has become a popular choice among tea drinkers in the country. The diverse range of Vietnamese tea varieties ensures that there is something for everyone in the Malaysian market.

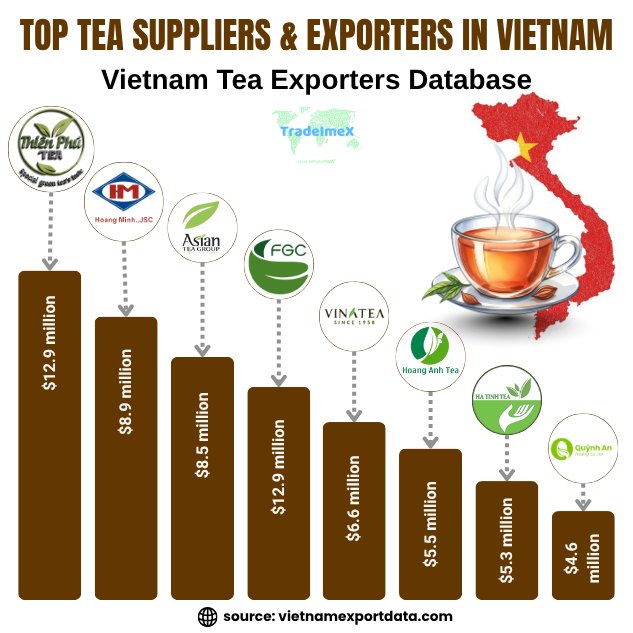

Top Tea Suppliers & Exporters in Vietnam: Vietnam Tea Exporters Database

If you are looking for top tea suppliers and exporters in Vietnam, the Vietnam Tea Exporters Database is a valuable resource to consider. This database provides a comprehensive list of reputable tea suppliers in Vietnam, offering a wide range of high-quality teas for export. The leading tea exporters in Vietnam, as per the verified Vietnam tea exporters data and tea suppliers list for 2024-25, include:

|

Rank |

Company |

Approx. Export Value (2024) |

Top Exported Tea Types |

Top Export Markets |

|

1 |

$12.9 million |

Bulk black tea, CTC grade |

Pakistan, Middle East |

|

|

2 |

Hoang Minh Tea Ltd. |

$8.9 million |

Black tea, maybe green tea |

Pakistan, China/Taiwan |

|

3 |

Asia Tea Co. Ltd. |

$8.5 million |

Orthodox black tea, CTC black tea, green tea |

China, Taiwan, ASEAN |

|

4 |

Future Generation Co. Ltd. (FGC) |

$8.5 million |

Green tea, packaged tea |

Taiwan, China, Southeast Asia |

|

5 |

Vietnam National Tea JSC (Vinatea) |

$6.6 million |

Green tea, black tea, and branded packaged tea |

USA, Europe, Taiwan |

|

6 |

Hoang Anh Tea Ltd. |

$5.5 million |

Green tea flakes, black tea |

China, the Middle East |

|

7 |

Ha Tinh Tea JSC |

$5.3 million |

Green tea, specialty tea |

Europe niche, China |

|

8 |

Quynh An Trading Co., Ltd. |

$4.6 million |

Bulk black tea |

Pakistan, Africa |

|

9 |

Dung Lam Tea JSC |

$4.4 million |

Green and black tea mixed |

ASEAN, Middle East |

|

10 |

Aditya Birla Global Trading (Phu Tho) Co., Ltd. |

$4.36 million |

Bulk tea for blending, black tea |

India, Asia region |

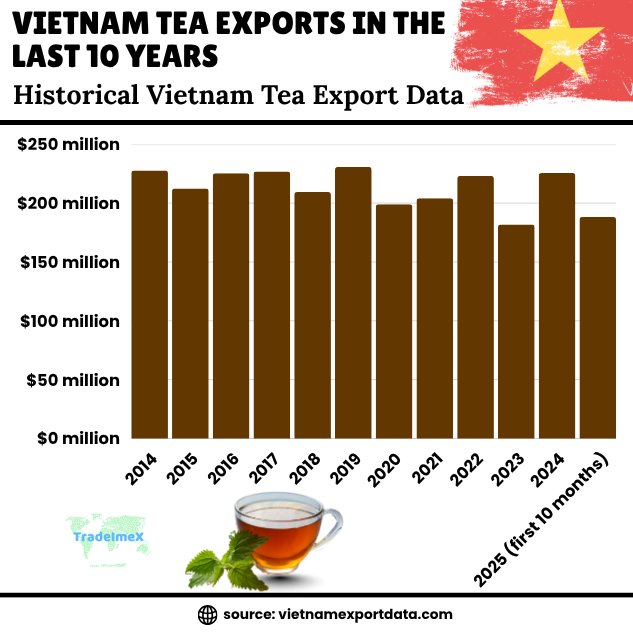

Vietnam Tea Exports in the Last 10 Years: Historical Vietnam Tea Export Data

|

Year of Exports |

Vietnam’s Total Tea Export Value ($) |

|

2014 |

$227.71 million |

|

2015 |

$212.42 million |

|

2016 |

$225.41 million |

|

2017 |

$226.79 million |

|

2018 |

$209.35 million |

|

2019 |

$230.74 million |

|

2020 |

$198.92 million |

|

2021 |

$204.12 million |

|

2022 |

$223.08 million |

|

2023 |

$181.78 million |

|

2024 |

$225.47 million |

|

2025 (first 10 months) |

$188.20 million |

Vietnam’s Major Tea Export Markets in 2025

Vietnam’s tea exports are heavily concentrated in a few key destinations:

|

Rank |

Country/Region |

Share of Export Value (Jan–Oct 2025) |

Year-on-Year Change |

|

1 |

Pakistan |

41.2% |

−7.1% |

|

2 |

Taiwan |

11.5% |

+2.9% |

|

3 |

China |

9.2% |

+3.2% |

|

4 |

Russia & CIS markets |

7% |

−4% |

|

5 |

Afghanistan & Middle East |

5% |

Flat |

|

6 |

USA / EU combined |

<4% |

+5–7% (small base) |

The dominance of Pakistan illustrates Vietnam’s dependence on a single buyer, exposing the industry to demand fluctuations and payment risks. Meanwhile, modest growth in Taiwan and China points to steady regional demand, especially for green and oolong teas.

The emerging opportunity lies in Europe, North America, and premium Asian segments, where organic and specialty teas fetch higher prices, often USD 3,000–5,000 per ton, versus the USD 1,700 average in bulk trade.

Vietnam’s Tea Exporter Structure and Industry Landscape

Exporter Base

Vietnam’s tea export base consists of around 150 active exporting firms, though fewer than 25 account for most of the volume. Exporters fall into three main categories:

-

Large state-linked enterprises — often vertically integrated, owning plantations and processing factories (e.g., Vinatea, Lam Dong Tea).

-

Private and cooperative exporters — sourcing from smallholder farmers, processing locally, and shipping in bulk.

-

Specialty and premium brands — small but growing; focus on organic certification, direct-to-consumer exports, and online channels.

A review of customs data for 2024–25 suggests roughly 60–70 major export shipments per month, with the largest players handling container loads bound for Pakistan and Taiwan.

Supply Chain Dynamics

-

Smallholder farmers supply about 65–70% of raw leaves.

-

Factories and cooperatives handle withering, rolling, drying, and grading.

-

Exporters then consolidate shipments, handle customs, and sell through overseas brokers.

Because of this fragmented structure, traceability and quality consistency remain recurring issues. Few exporters have established unified branding or international marketing networks, resulting in limited global recognition of “Vietnamese tea” as a branded origin.

Tea Export Price and Value Trends

The Vietnamese average tea export price of USD 1,723 per ton in 2025 compares unfavorably with other major tea exporters:

|

Country |

Average Export Price (USD/ton, 2025 est.) |

|

Kenya |

2,450 |

|

India |

2,800 |

|

Sri Lanka |

3,100 |

|

China |

4,000+ |

|

Vietnam |

1,700 |

The relatively low price reflects a focus on bulk commodity tea rather than high-value branded or specialty products. Additionally, currency movements, freight costs, and weak demand in Pakistan contributed to lower realized prices.

In contrast, premium Vietnamese brands targeting niche markets (e.g., organic green tea, high-mountain oolong) reported export prices between USD 3,000 and 5,000 per ton, showing the price potential of quality and branding.

Factors Shaping Vietnam’s Tea Export Performance in 2025

External Conditions

-

Global Tea Demand: Worldwide tea consumption in 2025 grew only modestly (1–2%) amid inflation and slower consumer spending, especially in Pakistan and the Middle East.

-

Competition: Strong supply from Kenya, India, and Sri Lanka pressured prices globally.

-

Weather: Northern Vietnam experienced erratic rainfall and localized floods mid-year, affecting yields in provinces like Yen Bai and Phu Tho.

Domestic Constraints

-

Limited Processing Technology: Many factories still rely on outdated equipment, leading to inconsistent drying and grading.

-

Quality Control: Residue levels and leaf uniformity remain concerns in some batches.

-

Farmer Income Pressure: Farmgate prices stagnated, discouraging replanting and quality investment.

-

Market Concentration: Dependence on a few large buyers creates vulnerability to sudden order cuts or payment delays.

Structural Shifts

Despite challenges, the sector is gradually evolving:

-

More exporters are pursuing organic and Rainforest Alliance certification.

-

Traceability systems and QR-code tagging are being piloted in Lam Dong and Thai Nguyen.

-

Private investment in packaging, instant tea, and RTD (ready-to-drink) tea factories has increased.

-

These transitions hint at a slow but steady climb up the value ladder.

Regional Breakdown within Vietnam

|

Region |

Key Provinces |

Main Tea Types |

Export Focus |

Share of National Output |

|

Northern Midlands |

Thai Nguyen, Phu Tho, Yen Bai |

Green, black |

Pakistan, Taiwan |

35–40% |

|

Northwest Highlands |

Son La, Lai Chau, Dien Bien |

Black, organic |

China, EU niche |

20% |

|

Central Highlands |

Lam Dong |

Oolong, specialty |

Taiwan, Japan, Korea |

25% |

|

North Central & Others |

Nghe An, Thanh Hoa |

Green, black |

Domestic + Middle East |

15% |

Each region plays a distinct role: northern provinces anchor bulk exports, while Lam Dong is the innovation hub for high-grade oolong and specialty teas.

Exporter Performance Insights

A closer look at company types in 2024–25 illustrates how performance diverges:

-

Traditional Bulk Exporters (e.g., long-established state or joint-stock companies) handle large volumes but struggle with falling prices. Their margins are typically under 5%.

-

Mid-tier Processors have started blending and flavoring teas to target ASEAN markets, achieving modest price gains.

-

Premium Tea Startups and cooperatives have emerged, especially in Lam Dong and Thai Nguyen, focusing on organic, single-estate, and high-mountain teas.

These players are achieving double the export price per ton, albeit at small volumes. This segmentation shows the dual nature of Vietnam’s tea industry: a bulk-driven base and a rising premium niche.

Challenges Facing the Vietnam Tea Exporters

-

Low Value Capture: The export price gap versus competitors underscores limited brand recognition and weak value addition.

-

Quality Control and Residue Compliance: Meeting EU and Japanese residue limits remains difficult for smaller processors.

-

Market Dependence: Over 40% of value tied to Pakistan creates risk.

-

Rising Input Costs: Fertilizers, labor, and energy costs have all climbed, squeezing margins.

-

Climate and Sustainability: Irregular rainfall and soil degradation threaten long-term yields.

-

Weak Marketing: Few exporters maintain direct marketing channels abroad; most rely on brokers, losing branding opportunities.

Opportunities and Strategic Directions

Despite these challenges, multiple growth levers exist for 2025 and beyond:

1. Move Up the Value Chain

Firms can shift from bulk sales toward:

-

Branded packaged teas.

-

Organic and fair-trade certified products.

-

Ready-to-drink tea beverages.

-

Premium oolong and herbal blends.

2. Market Diversification

Targeting under-penetrated markets like the UAE, Saudi Arabia, Egypt, the EU, and the US can reduce dependency on Pakistan. Vietnam’s trade agreements, such as the CPTPP and EVFTA, give exporters tariff advantages for expansion.

3. Branding and Promotion

A coordinated national campaign to position “Vietnam Tea” as a recognized origin could raise awareness and prices. Similar initiatives in coffee and pepper have proven effective.

4. Sustainability and Certification

Investments in soil rehabilitation, organic inputs, and waste reduction not only appeal to high-end markets but also secure long-term productivity.

5. Supply Chain Modernization

Digital traceability systems, cooperative consolidation, and improved logistics infrastructure can increase reliability and buyer confidence.

Policy and Institutional Support

Government and associations have already begun to address structural issues:

-

Vietnam Tea Association (VITAS) is promoting standards alignment and quality grading.

-

Provincial agricultural departments are funding replanting programs for ageing tea bushes.

-

Export promotion agencies are encouraging firms to participate in international trade fairs and online B2B platforms.

-

Training initiatives are helping farmers adopt safe pesticide use and organic practices.

Such measures aim to transform tea from a low-margin commodity into a higher-value export pillar similar to coffee or cashew nuts.

Outlook for Late 2025 and 2026

If export momentum continues at the October pace (roughly 12,000 tons per month), Vietnam’s full-year 2025 tea exports could reach around 130,000–135,000 tons, near the upper end of historical averages.

However, value growth may remain flat without price recovery. Expected average export prices for 2026 are projected between USD 1,700–1,750 per ton, unless exporters accelerate product upgrading.

Looking forward:

-

Volume Growth: Stable to modestly rising (1–3%) depending on weather and replanting success.

-

Value Growth: Moderate, driven by product diversification and premiumization.

-

Market Shifts: Slight reduction in Pakistan’s share, gradual rise in Asia-Pacific and European demand.

-

Structural Reform: Greater consolidation among exporters and emphasis on quality control.

In short, the industry’s near-term goal will be stabilization, while the medium-term ambition should be value transformation.

Conclusion and Final Take

Vietnam’s tea export story in 2024–25 is a blend of resilience and transition. Despite global uncertainty, falling prices, and tough competition, the country still managed to ship nearly 12,000 tons of tea in October 2025, underscoring its robust production and export capacity. Yet the broader data reveal a structural challenge: exporting more does not necessarily mean earning more. Average prices remain low, dependence on Asian countries is heavy, and too few of Vietnam’s tea leaves leave the country as a branded or value-added product.

The future lies in quality, branding, and diversification. If growers continue adopting sustainable practices, exporters invest in processing and marketing, and policymakers support modernization, Vietnam could not only maintain its export scale but also move decisively up the global tea value chain.

We hope that you liked our data-driven and interactive blog report on the Vietnam tea export data 2025. To access the latest Vietnam import-export data or search live data on Vietnam tea exports by country, visit VietnamExportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top tea exporters & suppliers in Vietnam, as per your needs.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

1

Love

1

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0